The Canadian dollar had an excellent week, riding on good figures from the US rather than from its own data. After closing under parity, can the pair move further down? Ivey PMI and housing data are the highlight of this week. Here’s an outlook for the Canadian events and an updated technical analysis for USD/CAD.

Last week, Gross Domestic Product edged down 0.1% in November following no growth in October. This is the first decline since May 2011 which was contrary to economists expectations of 0.2% expansion. The main drops occurred in the energy sector with oil and gas sliding 2.5% but the manufacturing sector increased 0.6% on durable goods. Employment data were weak with a rise in the unemployment rate, but the excellent job figures from the US provided lots of hope. Will we see better results next month?

Updates: USD/CAD rose from the lows of 0.99 but didn’t reach parity. The greenback strengthens as worries about Greece rise. The loonie enjoyed a leap of 11.1% in building permits to keep USD/CAD below parity. John Kicklighter analyzes the forces moving the loonie. USD/CAD is around 0.9950 after Bernanke played down the US job improvement. The Canadian NHPI rose by only 0.1%, reflecting trouble in Canadian housing. In addition, the lower Chinese activity and new shadows over Greece are very worrying. USD/CAD parity is now seen from the other side: the pair just crossed these levels.

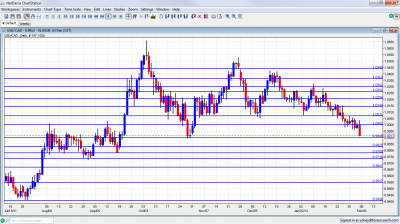

USD/CAD daily chart with support and resistance lines on it. Click to enlarge:

- Ivey PMI: Monday, 15:00. Canadian purchasing activity increased in December reaching63.5 in from59.9 in November. The reading was higher than the decline to 59.1 anticipated by analysts suggesting expansion in the Canadian economy. A drop to 57.8 is expected now.

- Building Permits: Tuesday, 13:30. The total value of building permits dropped by 3.6% in November after an increase of 11.9% in October. The major decline occurred in non residential permits while residential permits climbed 6.9%. A rise of 0.8% is predicted.

- Housing Starts: Wednesday, 13:15. The number of residential construction starts edged up in December by 200,000 after increasing 185,600 in November. This reading was beyond the 186,000 housing starts predicted indicating a recovery in the housing sector. A small decline to 192,000 is forecasted.

- NHPI : Thursday, 13:30. The New Housing Price Index (NHPI) increased by 0.3% in November, after gaining 0.2% in October. The top increases were in the metropolitan regions of Toronto and Oshawa. However builders in Calgary announced they would lower prices to attract buyers. A further increase of 0.5% is expected.

- Trade Balance: Friday, 13:30. Canadian Trade balance switched to surplus of $1.1 billion in November after a $0.5 billion deficit in October. Exports increased by 3.2% while imports decreased by 0.8%. Economists expected deficit to remain -$0.5 billion. Surplus is expected to narrow to $0.7 billion.

* All times are GMT.

USD/CAD Technical Analysis

Dollar/CAD started the week with another challenge on the 1.0070 line (discussed last week). After failing to breach this line, the pair went on to struggle with parity, and eventually made a sharp drop to close at 0.9913.

Technical lines, from top to bottom:

We start from lower ground this time. 1.0430 provided support when the pair was trading at higher ground during November and was tested successfully also in December, making it stronger. 1.0360 capped the pair in September and October and also provided support. It is weaker now.

The round number of 1.03 was the peak of a move upwards seen in November 2010 and has found new strength after working as a cap in January 2012. 1.0263 is the peak of surges during October, November and December, but was shattered after the move higher. The break above this line proved to be short lived, and it returned to the previous strength.

The round figure of 1.02 was a cushion when the pair dropped in November, and also the 2009 trough. It is weaker now but remains pivotal. 1.0143 was a swing low in September and worked as resistance several times afterwards. It is a strong line of resistance and should be watched on every move higher. The failure to break it marked the collapse of the pair.

1.0070 was a trough more than once in November, December and January. It worked as a very strong cap also in February 2012. The very round number of USD/CAD parity is a clear line of course, and was a line of battle that eventually saw the pair fall lower.

Under parity, the round number of 0.99 provided support on a fall during October and also served as resistance back in June. In February 2012, the pair fell short of challenging it. 0.9830 provided support for the pair during September and is a minor line on the way down.

0.9780, where the current run began is the next and important support line. It is closely followed by 0.9736, which provided support during August 2011.

The veteran 0.9667 line worked as support at the beginning of 2011 and then for several months during the spring. It is a very clear and strong line on the chart. 0.9550 worked as support during April and also June and is minor now.

0.9406 was the trough in July 2011 and is the final frontier for now. Below this line, its back to 2007.

I remain bearish on USD/CAD.

Canada suffers from a housing bubble and from disappointing job figures. Nevertheless, the strength of Canada’s No. 1 trading partner, the US (seen in excellent Non-Farm Payrolls), provides hope for the Canadian economy, more than oil prices, and even if Bernanke doesn’t further ease. Regarding oil prices, they aren’t that high, the tensions around Iran remain on the agenda and this could flame up prices and the loonie.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the New Zealanddollar (kiwi), read the NZD forecast.

- For USD/CAD (loonie), check out the Canadian dollar outlook

- For the Swiss Franc, see the USD/CHF forecast.