Dollar/CAD had a dramatic week, crashing on another hawkish hike from the BOC. Can it break under 1.20? Manufacturing sales stand out this week. Here are the highlights and an updated technical analysis for USD/CAD.

The BOC did it again. The Bank of Canada raised interest rates, and that was not fully priced in. They also left the door open for another move on the rates. The BOC is happy with the growth of the Canadian economy and for good reasons. The jobs report came out at 22.2K jobs gained, better than expected and the unemployment rate dropped to 6.2%. Adding some weakness of the US dollar, USD/CAD fell to the 1.20 handle at some point, before recovering.

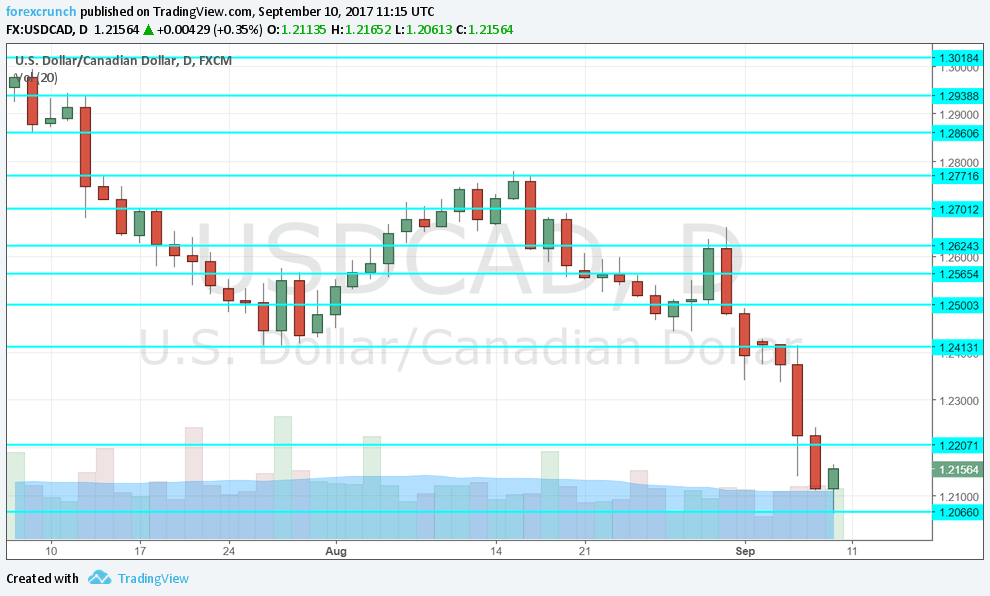

[do action=”autoupdate” tag=”EURUSDUpdate”/]USD/CAD daily graph with support and resistance lines on it. Click to enlarge:

- Housing Starts: Monday, 12:15. The number of housing starts advanced in the past two months, reaching a level of 222K in July. Will it continue rising? 216K housing starts are predicted.

- NHPI: Thursday, 12:30. The rise in the prices of new homes stalled in June, with a modest uptick of 0.2% after stronger advances beforehand. The turmoil in the housing market in Toronto may be taking a toll.

* All times are GMT

USD/CAD Technical Analysis

Dollar/CAD traded in ranges described last week.

Technical lines from top to bottom:

1.2860 was a relatively significant stepping stone on the way down, holding the pair for some time. It is followed by 1.2775, which marked a recovery attempt.

1.27 is a round number and also the top of a short-lived range. 1.2640 was the bottom of that range and a level where the pair reached after bouncing back.

1.2580 is a pivotal line and capped the pair temporarily on its recovery path. 1.25, a very round number, provided support for the pair in August.

1.2410 held the pair cushioned for some time, but was eventually broken. 1.22 is a round number and also worked as support a few years ago.

1.2065 is the (current) swing low of September 2017. It is followed by the obvious level of 1.20.

Below 1.20, we find 1.1925.a place of support as it worked as such in early 2015. Below that point, we see 1.17.

I remain bearish on USD/CAD

As demonstrated recently, the Canadian economy is doing quite well. The pair made a significant correction and resumed its downtrend and there is more room to the downside, especially with the hawkish BOC.

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – projections for the Aussie dollar.

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!