USD/JPY posted slight gains last week and closed just above the 107 line. The upcoming week is busy, with 10 events on the schedule. Here is an outlook on the major events moving the yen and an updated technical analysis for USD/JPY.

In the US, Nonfarm Payrolls was dismal, falling to 160 thousand, well below expectations. There were no major Japanese releases last week, with Japanese markets closed for holidays for most of last week.

do action=”autoupdate” tag=”USDJPYUpdate”/]

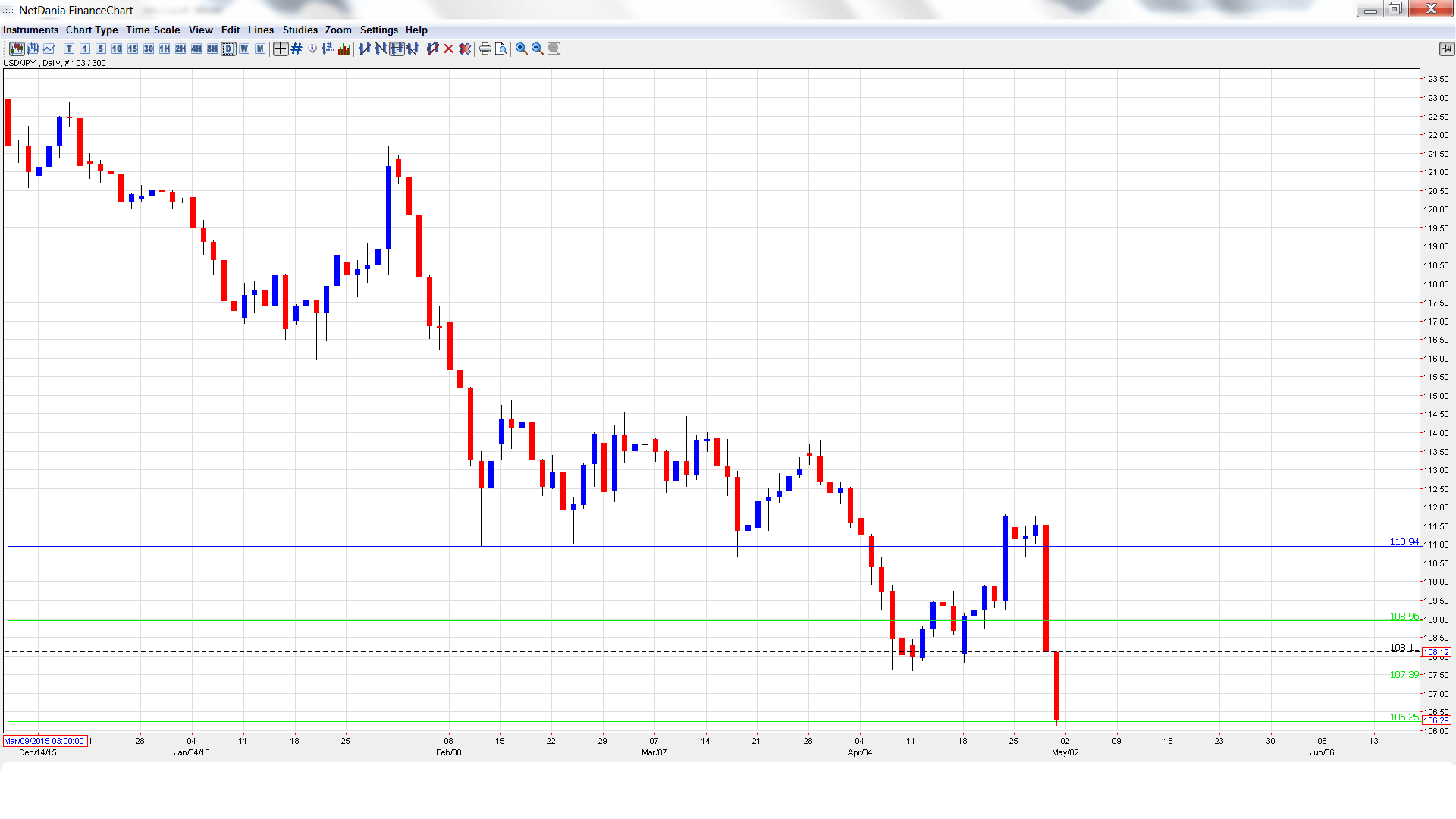

USD/JPY graph with support and resistance lines on it. Click to enlarge:

