USD/JPY dropped as low as the 116 line, but closed the week at 116.76. This week has four events. Here is an outlook for the highlights of this week and an updated technical analysis for USD/JPY.

Japanese consumer inflation and spending indicators continued to point downward last week. The yen was buoyed by the BoJ Summary, which was moderately optimistic about the Japanese economy. In the US, consumer confidence sparkled, as US consumers remain optimistic about economic conditions. On the labor front, unemployment claims dropped, beating expectations.

do action=”autoupdate” tag=”USDJPYUpdate”/]

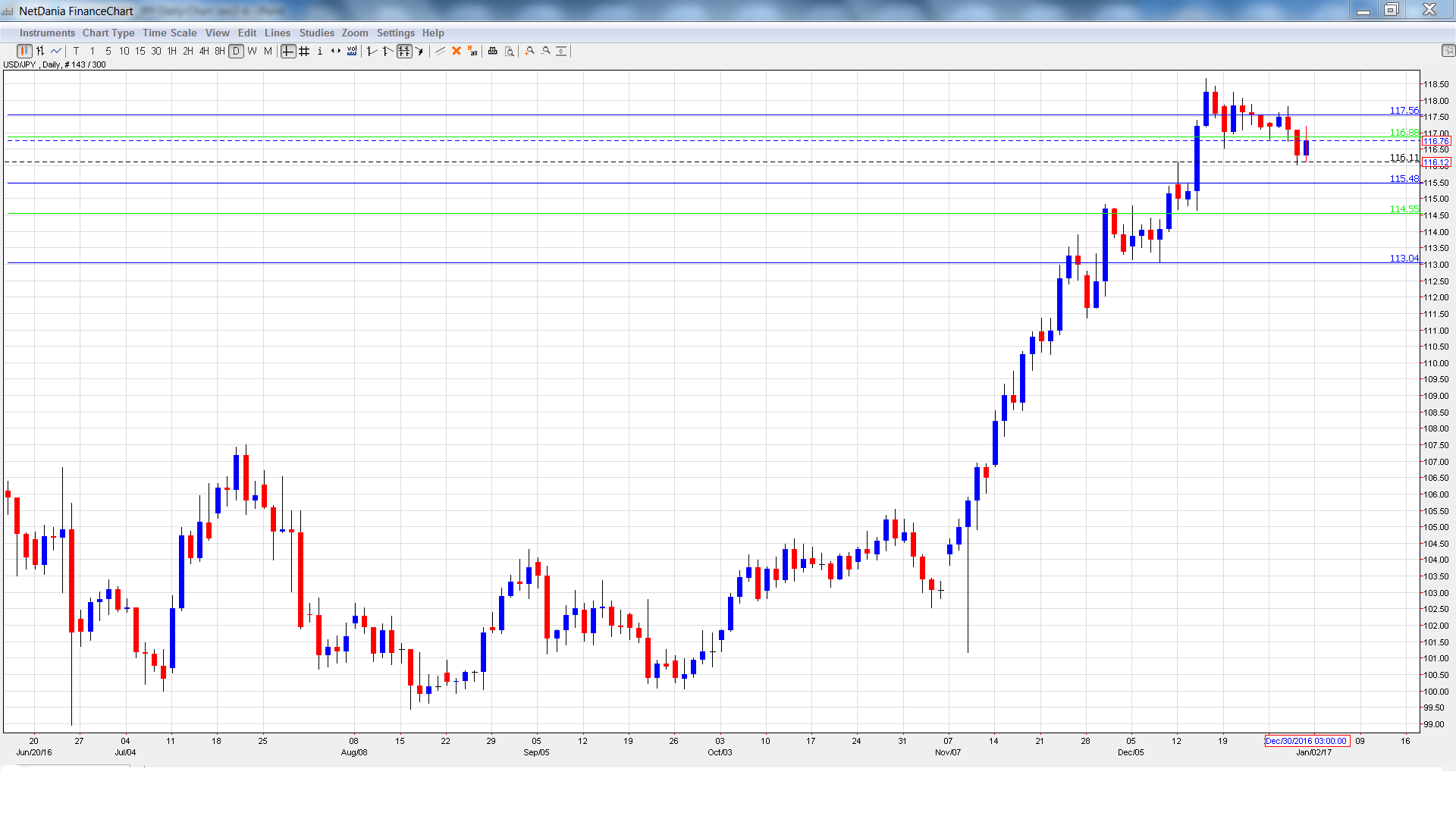

USD/JPY graph with support and resistance lines on it. Click to enlarge:

- Final Manufacturing PMI: Wednesday, 00:30. The index showed little change in November, posting a reading of 51.3, which was within expectations. The indicator is expected to rise to 51.9 in the December report.

- Monetary Base: Wednesday, 23:30. Monetary Base has been steadily dropping since early 2016 and dropped to 21.5% in November, short of the forecast of 23.2%. The trend is expected to reverse in December, with an estimate of 22.3%.

- 10-year Bond Auction: Thursday, 3:45. The yield on 10-year bonds improved in December to 0.03%. This marked the first foray into positive territory since March. Will we see positive reading in the January auction?

- Average Cash Earnings: Friday, 00:00. This indicator, which measures income levels, is correlated to consumer spending. In October, the indicator edged lower to 0.1%, short of the estimate of 0.2%. The estimate for November stands unchanged at 0.2%.

USD/JPY Technical Analysis

USD/JPY opened the week at 117.30 and climbed to a high of 117.81, testing resistance at 117.52 (discussed last week). The pair then reversed directions and dropped to a low of 116.02. USD/JPY closed the week at 116.76.

Live chart of USD/JPY:

Technical lines from top to bottom:

121.44 is a strong resistance line.

120.25 is protecting the symbolic 120 level.

118.79 was last breached in February.

117.52 remains busy and was tested in resistance last week.

115.90 is providing support.

114.55 marked a high point in March.

113.04 is the final support level for now.

I remain bullish on USD/JPY

Welcome to a brand new year! With the Trump presidency around the corner, the markets are expecting US growth to continue, which could mean more rate hikes from the Federal Reserve. So, the US dollar could start 2017 with broad gains.

Our latest podcast is titled What will move markets in 2017

Follow us on Sticher or iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Canadian dollar (loonie), check out the Canadian dollar forecast.

- For the kiwi, see the NZD/USD forecast.