Dollar/CAD ticked higher in a week that did not see too much excitement. The upcoming week features the full reaction to the data: the rate decision. Will Poloz signal a long pause? Here are the highlights and an updated technical analysis for USD/CAD.

Oil prices slipped a bit lower, but the C$ did not react in a very direct manner to that. Tension is mounting toward the BOC decision. In the US, some progress on tax reform provided support to the US dollar. Late in the week, poor inflation figures from Canada sent the loonie lower.

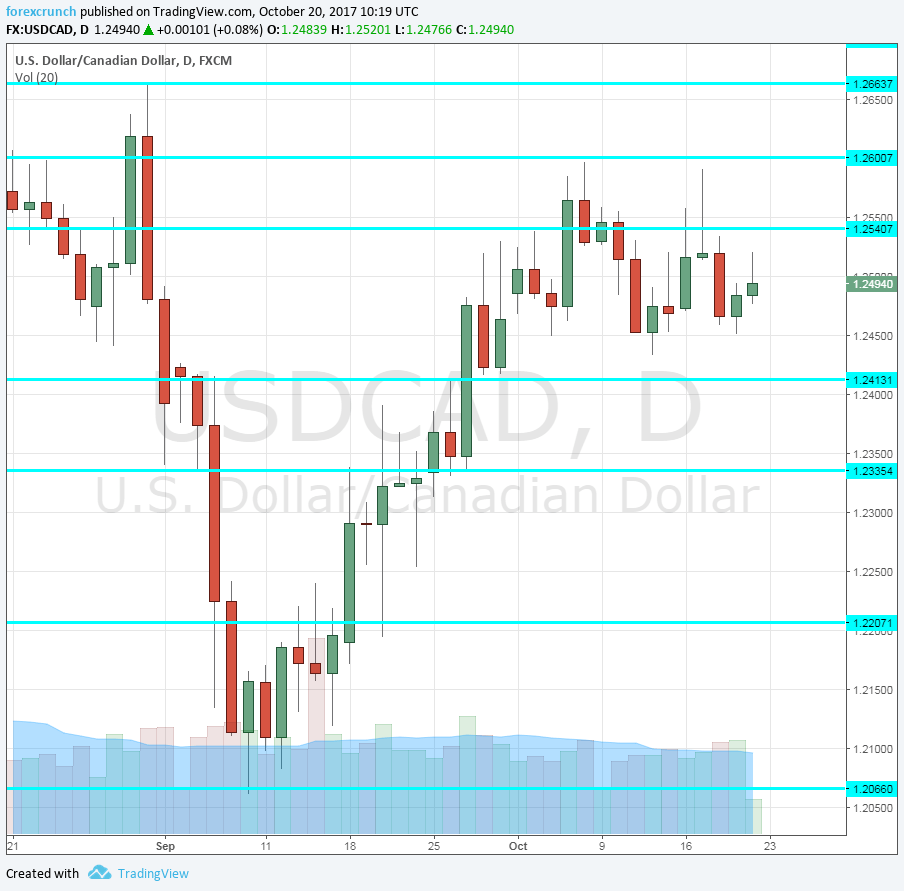

[do action=”autoupdate” tag=”EURUSDUpdate”/]USD/CAD daily graph with support and resistance lines on it. Click to enlarge:

- Wholesale Sales: Monday, 12:30. Sales at the wholesale level have a good correlation with retail sales, which are published late. The volume of sales jumped by 1.5% in July. We now get the figures for August. A rise of 1.% is predicted.

- Rate decision: Wednesday, 14:00, press conference at 15:15. The Bank of Canada raised interest rates in two consecutive meetings, boosting the Canadian dollar. However, in a recent public appearance, Governor Stephen Poloz said it was a “normalization”: undoing of the two rate hikes from 2015. And while growth is strong and inflation is set to pick up, the next moves will be much slower. So, the BOC is expected to leave the interest rate unchanged at 1%. The reaction depends on the message. If the Bank remains optimistic and hints at further hikes in 2018, the loonie could rise. A “wait and see” approach could send the C$ to fall.

* All times are GMT

USD/CAD Technical Analysis

Dollar/CAD kicked off the week with a rise, hitting resistance at 1.2540 (mentioned last week).

Technical lines from top to bottom:

1.2770 capped a recovery attempt in August and is our top line for now. 1.2665 was a swing high of a move higher in early September. It is followed by 1.26, a rdoun number that worked as resistance in October.

1.2540 capped the pair in early October when it traded in a narrow range. 1.2410 held the pair cushioned for some time but was eventually broken. 1.22 is a round number and also worked as support a few years ago.

1.22 is a round number and also worked as support a few years ago. 1.2065 is the (current) swing low of September 2017. It is followed by the obvious level of 1.20.

I remain bearish on USD/CAD

While the BOC is not set to raise rates now, they are still optimistic about the economy and this could send the C$ higher – the USD/CAD lower.

Our latest podcast is titled Black gold shining and comparing QEs

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – projections for the Aussie dollar.

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!