The Canadian dollar got closer to parity with USD but eventually retreated. BOC Business Outlook Survey and Trade Balance are the main events this week. Here is an outlook for the main events and an updated technical analysis for USD/CAD.

Last week brought good news for the Canadian market with a better than predicted rise of 7.4% in the value of Building Permits issued in May compared to a 5.2% contraction in the previous month and a higher than expected rise of 7,300 jobs with a drop to 7.2% in unemployment rate. Will this trend continue?

Updates: The Bank of Canada Business Outlook Survey will be released later on Monday. This highly-respected report is released each quarter. USD/CAD is quiet, as the pair was trading just above the 1.02 line, at 1.0202. Housing Starts will be released later on Tuesday. The BOC Business Outlook Survey found that overall, business-lending conditions in Canada had eased during Q2. The loonie improved following the release of the report. USD/CAD was trading at 1.0169. A strong Housing Starts release reflected the red-hot housing sector. The indicator climbed to 223 thousand, easily exceeding the market forecast of 203K. Trade Balance, a key indicator, will be released later on Wednesday. The markets are hoping that last month’s deficit does not repeat itself. The loonie edged higher, as USD/CAD fell below the 1.02 line. The pair was trading at 1.0178.. The Trade Balance recorded a wider deficit, posting a figure of -0.8 billion. This represented an eight-month low. NHPI will be released later on Thursday. No change is expected in the July reading of this housing inflation index. The Canadian dollar lost ground following the news that the Federal Reserve was not planning any monetary easing to help the US economy. USD/CAD was trading at 1.0237.

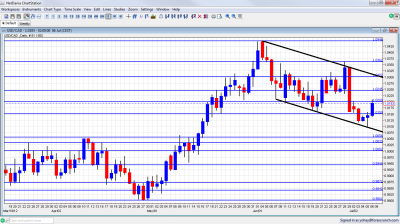

USD/CAD daily chart with support and resistance lines on it. Click to enlarge:

- BOC Business Outlook Survey; Monday, 14:30. Spring Business outlook survey discovered renewed optimism among Canadian businesses with a sharp rise of expectations for sales, hiring and investment, a new Bank of Canada survey suggests. 58 respondents expected higher sales in the next 12 months, as opposed to 23 that expected fewer. Companies stated they will increase their level of investment in machinery and equipment which is a good sign for future economic prospects.

- Housing Starts: Tuesday, 12:15. The pace of Canadian housing starts moderated to 212,000 units in May following the 244,900 boost in April. The decline was in line with economists’ predictions. The main cause for this slowdown was multiple-family urban starts plunging 20.7% while urban single starts decreased 4.2%. Another drop to 202,000 is estimated this time.

- Trade Balance: Wednesday, 12:30.Canada’s trade balance flipped to a deficit of 367 million Canadian dollars in April following a surplus of $152 million in March. Economists expected a smaller drop to a 200 million surplus. This decline occurred amid a price drop for exports.Canada’s trade surplus with the United States, its main trading partner, declined to $3.8 billion from $4.5 billion in March. Deftcit is expected to reach 500 billion.

- NHPI : Thursday, 12:30. New housing prices continued to increase rising 0.2% in April following a 0.3% climb in March. On a yearly base, NHPI in April was 2.5%, following a 2.6% increase recorded in March. The rise occurred amid good market conditions indicating stronger housing market conditions. A rise of 0.3% is predicted now.

* All times are GMT.

USD/CAD Technical Analysis

Dollar/C$ began the week by trying to break above the 1.02 (discussed last week) line, twice. The pair eventually fell below the 1.0150 level and traded beneath this line line. Things changed at the end of the week when it rose back up and eventually closed at 1.0193.

Technical lines, from top to bottom:

1.0750 was the peak of ranges several times in the past few years, and is a very important line. 1.0660 was last seen in September 2011, but this line was also a long running swing high several times beforehand.

1.0523 was a peak back in November and is minor resistance. 1.0460 capped the pair in June 2012 and also had a minor role in the past. It is now high resistance.

1.0360 was a pivotal line in June 2012 and is now significant resistance. It proved its strength in June 2012. The round number of 1.03 was resistance at the beginning of the year and now returns to this role. It worked perfectly well during June – over and over again, until finally being run through.

1.0245 served as a separator for the move up when the pair rallied in May 2010 but is weaker now. The round figure of 1.02 was a cushion when the pair dropped in November, and also the 2009 trough. It is now becoming stronger once again after stopping a rise in July.

1.0150 was a swing low in September and worked as resistance several times afterwards. It was challenged in June 2012. and served as a separator in July 2012. This continues to be a key line to watch.

Just above parity, 1.0030 capped the pair twice in March 2012 but is weaker now after working only temporarily in May. The very round number of USD/CAD parity is a clear line of course, and the battle is renewed after the recent climb.

Under parity, we meet another pivotal line at 0.9950. It served as a top border to range trading in March 2012 and later as a line in the middle of the range.

0.99, the round number is now present on the graph after capping the pair in May 2012. 0.9840 provided support for the pair during September and was reduced to a minor line now.

Lower, 0.9725 worked as strong support back at the fall of 2011. The last line for now is 0.9667, which was another strong cushion in the past.

Downtrend Channel

As you can see on the graph, the pair is trading in a downwards channel that began at the beginning of June. Downtrend support is more significant than downtrend resistance.

I remain bearish on USD/CAD.

Even throughout the US dollar storm that gripped the markets at the end of the week, the Canadian dollar was resilient. The positive employment data, and the recovering oil prices support the pair. Canada’s biggest market, the US, is muddling along – not weighing on the loonie and not helping it.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the New Zealand Dollar (kiwi), read the NZD forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast

- For the Swiss Franc, see the USD/CHF forecast