USD/JPY had an uneventful week to sign off 2015, as the pair closed the week almost unchanged, at 120.22. The upcoming week has six events. Here is an outlook on the major events moving the yen and an updated technical analysis for USD/JPY.

US indicators were by no means impressive last week, as unemployment claims and housing data missed expectations. There was better news from consumer confidence, which beat the forecast. Japanese Retail Sales posted its second decline in three readings, ending the year on a sour note.

do action=”autoupdate” tag=”USDJPYUpdate”/]

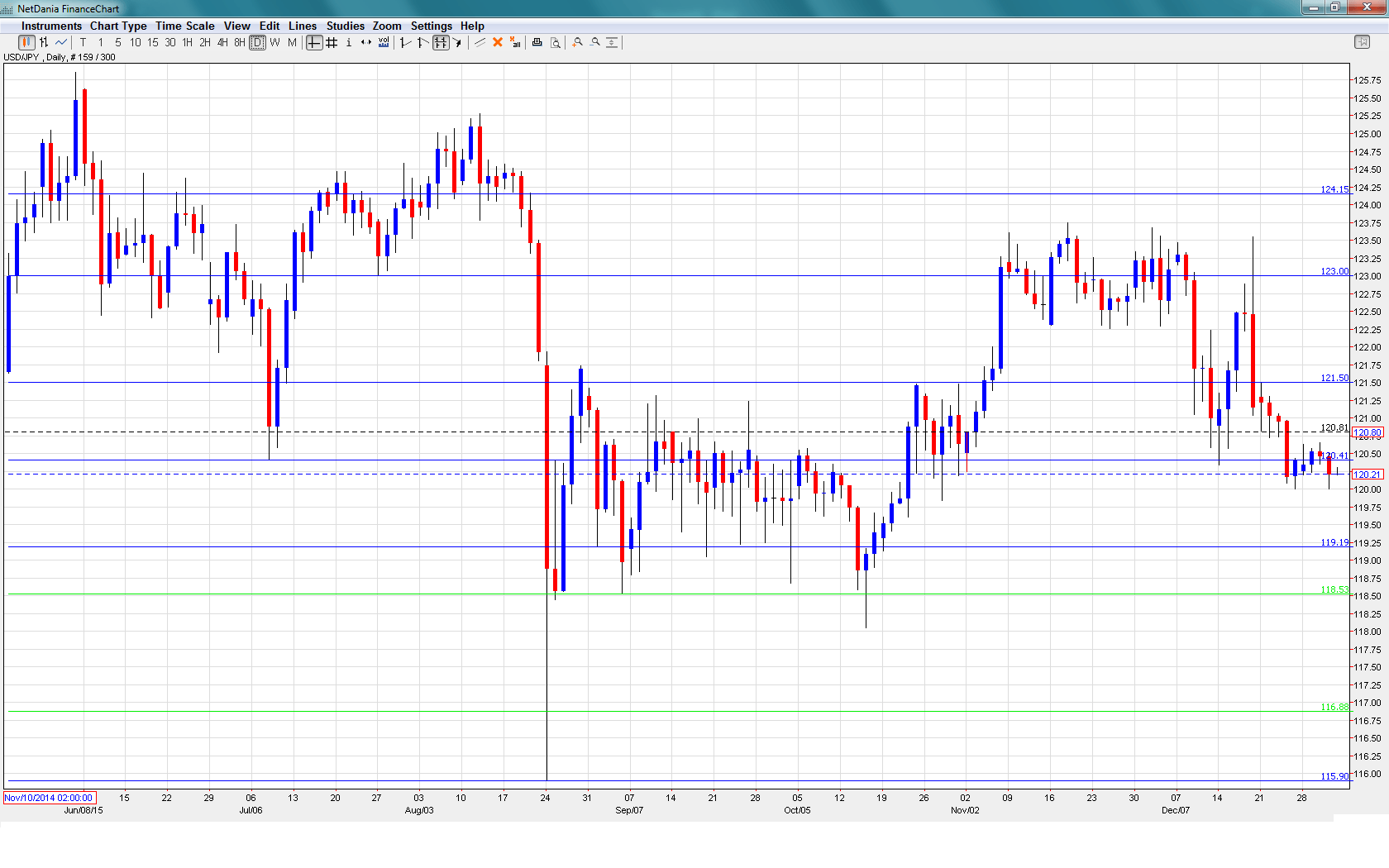

USD/JPY graph with support and resistance lines on it:

- Final Manufacturing PMI: Monday, 1:35. The index has remained been above the 50-point level in the second half of 2015, indicative of ongoing expansion in the manufacturing sector. In November, the indicator came in at 52.6 points, very close to the forecast of 52.8 points. Little change is expected in December, with an estimate of 52.5 points.

- Monetary Base: Monday, 23:50. Monetary Base has fallen short of the estimate in the past two releases, both of which were readings of 32.5%. The markets are expecting a slight rise in the December report, with an estimate of 33.2%.

- 10-year Bond Auction: Tuesday, 3:45. Yields on 10-year bonds have been steady, with the past two readings coming in at 0.32%. No significant change is expected in the upcoming release.

- 30-year Bond Auction: Thursday, 3:45. The 30-year bonds have also shown little movement in recent readings, with the December yield coming in at 1.40%, almost unchanged from a month earlier. Will we see more of the same in the January auction?

- Average Cash Earnings: Friday, 1:30. Disposable income is linked to consumer spending, a key driver of economic growth. The indicator edged up to 0.7% in November, beating the forecast of 0.4%. Another reading of 0.7% is expected in the December report.

- Leading Indicators: Friday, 5:00. This minor report is based on 11 indicators, with much of the data having already been released. The November report improved to 102.9%, matching the forecast. The upward trend is expected to continue, with the estimate standing at 103.9%.

* All times are GMT

Live chart of USD/JPY: [do action=”tradingviews” pair=”USDJPY” interval=”60″/]

USD/JPY Technical Analysis

USD/JPY opened the week at 120.22 and touched a high of 120.66, testing resistance at 120.40 (discussed last week). The pair then reversed directions and dropped to a low of 119.88. USD/JPY closed the week at 120.22.

Technical lines from top to bottom:

124.16 was an important cap in late June.

The round number of 123 remains a strong resistance line.

121.50 is next.

120.40 remains busy and was tested last week. It is a weak resistance line.

119.19 is an immediate support line. It has held firm since October.

118.50 is next.

116.90 supported dollar/yen early in 2015.

115.90 is the final support level for now.

I am bullish on USD/JPY

The BOJ is under strong pressure to implement further easing, which would sharpen monetary divergence and weaken the yen. Even if US numbers are not strong, the Fed is set to raise rates again early in the New Year, which is bullish for the greenback.

Here is our 2016 Financial Markets Guide:

Follow us on Sticher or on iTunes

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the kiwi, see the NZDUSD forecast.