- Monetary Policy Meeting Minutes: Sunday, 23:50. The BoJ will release the minutes of its March policy meeting. Analysts will be combing through, looking for clues as to the BoJ’s future interest policy.

- Average Cash Earnings: Monday, 00:00. The indicator is closely linked to consumer spending, a key driver of engine growth. The indicator jumped 0.9% in February, marking a 10-month gain. This easily beat the estimate of 0.2%. The estimate for March stands at 0.6%.

- Consumer Confidence: Monday, 5:00. Consumer confidence indicators are also closely linked to consumer spending. The indicator continues to post readings close to the 40-point level, indicative of pessimism on the part of consumers. Another weak reading is expected in April, with a forecast of 40.8 points.

- 10-year Bond Auction: Tuesday, 3:45. Yields on 10-year bonds have dipped into negative territory, with the April yield coming in at -0.07%. Will the May yield also post a negative reading?

- Leading Indicators: Wednesday, 5:00. This minor indicator dipped to 99.8% in February, very close to the estimate. The downward trend is expected to continue in the March report, with an estimate of 96.4%.

- Current Account: Wednesday, 23:50. This indicator should be treated as a market-mover since it is closely linked to currency demand. The account surplus jumped to JPY 1.73 trillion in February, well above the estimate of JPY 1.57 trillion. The upward trend is expected to continue in March, with an estimate of JPY 1.90 trillion.

- 30-year Bond Auction: Thursday, 3:45. Yields on 30-year bonds have been steadily dropping, with the April yield coming on 0.39%.

- Economy Watchers Sentiment: Thursday, 5:00. The indicator remains below the 50-level, indicative of pessimism on the part of consumers. Another weak reading is expected, with an estimate of 44.9 points.

- M2 Money Stock: Thursday, 23:50. The indicator remains steady, and came in 3.2% in the March release, within expectations. Another gain of 3.2% is expected in the April report.

- Tertiary Industry Activity: Friday, 4:30. The indicator has been struggling, posting three declines in the past four releases. In February, the indicator posted a decline of 0.1%, above the forecast of -0.4%. The markets are braced for another decline in March, with an estimate of -0.2%.

* All times are GMT

USD/JPY Technical Analysis

USD/JPY opened the week at 106.43 and touched a low of 105.59, as support held firm at 105.44 (discussed last week). The pair then reversed directions and climbed to a high of 107.49. USD/JPY closed the week at 107.08.

Live chart of USD/JPY: [do action=”tradingviews” pair=”USDJPY” interval=”60″/]

Technical lines from top to bottom:

We start with resistance at 111.74.

110.94 was an important support level in February.

109.90 was a cap for much of April.

108.95 was a cushion in May 2006.

107.39 was tested in resistance and is a weak line.

106.25 is providing support. It marked the start of a dollar rally in October 2014 which saw USD/JPY move above the 121 line.

105.44 is next.

The round number of 104 was a key line in May 2008.

102.50 is the final support line for now.

I am bearish on USD/JPY

The yen has surged 1500 points in 2016, and the BoJ may not have any ammunition left to prevent the currency from continuing to appreciate. As well, weak US employment numbers at the end of last week could weigh on the US dollar.

In our latest podcast we examine: Markets vs. Trump vs. Clinton

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Canadian dollar (loonie), check out the Canadian dollar forecast.

- For the kiwi, see the NZD/USD forecast