USD/JPY posted marginal gains last week, as the pair closed at 101.18. This week’s key events are the Tankan Indices. Here is an outlook for the highlights of this week and an updated technical analysis for USD/JPY.

In Japan, key indicators didn’t provide any positive news. Consumer spending numbers declined, while inflation indicators remained in negative territory. Over in the US, consumer confidence came out at the highest since 2007, but durable goods orders were mixed. Final GDP was slightly better than expected in the US, but at 1.4%, growth remains very slow.

do action=”autoupdate” tag=”USDJPYUpdate”/]

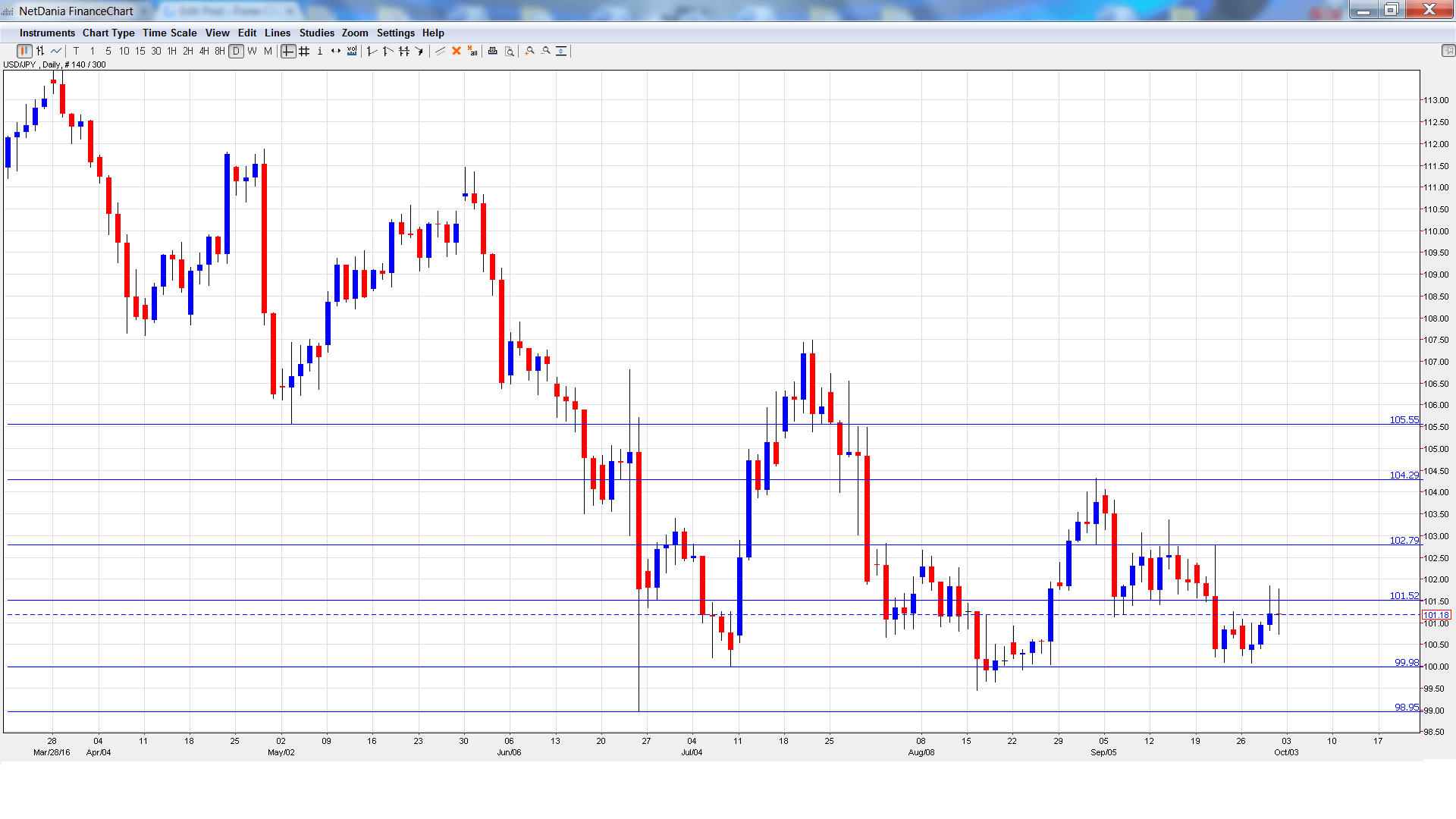

USD/JPY graph with support and resistance lines on it. Click to enlarge:

- Tankan Manufacturing Index: Sunday, 23:50. The index remained steady at +6 points in Q2, beating the forecast of +4 points. The markets are expecting a slight improvement in Q3, with an estimate of +7 points.

- Tankan Non-Manufacturing Index: Sunday, 23:50. This key services indicator dropped to +19 points in Q2, matching the forecast. It was the weakest since the second quarter of 2015. The downward trend is expected to continue in Q3, with an estimate of +18 points.

- Final Manufacturing PMI: Monday, 00:30. This minor indicator has recorded six straight readings below the 50-level, indicative of ongoing contraction in the manufacturing sector. The markets are expecting slight improvement in the September report, with an estimate of 50.3 points.

- Monetary Base: Monday, 23:50. Monetary Base has been steadily losing ground and dipped to 24.2% in August. The markets are expecting the downswing to continue in September, with an estimate of 23.4%.

- 10-year Bond Auction: Tuesday, 3:45. 10-year bonds continue to hover in negative territory, and the September yield remained unchanged at 0.05%. No significant change is expected at the October auction.

- Consumer Confidence: Tuesday, 5:00. The Japanese consumer remains pessimistic, as the indicator continues to post readings close to the 40-level. The August release came in at 42.0 points and little change is expected in the September report.

- Average Cash Earnings: Friday, 00:00. This indicator is used to track consumer income, with is linked to consumer spending. In July, the indicator climbed 1.4%, well above the estimate of 0.5%. The August release is expected to show a softer gain, with an estimate of 0.5%.

- Leading Indicators: Friday, 5:00. This composite index is based on 11 economic indicators, but is a minor event as most of data has already been released. In July, the indicator improved to 100.00%, beating the estimate. The upward swing is expected to continue in August, with an estimate of 101.7%.

* All times are GMT

USD/JPY Technical Analysis

USD/JPY opened the week at 100.92. The pair dropped to a low of 100.07, as support held firm at 99.98 (discussed last week). USD/JPY then reversed directions and climbed to a high of 101.84. The pair was unable to consolidate at this level and lost ground, closing the week at 101.18.

Live chart of USD/JPY:

Technical lines from top to bottom:

105.55 was a cushion in May and June.

104.25 is next.

102.79 has been a cap since mid-September.

101.52 was tested during the week but remains a weak resistance line.

99.98 continues to provide support. It was tested last week as the pair lost ground before rebounding.

98.95 has provided support since late June.

97.61 has provided support since November 2013.

96.56 is the final support line for now.

I remain neutral on USD/JPY

The BoJ continues to talk about adopting further easing if necessary, but appears unwilling to back up its words with action. This paves the path for the yen to strengthen and move closer to the symbolic 100 level. With a December rate hike priced in at about 50%, key US indicators will be closely watched by the Fed and could have significant impact on movement of the US dollar.

Our latest podcast is titled Bold BOJ vs. Fearful Fed

Follow us on Sticher or iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Canadian dollar (loonie), check out the Canadian dollar forecast.

- For the kiwi, see the NZD/USD forecast