USD/CAD finally moved to lower ground. Gradual rises in oil prices are exactly what’s needed to help Canada without hurting US demand. The rate decision and employment data are the major events this week. Here’s an outlook for the Canadian events and an updated technical analysis for USD/CAD.

Updates: A rise in GDP of 0.4% lifted the loonie over the parity level, as the pair dropped to 0.9950. USD/CAD pushed over parity, then retracted to 0.9992. The markets are waiting for the PMI release. USD/CAD is hovering at the parity line. Ivey PMI hit 66.5, a 10-month-high. Building Permits fell by 12.3%, a nine-month low.

Canada returned to growth in the last month of 2011. The 0.4% rate exceeded expectations and helped the loonie secure lower ground. Employment data, which is released very close the US job figures, will provide another exciting Friday.

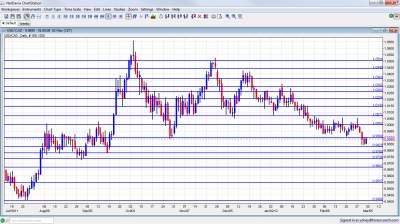

USD/CAD daily chart with support and resistance lines on it. Click to enlarge:

- Ivey PMI: Tuesday, 15:00. Canadian Ivey Purchasing Managers Index (PMI) unexpectedly surged in January to 64.1 from63.5 in December suggesting growing optimism in the Canadian market. The reading was much better than the 58.6 anticipated by economists. A drop to 62.3 is expected.

- Building Permits: Wednesday, 13:30. The number of building permits soared by 11.1% in December, the highest level since 2007, due to bigger budget for construction issued by the municipalities. A rise of 2.3% is predicted.

- Housing Starts: Thursday, 13:15. January housing starts dropped to 197,900 units from200,000 in the previous month however higher than the 193,000 predicted by analysts. Although the building sector is on a growth trend, economists fear of a slowdown in the coming months due to over-building. The same rise of 198,000 is expected now.

- NHPI : Thursday, 13:30. New home prices inCanada slowed in December to 0.1% following 0.3% in November suggesting a possible slowdown in the housing market. This reading was lower than the 0.2% rise anticipated by economists. The BOC is worried about the high household debt levels nearing levels seen in theUnited States before the 2008-09 collapse. But according to general belief there will only be a slowdown in the market. An increase of 0.4% is forecasted.

- Rate decision: Thursday, 14:00. The Bank of Canada kept the overnight rate at 1.0% over fears for a worsening of the euro debt crisis, global uncertainty and the increase of domestic household debt. The BOC has lowered its yearly growth estimate to 2.0% for 2012. No change is expected.

- Employment data: Friday, 12:00.Canada’s job market softened unexpectedly in January with a low job creation of 2,300 and more layoffs in the construction and service sectors bringing unemployment rate up to 7.6% from 7.5%. Analysts expected a job growth of 23,300 positions with no change in unemployment rate. An addition of 13,900 jobs is anticipated with the same unemployment rate of 7.6%.

- Trade Balance: Friday, 13:30. Canada’s International Merchandise trade increased its surplus to 2.69 billion Dollars in December after a prior surplus of 1.07 billion Dollars. This reading was higher than the 0.8 billion Dollars surplus forecasted by analysts. A smaller surplus of 2.0 billion is expected now.

- Labor Productivity: Friday, 13:30. The labor output of Canadian businesses increased 0.4% in the third quarter following a 1.0% drop in the second quarter amid an upturn of 0.7% in business productivity. An increase f 0.7% is predicted now.

* All times are GMT.

USD/CAD Technical Analysis

Dollar/CAD kicked off the week with a failed attempt to break above parity. It quickly returned to the 0.99 to 1 range. When it finally broke under 0.99 (mentioned last week), the break was decisive. Attempts to get back above this line failed.

Technical lines, from top to bottom:

The big week ahead requires taking caution and looking at a wide array of lines. 1.0550 served as a minor cap back in September, when the pair traded higher. The round number of 1.05 had a similar role later on, during a surge in November.

The 1.0440 line worked as support when the pair was trading at higher ground during November and was tested successfully also in December, making it stronger. 1.0360 capped the pair in September and October and also provided support. It is weaker now.

The round number of 1.03 was the peak of a move upwards seen in November 2010 and has found new strength after working as a cap in January 2012. 1.0263 is the peak of surges during October, November and December, but was shattered after the move higher. It’s far at the moment..

The round figure of 1.02 was a cushion when the pair dropped in November, and also the 2009 trough. It is weaker now but remains pivotal. 1.0143 was a swing low in September and worked as resistance several times afterwards.

Closer to parity, 1.0070 was a trough more than once in November, December and January. It worked as a very strong cap also in February 2012. The very round number of USD/CAD parity is a clear line of course, and was a line of battle that eventually saw the pair fall lower.

Under parity, the round number of 0.99 provided support on a fall during October and also served as resistance back in June. The break below this line in March 2012 was very decisive. 0.9830 provided support for the pair during September and is now stronger after a first attempt to breach it failed.

0.9780, where the current run began is the next and important support line. It is closely followed by 0.9736, which provided support during August 2011.

The veteran 0.9667 line worked as support at the beginning of 2011 and then for several months during the spring. It is a very clear and strong line on the chart. 0.9550 worked as support during April and also June and is minor now.

0.9406 was the trough in July 2011 and is the final frontier for now. Below this line, its back to 2007.

I am bearish on USD/CAD.

Oil prices can be a double-edged sword, but they seem to rise rather gradually. On one hand, Canada exports the black gold, but as taxes are low on fuel in the US, every change in global prices has an immediate impact on consumers and on the economy. Canada is dependent on the strength of the US economy, which now seems geared up for a strong NFP report. The Greek crisis, which has reached the cliff, could certainly weigh on the loonie, but it is showing greater strength than other commodity currencies.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the New Zealand Dollar (kiwi), read the NZD forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast

- For the Swiss Franc, see the USD/CHF forecast.