The Canadian dollar is back on the horse and this time thanks to domestic data rather than the slippery slope of oil prices, which can be a roller coaster.

Data in Canada certainly beat expectations and this helped the loonie recover. CPI rose and so did retail sales. Headline inflation rose by 0.6%, double the expectations for 0.3%. Core inflation rose 0.7% instead of 0.4% predicted. This shows that inflation still remains robust despite the gains in the value of the Canadian dollar. Prices of imported goods were expected to drop and push down inflation. So far, this has not materialized and the BOC has no rush to cut rates.

The Canadian consumer also looks upbeat: the volume of sales rose by 0.4% against a drop double the size, according to the early expectations. Core sales also surprised to the upside with +0.2% instead of -0.8% and in addition, this came on top of an upwards revision for the previous month.

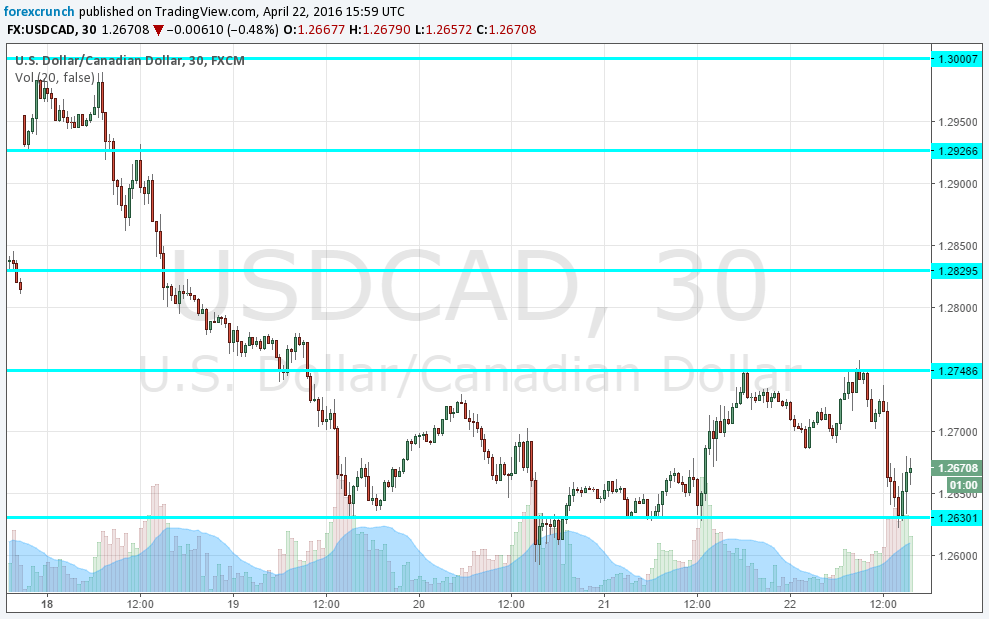

USD/CAD was flirting with resistance at 1.2750. This served as support before the pair dropped to lower levels and switched positions quite swiftly. When the data broke out the top of the range held up and Dollar/CAD fell around 100 pips to test the lows of 1.2622 before bouncing back up.

The technical behavior is quite nice and undoubtedly superior to that of more popular currency pairs, especially the world’s No. 1 pair: EUR/USD.