Dollar/CAD was moving on up in a busy week, hitting the highest levels since the summer. The upcoming week features two big events: the GDP release and the jobs report. Will the loonie continue suffering? Here are the highlights and an updated technical analysis for USD/CAD.

The Bank of Canada did not raise rates and also went quite dovish. They do not intend to raise rates anytime soon, and this sent the loonie lower. Canadian wholesale sales disappointed with a rise of only 0.5%. In the US, speculation about a hawkish Fed Chair stimulated the dollar, especially as Yellen is out. The US economy looks good.

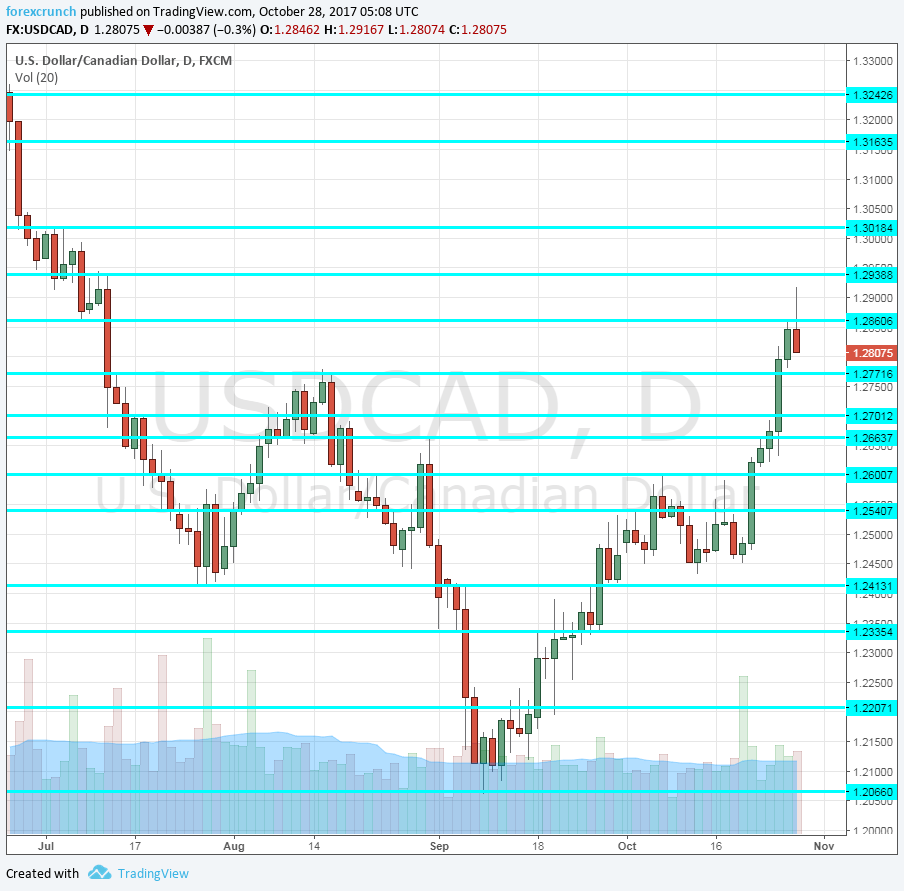

[do action=”autoupdate” tag=”EURUSDUpdate”/]USD/CAD daily graph with support and resistance lines on it. Click to enlarge:

- GDP: Tuesday, 12:30. The Canadian economy stalled back in July, falling short of expectations after an excellent first half of the year. Canada is unique in publishing its Gross Domestic Product once a month in contrast to once per quarter in most countries. A growth rate of 0.1% is on the cards.

- RMPI: Tuesday, 12:30. The Raw Materials Price Index jumped by 1% in August, beating expectations and ending a three-month losing streak. Canada exports oil, a raw material, making this figure important.

- Manufacturing PMI: Wednesday, 13:30. Canada’s manufacturing sector is growing nicely according to this measure by Markit. In September it advanced from 54.6 to 55 points.

- Stephen Poloz talks: Tuesday, 19:30 and Wednesday, 20:15. The Governor of the Bank of Canada will testify twice in front of parliament and will likely comment on a wide range of topics. After his relatively dovish appearance at the press conference, Poloz could provide more details and perhaps more hints about the next moves of the BOC.

- Jobs report: Friday, 12:30. Canada gained 10K jobs in September, slightly below expectations, but the unemployment rate dropped to 6.2%. All in all, the Canadian economy had an excellent first half, with more moderate growth later on. A gain of 13.6K is forecast now. The unemployment is expected to remain unchanged at 6.2%.

- Trade balance: Friday, 12:30. Though it is overshadowed by the more important employment report, the trade numbers could have an impact. Canada’s trade deficit expanded to 3.4 billion in August, worse than expected. The country last enjoyed a surplus in January.

* All times are GMT

USD/CAD Technical Analysis

Dollar/CAD moved up early in the week, tackling the 1,2665 level mentioned last week.

Technical lines from top to bottom:

We start from higher ground today. 1.3160 provided support back in June. 1.3080 was a line of resistance to the pair in its recovery attempts in July.

1.2940 was another cap back in July. It is followed by 1.2860 which worked as supporte back then.

1.2770 capped a recovery attempt in August and is our top line for now. 1.2665 was a swing high of a move higher in early September. It is followed by 1.26, a round number that worked as resistance in October.

1.2540 capped the pair in early October when it traded in a narrow range. 1.2410 held the pair cushioned for some time but was eventually broken. 1.22 is a round number and also worked as support a few years ago.

1.22 is a round number and also worked as support a few years ago. 1.2065 is the (current) swing low of September 2017. It is followed by the obvious level of 1.20.

I am neutral on USD/CAD

It seems like most of the bad news is already behind us and the loonie could at least stabilize.

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – projections for the Aussie dollar.

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!