USD/CAD posted sharp gains last week, climbing 140 points. The pair closed the week just shy of the 1.32 level. This week’s highlights are retail sales and CPI reports. Here is an outlook on the major market-movers and an updated technical analysis for USD/CAD.

Canadian Manufacturing Sales dropped to 0.1%, well off the forecast of 0.6%. The Canadian dollar, which is sensitive to oil prices, lost ground as oil prices dipped last week. US data was a mixed bag. Retail sales contracted and missed expectations. However, CPI and jobless claims were slightly better than expected.

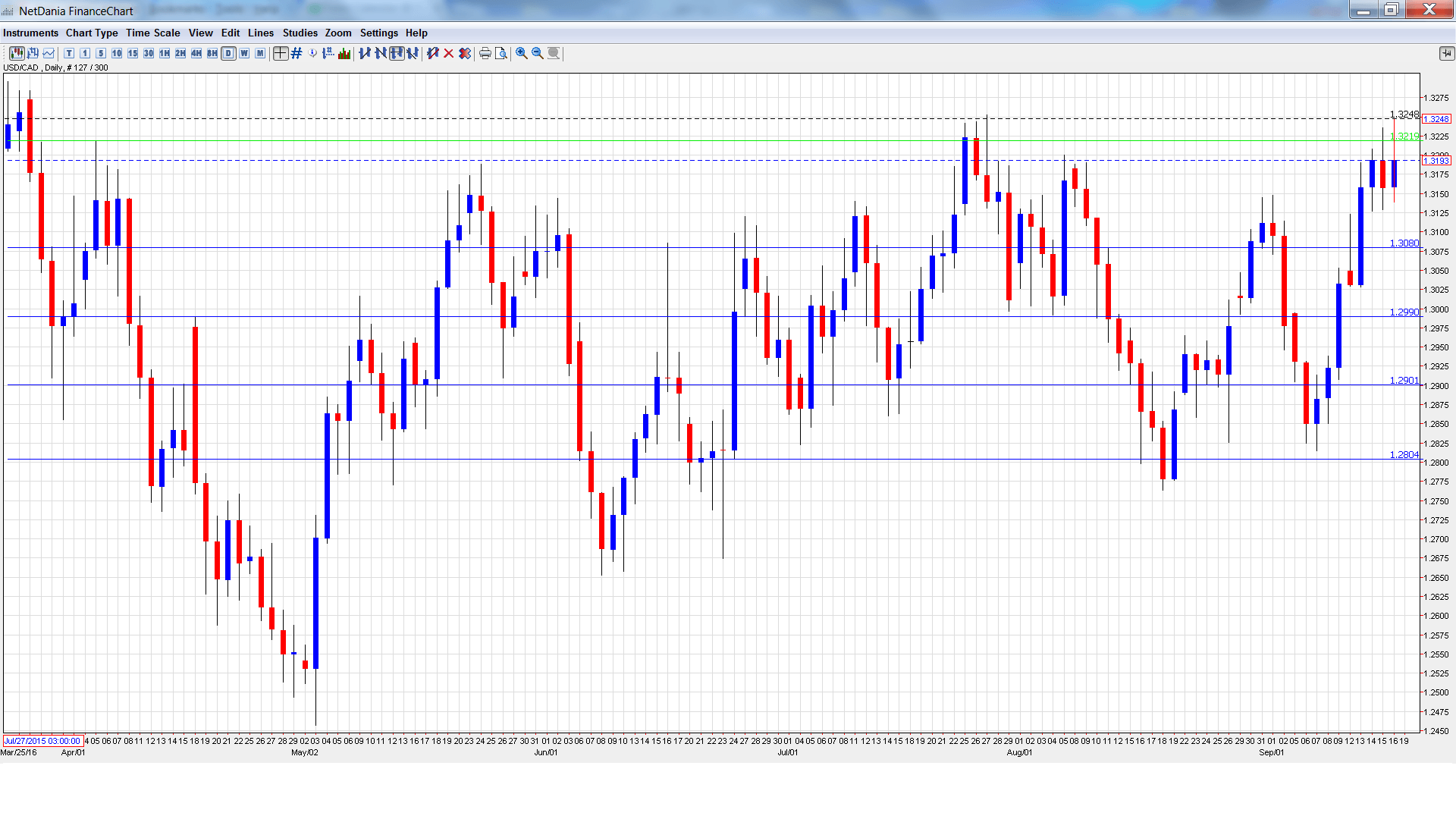

USD/CAD daily graph with support and resistance lines on it. Click to enlarge:

- BoC Governor Stephen Poloz Speaks: Tuesday, 16:45. Poloz will deliver remarks at an event in Quebec City. A speech which is more hawkish than expected is bullish for the Canadian dollar.

- Wholesale Sales: Wednesday, 12:30. The indicator dropped to 0.7% in June, above the forecast of 0.5%. The downward trend is expected to continue in the July report, with an estimate of 0.3%.

- Core CPI: Friday, 12:30. The index has shown no growth recently, posting two straight readings of 0.0%. Better news is expected in the August release, with an estimate of 0.2%.

- Core Retail Sales: Friday, 12:30. Core Retail Sales declined 0.8% in June, well off the forecast of 0.3%. The markets are expecting the indicator to rebound in July, with an estimate of 0.5%.

- CPI: Friday, 12:30. CPI disappointed with a decline of 0.2% in July, its first decline in 2016. The estimate for the August report stands at 0.1%.

- Retail Sales: Friday, 12:30. Retail Sales is the primary gauge of consumer spending. The indicator came in at -0.1% in June, well short of the forecast of +0.5%. The markets are predicting a turnaround in the July reading, with an estimate of +0.2%.

USD/CAD opened the week at 1.3094 and dropped to a low of 1.3028 early in the week. USD/CAD then rebounded sharply and climbed to a high of 1.3248, testing resistance at 1.3219 (discussed last week). The pair closed the week at 1.3193.

Live chart of USD/CAD:

Technical lines, from top to bottom

With USD/CAD posting sharp gains, we start at higher levels:

1.3551 has provided resistance since March 2016.

1.3457 was a cap in September 2015.

1.3353 is next.

1.3219 was a cap in April. This line is a weak resistance level which could see action early in the week.

1.3081 has switched to support following strong gains by USD/CAD last week.

1.2990 has strengthened in support.

The round number of 1.2900 is next.

1.2804 was an important cushion after the Brexit vote in late June. It is the final support line for now.

I am bullish on USD/CAD

It’s not a pretty picture for the struggling Canadian dollar. Oil prices are under strong pressure and the Federal Reserve could still raise rates in December. So it could be another rough week for the Canadian currency.

Our latest podcast is titled Brexit: Bad, Bearable or Brilliant?

Follow us on Sticher or iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the kiwi, see the NZDUSD forecast.