USD/JPY posted huge losses, surging some 520 points. The pair closed at 106.23, its lowest level since October 2014. The upcoming week is very quiet, with just two events on the calendar. Here is an outlook on the major events moving the yen and an updated technical analysis for USD/JPY.

The dollar dropped sharply following the Fed statement, which made no mention of a June hike. US Advance GDP came in at 0.5%, short of the estimate. The Bank of Japan opted to remain on the sidelines, despite the stronger yen which has hurt the Japanese export sector.

do action=”autoupdate” tag=”USDJPYUpdate”/]

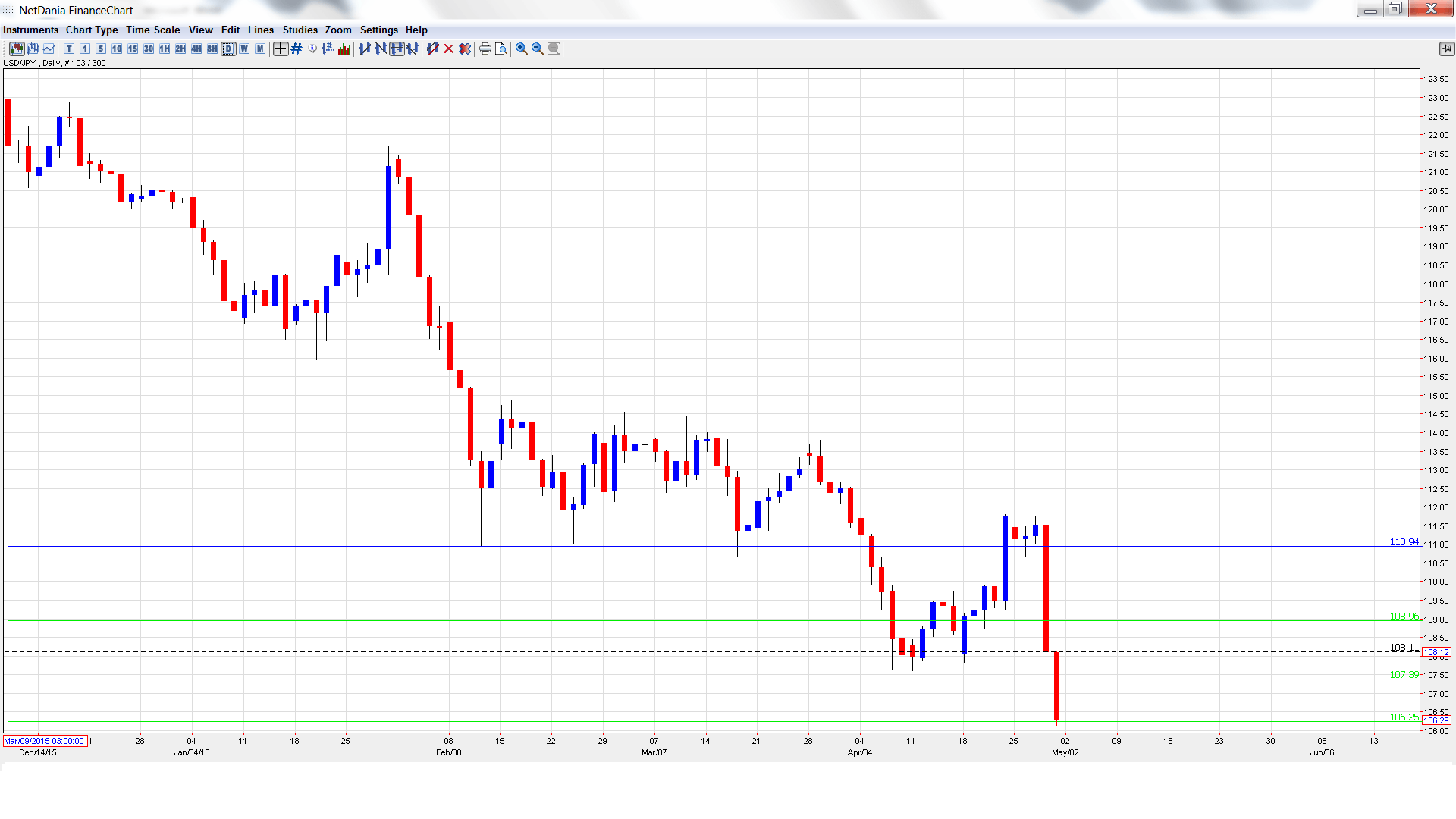

USD/JPY graph with support and resistance lines on it. Click to enlarge:

- Final Manufacturing PMI: Monday, 2:00. The PMI has lost ground over the past three readings and dropped to 49.1 points in March, which indicates contraction in manufacturing growth. The downturn is expected to continue in April, with an estimate of 48.0 points.

- Monetary Base: Tuesday, 8:30. The indicator dipped to 28.5% in March, within expectations. Better news is expected in the April report, with a forecast of 29.3%.

* All times are GMT

USD/JPY Technical Analysis

USD/JPY opened the week at 111.45 and touched a high of 111.88. The pair reversed directions and posted sharp losses late in the week, dropping to a low of 106.14, breaking support at 106.25 (discussed last week). USD/JPY closed the week at 106.23.

Live chart of USD/JPY: [do action=”tradingviews” pair=”USDJPY” interval=”60″/]

Technical lines from top to bottom:

With USD/JPY posting sharp losses, we start at lower levels:

110.94 was an important support level in February.

108.95 was a cushion in May 2006. It is a weak resistance line.

107.39 has switched to a resistance role following strong losses by USD/JPY.

106.25 marked the start of a dollar rally in October 2014 which saw USD/JPY move above the 121 line.

105.44 is an immediate support line.

The round number of 104 was a key line in May 2008.

102.50 is the final support line for now.

I am neutral on USD/JPY

With the pair posting huge losses, we may be due for a downward correction. At the same time, with the BoJ staying on the sidelines and not implementing any easing, the yen has room to move even higher.

In our latest podcast we ask: is China out of the woods?

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Canadian dollar (loonie), check out the Canadian dollar forecast.

- For the kiwi, see the NZD/USD forecast