The Canadian dollar rebounded, as USD/CAD dropped 120 points last week. The pair closed at 1.3127. It’s a busy week, with the release of retail sales, CPI and the benchmark interest rate. Here is an outlook on the major market-movers and an updated technical analysis for USD/CAD.

In the US, retail sales were mixed but the Fed meeting minutes have added fuel to expectations of a rate hike in December. There were no major Canadian releases last week.

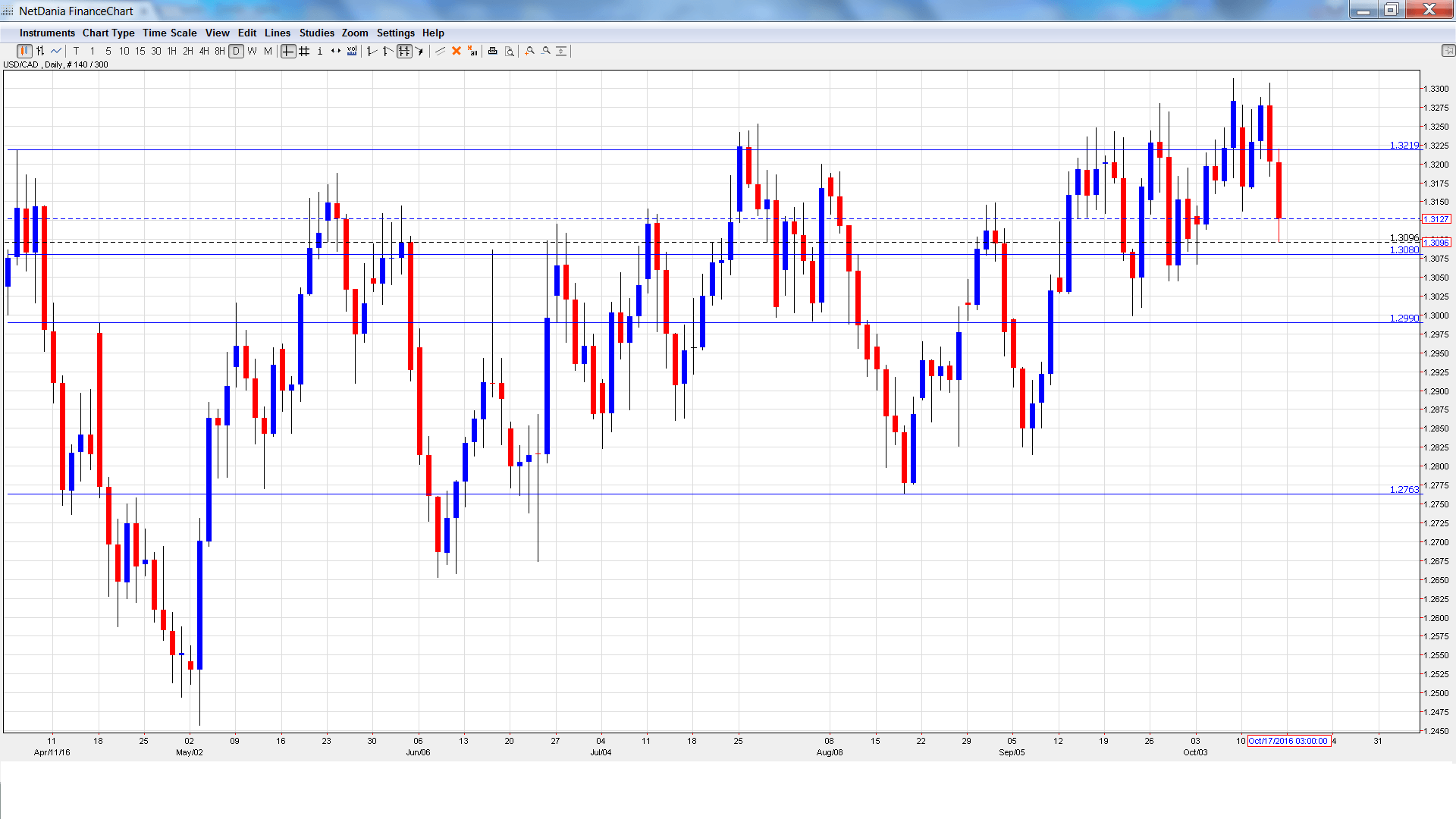

USD/CAD daily graph with support and resistance lines on it. Click to enlarge:

- Foreign Securities Purchases: Monday, 12:30. This indicator is linked to currency demand, as foreigners must purchase Canadian dollars in order to buy Canadian securities. In July, the indicator came in at C$5.23 billion, well short of expectations. The August estimate is C$6.24 billion.

- Manufacturing Sales: Tuesday, 12:30. This is the first key indicator of the week. In July, the indicator dropped to just 0.1%, well off the forecast of 0.6%. The markets are expecting an improvement in August, with an estimate of 0.3%.

- BoC Monetary Policy Report: Wednesday, 14:00. This report is released each quarter. It provides details of the BoC’s view on inflation and economic conditions, and analysts will be looking for clues regarding future monetary policy. A press conference will follow the release of the report.

- Overnight Rate: Wednesday, 14:00. The BoC has pegged the benchmark rate at 0.50% since May 2015 and no change is expected in October decision. Still, a dovish rate announcement could push the Canadian dollar lower.

- Core CPI: Friday, 12:30. Core CPI has been stagnant, with three straight readings of 0.0%. The markets are predicting a small gain of 0.2% in the September report.

- Core Retail Sales: Friday, 12:30. The indicator has not looked good, posting two consecutive declines, missing expectations on each occasion. The estimate for the August release stands at 0.2%.

- CPI: Friday, 12:30. CPI has posted two straight declines, pointing to weak inflation levels. The markets are expecting an improvement in August, with an estimate of 0.2%.

- Retail Sales: Friday, 12:30. This indicator is the primary gauge of consumer spending. After posting two straight declines of 0.1%, a strong gain of 0.5% is expected in the August report.

USD/CAD opened the week at 1.3248. Late in the week, the pair climbed to a high of 1.3307 but was unable to consolidate at this level and dropped to a low of 1.3096, as support held at 1.3081 (discussed last week). The pair closed the week at 1.3127.

Live chart of USD/CAD:

Technical lines, from top to bottom

1.3551 has provided resistance since March 2016.

1.3457 was a cap in September 2015.

1.3353 has switched to a support line following sharp gains by USD/CAD last week.

1.3219 was a cap in April.

1.3081 is the next support line.

1.2990 has held firm since early September.

The round number of 1.2900 is next.

1.2763 has been a cap since August. It is the final support line for now.

I remain bullish on USD/CAD

The US economy remains strong and with a December rate hike priced at 60%, monetary divergence continues to favor the US dollar. At the same time, oil prices have been moving up sharply and the Canadian dollar could get a boost if this trend continues.

Our latest podcast is titled Bold BOJ vs. Fearful Fed

Follow us on Sticher or iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the kiwi, see the NZDUSD forecast.