The Canadian dollar managed to erase a bit of its yearly losses in the last week of 2011. Employment figures are the main event this week. Here’s an outlook for the Canadian events and an updated technical analysis for USD/CAD.

Tensions around Iran’s military exercise in the straights of Hormuz keep oil prices from falling, and this supports the greenback. Mid-east violence could start in another region, between Syria, Lebanon and Israel. These themes will continue in 2012.

Updates: Tensions around the Straights of Hormuz and some European hope push the Canadian dollar higher. The US and Iran heighten tensions regarding presence in the Persian Gulf. This sent oil prices well above $100 and helped the loonie. On the other hand, the new European worries stopped the pair from challenging parity and it is struggling with 1.0143 once again. The Iranian threat to US regarding sailing an aircraft carrier into the Persian Gulf pushed oil even higher, but Europe had the upper hand, and USD/CAD is above 1.0143 once again.

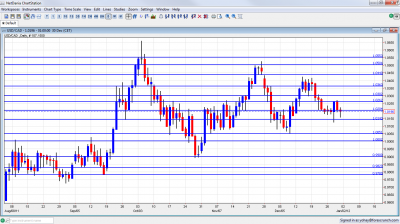

USD/CAD daily chart with support and resistance lines on it. Click to enlarge:

- RMPI: Thursday, 13:30. Both Raw Materials Price Index and Industrial Product Price Index decreased in October due to a major drop in the price of metals. The RMPI declined 1.2% after rising 1.4% in September. The IPPI slid 0.1% in October, following increases of 0.5% in September. RMPI is expected to rise by 0.1% while IPPI is predicted to increase by 0.3%.

- Ivey PMI: Thursday, 15:00. Purchasing activity continued to grow in November reaching 59.9 after scoring54.4 in the previous month. The reading was nearly 5 points above expectations suggesting an improvement in The Canadian market activity. A drop to 56.7 is expected now.

- Employment data: Friday, 12:00.Canada’s healthy job market encountered two worrisome drops in the last two months. Unemployment rate moved up to 7.4% in November after 7.3% in the previous month and the labor market contracted 18,600 jobs following54,000 in October while economists expected an 18,100 gain. Nevertheless, compared to a year ago there are 212,000 more employees in November which is still encouraging. An addition of 15,300 Jobs is predicted with no change in unemployment rate.

* All times are GMT.

USD/CAD Technical Analysis

Dollar/CAD began the week very slowly around the pivotal 1.02 line (discussed last week). It then dropped sharply but bounced quickly. An attempt to break above 1.0263 failed and the pair closed the year at 1.0196.

Technical lines, from top to bottom:

1.0550 is a minor line on the way up – a line which can slow the pair. 1.0500 is another minor line of resistance. It was a pivotal around the same time and was a point of resistance before the pair fell.

1.0430 provided support when the pair was trading at higher ground during November and was tested successfully also in December, making it stronger. 1.0360 capped the pair in September and October and also provided support. It is weaker now.

The round number of 1.03 was the peak of a move upwards seen in November and has found new strength after working as a distinct line separating ranges. 1.0263 is the peak of recent surges during October, November and December, but was shattered after the move higher.

The round figure of 1.02 was a cushion when the pair dropped in November, and also the 2009 trough. It is weaker now but remains pivotal. 1.0143 was a swing low in September and worked as resistance in the past. It capped a small recovery attempt in November.

1.0050 worked as support in November, was a swing low in December and had the opposite role back in 2010. It worked as a great cushion for the pair in November.

The very round number of USD/CAD parity is a clear line of course, and it will be closely watched on a potential downfall. Under parity, the round number of 0.99 provided support on a fall during October and also served as resistance back in June.

0.9830 provided support for the pair during September. 0.9780, where the current run began is the next and important support line.

I remain bearish on USD/CAD.

Data in the US remains encouraging and also the rising Mid-East tensions support the Canadian dollar. After two bad domestic employment reports, this one could be better now. If the pair didn’t leap on those reports and on the stall of the Canadian economy, it has room for rises once Canadian data improves.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the New Zealand dollar (kiwi), read the NZD forecast.

- For USD/CAD (loonie), check out the Canadian dollar

- For the Swiss Franc, see the USD/CHF forecast.