The Japanese yen rebounded with strong gains, as USD/JPY slipped 220 points. The pair closed the week at 112.41, marking the lowest weekly close since the end of November 2016. There are 9 events on the calendar. Here is an outlook for the highlights of this week and an updated technical analysis for USD/JPY.

It’s been a rocky start for Donald Trump’s Presidency, who has picked fights with Mexico and Australia but hasn’t outlined economic or fiscal policies. US job numbers were mixed, as Nonfarm Payrolls was better than expected but wage growth was weaker than expected. In Japan, Household Spending posted another decline, but managed to beat expectations. As expected, the BoJ held interest rates at -0.10%.

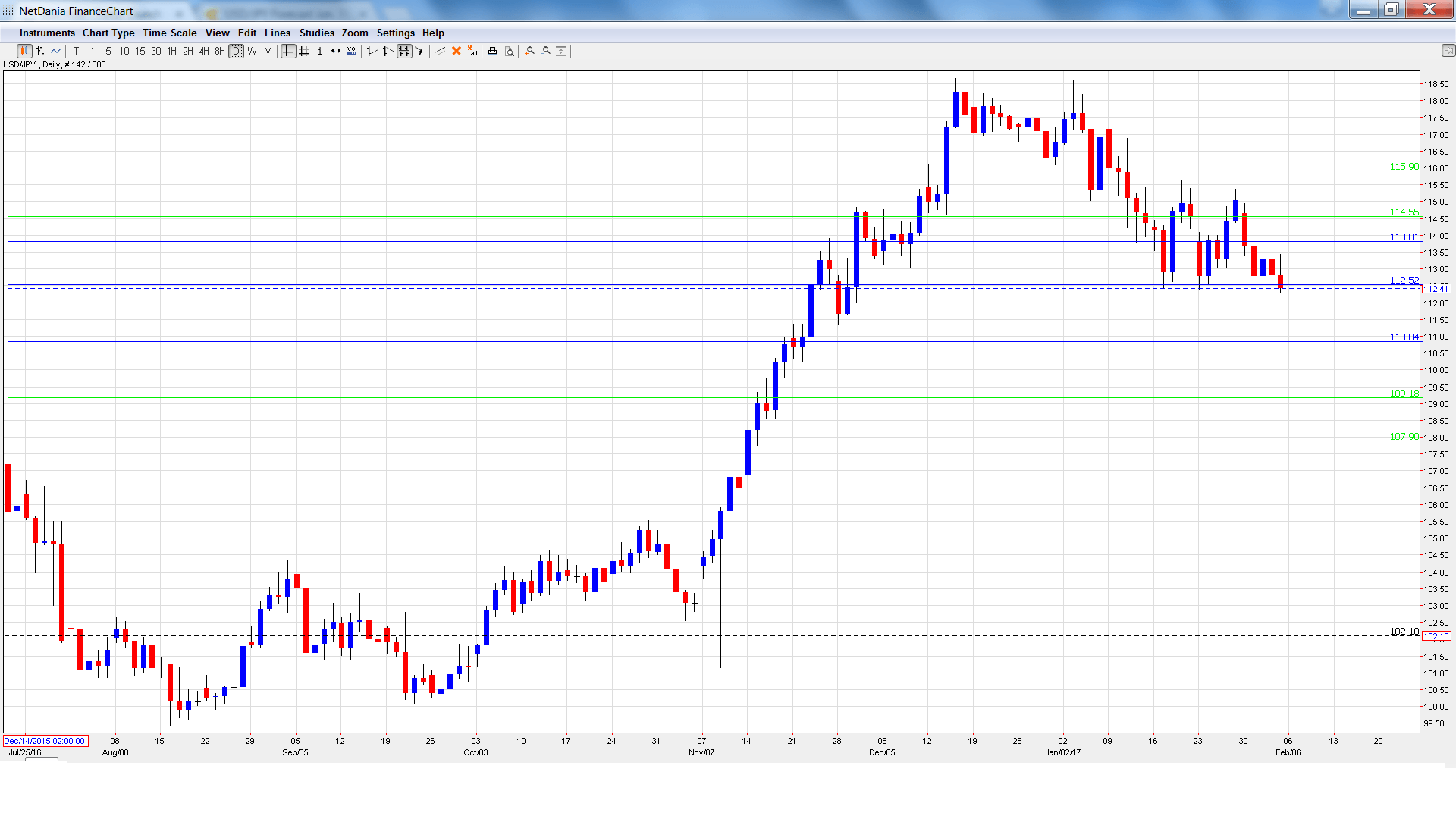

[do action=”autoupdate” tag=”USDJPYUpdate”/]USD/JPY graph with support and resistance lines on it. Click to enlarge:

- Average Cash Earnings: Monday, 00:00. The indicator edged up to 0.2% in November, matching the forecast. The upward trend is expected to continue in December, with an estimate of 0.4%.

- Leading Indicators: Tuesday, 5:00. The indicator continues to rise, and reached 102.7% in November, just above the forecast of 102.6%. The indicator is expected to rise in December to 105.6%.

- BoJ Summary of Opinions: Tuesday, 23:50. This report follows the January monetary policy statement, in which the BoJ maintained interest rates at -0.10%. Analysts will be combing through the report, which contains the bank’s forecasts for inflation and economic growth.

- Economy Watchers Sentiment: Wednesday, 5:00. The indicator improved to 51.4 in December, pointing to optimism. This beat the forecast of 49.3. The upswing is expected to continue, with a forecast of 51.9.

- Core Machinery Orders: Wednesday, 23:50. The indicator has been struggling, recording three declines in the past four readings. In November, the indicator declined 5.1%, its sharpest drop since April 2016. The markets are expecting a strong turnaround in December, with an estimate of 3.2%.

- 30-y Bond Auction: Thursday, 3:45. The yield on 30-year bonds continues to rise, reaching 0.75% in January.

- Preliminary Machine Tool Orders: Thursday, 6:00. This manufacturing indicator posted a strong gain of 4.4% in December, breaking a nasty trend of 16 straight declines. Will the positive news continue in January?

- PPI: Thursday, 23:50. This inflation indicator continues to post declines. Still, the readings have been improving, as the December report posted a decline of 1.2%. The markets are expecting a flat reading of 0.0% in January.

- Tertiary Industry Activity: Friday, 4:30. The indicator has posted two straight readings of 0.2%. The markets are braced for a decline of 0.1% in December.

USD/JPY opened the week at 114.65 and quickly touched a high of 114.94. It was all downhill from there, as the pair dropped to 112.05, breaking below support at 112.53 (discussed last week). USD/JPY closed the week at 112.41.

Live chart of USD/JPY:

Technical lines from top to bottom:

With USD/JPY posting sharp losses, we start at lower levels:

115.90 has strengthened following sharp losses by USD/JPY.

114.55 marked a high point in March 2015.

113.80 is the next support level.

112.53 was a cap in April 2016. It was tested for a second straight week and is a weak resistance line.

110.83 is providing support.

109.18 marked the start of a rally in September 2008 which saw USD/JPY drop close to the 0.87 level.

107.90 is the final support level for now.

I am bullish on USD/JPY

Monetary divergence favors the dollar, as the Fed will likely raise rates in the first half of 2017. The US economy continues to outperform that of Japan, and Trump’s protectionist stance could sour investors on Japan, which is heavily reliant on exports.

Our latest podcast is titled Worrying wages and shining gold

Follow us on Sticher or iTunes

Safe trading!

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Canadian dollar (loonie), check out the Canadian dollar forecast.

- For the kiwi, see the NZD/USD forecast.