The yen reversed directions last week and posted slight losses. USD/JPY closed the week at 108.88. This week’s highlights are the BoJ Rate Statement and Household Spending. Here is an outlook for the highlights of this week and an updated technical analysis for USD/JPY.

In the US, last week’s readings were lukewarm. Housing numbers were mixed and manufacturing and employment numbers missed their estimates. In Japan, the trade surplus dropped sharply and missed expectations.

Updates:

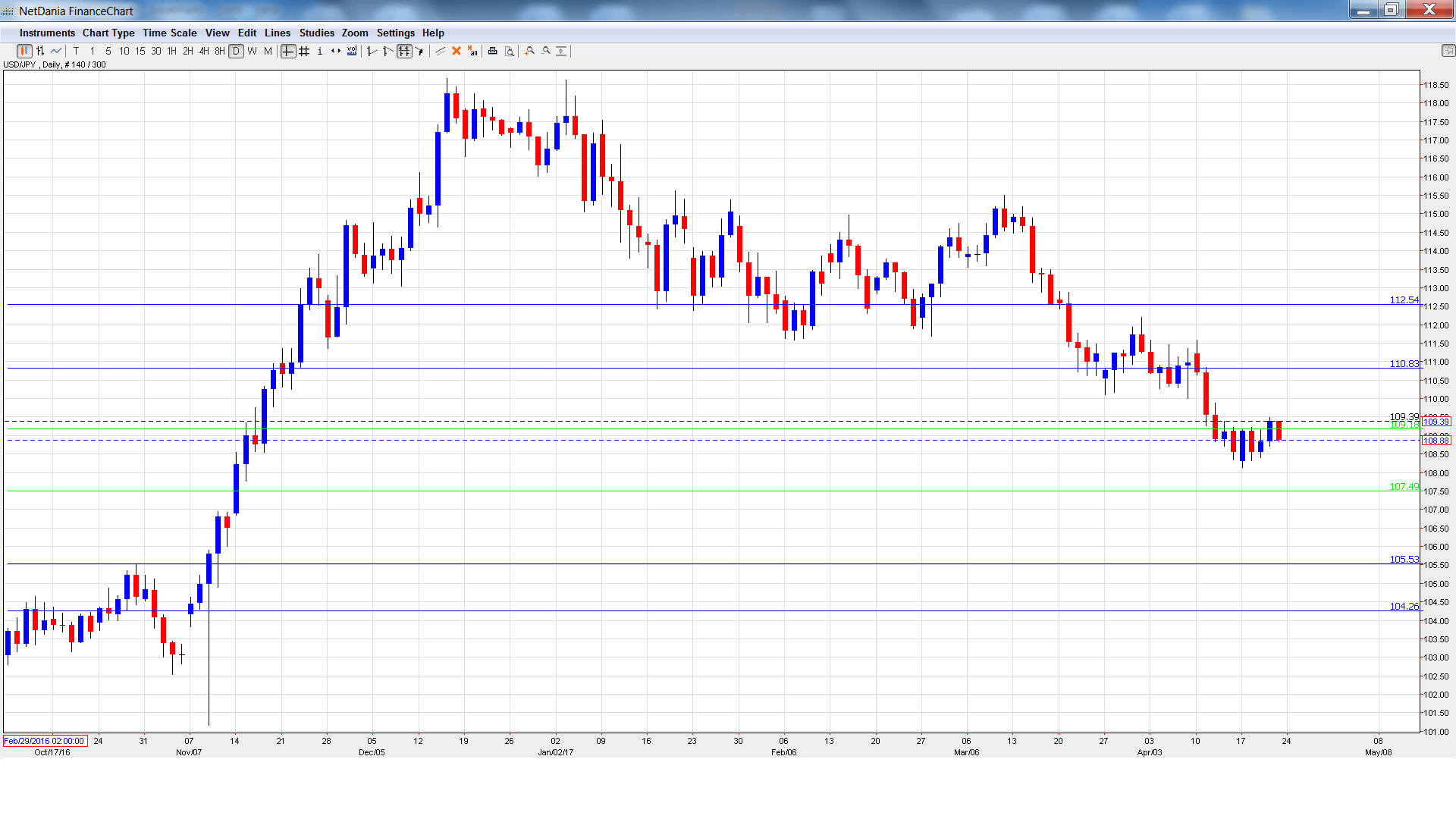

USD/JPY graph with support and resistance lines on it. Click to enlarge:

- SPPI: Monday, 23:50. This index measures inflation in the corporate sector. In February, the index climbed to 0.8%, above the forecast of 0.5%. This marked the indicator’s strongest gain since March 2015. The March estimate stands at 0.7%.

- All Industries Activity: Wednesday, 4:30. This indicator provides a snapshot of the level of activity in the business sector. In January, the indicator posted a weak gain of 0.1%, matching the forecast. The markets are expecting a sharp jump of 0.8% in February.

- BoJ Monetary Policy Statement: Thursday, 3:50. The BoJ will announce the April interest rate in this statement. The BoJ will also release an Outlook Report, which is released quarterly and provides details of the central bank’s view of current economic conditions and inflation. A press conference will follow.

- Household Spending: Thursday, 23:30. This is a key consumer spending indicator. The markets are used to seeing declines from this indicator, but the January drop of 3.8% was a particularly weak reading. The estimate for February stands at -0.6%.

- Preliminary Industrial Production: Thursday, 23:50. The indicator jumped 2.0% in January, easily beating the estimate of 1.3%. The markets are braced for a decline of 0.6% in February.

- Housing Starts: Friday, 5:00. Housing Starts sagged in January, coming in at -2.6%. This was much weaker than the estimate of -1.2%. Little change is expected in the February reading, with a forecast of 2.5%.

USD/JPY opened the week at 108.30. The pair quickly dropped to a low of 108.13. Late in the week, the pair touched a high of 109.49, testing resistance at 109.18 (discussed last week). USD/JPY closed the week at 108.88.

Technical lines from top to bottom:

112.53 has held in resistance since mid-March.

110.83 is next.

109.18 was tested in resistance early in the week.

107.49 was a cap in July 2016.

105.55 was a cushion in May and June.

104.25 is the final support line for now.

I am neutral on USD/JPY

The US economy is doing well, but the markets are not impressed with Trump’s first 100 days in office. The Japanese economy has shown improvement, but US protectionism remains a serious risk and Trump is likely to react if the Japanese weakens.

Our latest podcast is titled French fate and British snaps

Follow us on Sticher or iTunes

Safe trading!

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Canadian dollar (loonie), check out the Canadian dollar forecast.

- For the kiwi, see the NZD/USD forecast.