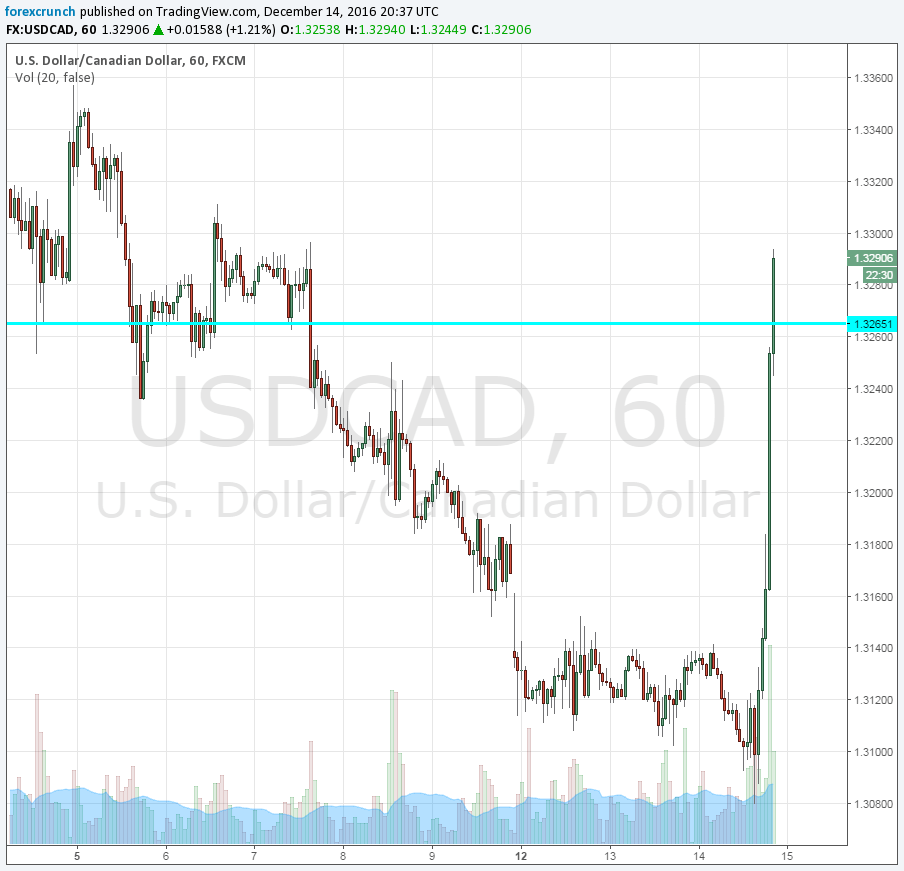

The FED raised rates and upgraded the dot-plot to reflect three rate increases in 2017. Despite some downplaying by Yellen, the greenback continues higher.

Alongside the inverse correlation between oil prices and the dollar, the Canadian dollar is suffering. The pair rises to a high of 1.3294. Note that if the FOMC indeed raises rates, it will be a sign of confidence. A sign of confidence means a strong US economy, thus more demand for Canadian goods. At the moment, the loonie is quite lonely.

Up to this rate decision, the Canadian dollar enjoyed the OPEC Accord, which boosted oil prices and the C$ as a result. It took some time for WTI Crude Oil to break above the $52 level and now it’s back under this line at the $50 handle.

Further resistance awaits at1.3380. The next barrier to the topside is 1.3480. If it reverses, the level to watch is 1.31, and this is followed by 1.30.

Here is the Dollar/CAD chart.