The Japanese yen sparkled last week, as USD/JPY gained 160 points. The pair close the week at 100.72. There are eight events on the schedule. Here is an outlook for the highlights of this week and an updated technical analysis for USD/JPY.

The market spotlight was on the central banks last week. As expected, the Federal Reserve left rates were unchanged at 0.25%. At the same time, the Fed broadly hinted that a December hike is a strong possibility. The BoJ also held rates, but made some minor changes to monetary policy, with a stronger emphasis on combating deflation.

do action=”autoupdate” tag=”USDJPYUpdate”/]

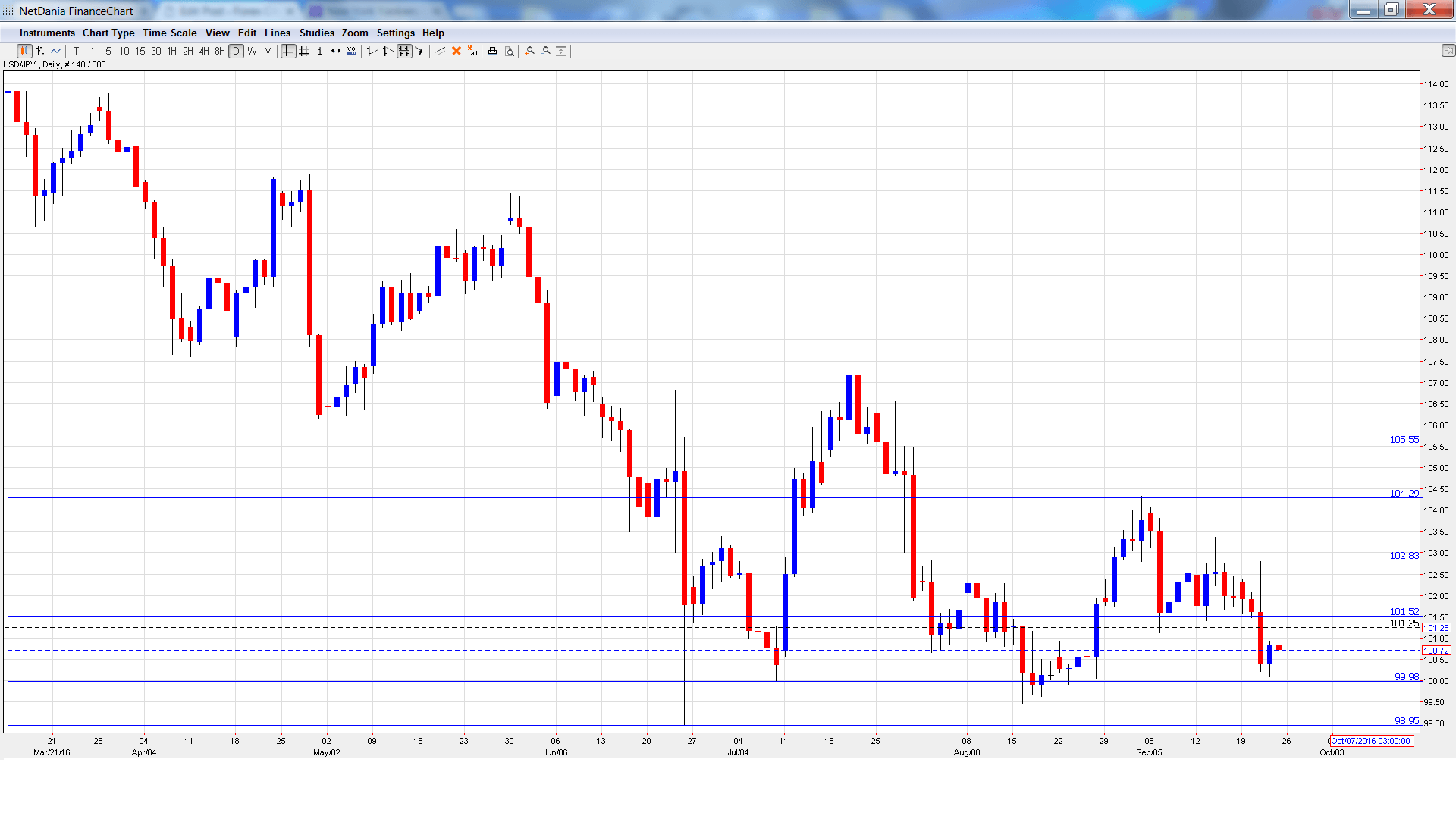

USD/JPY graph with support and resistance lines on it. Click to enlarge:

- BoJ Governor Haruhiko Kuruda Speaks: Monday, Tentative. Kuruda will speak at a meeting in Osaka. A speech that is more hawkish than expected is bullish for the Japanese yen.

- BoJ Monetary Policy Meeting Minutes: Tuesday, 23:50. The minutes will provide details of the bank’s July policy meeting, and the markets will be looking for hints regarding the BoJ’s future monetary policy.

- Retail Sales: Wednesday, 23:50. The indicator has looked dismal, with just one gain in 2016. The markets are bracing for more bad news from the August release, with an estimate of -1.7%.

- BoJ Governor Haruhiko Kuruda Speaks: Thursday, 6:35. Kuruda will deliver remarks at an event in Tokyo.

- Household Spending: Thursday, 23:30. This important consumer spending indicator continues to post declines, although it improved to -0.5% in July. The estimate for the August report stands at -2.1%.

- Tokyo Core CPI: Thursday, 23:30. This is the most important Japanese inflation indicator and should be treated as a market-mover. The indicator last posted a gain in December 2015, as deflation remains a serious concern for policymakers. A decline of 0.4% is expected in September.

- BoJ Summary of Opinions: Thursday, 23:50. This minor report is released about 10 days after the last monetary policy statement, and provides details of the bank’s projection for inflation and economic growth.

- BoJ Core CPI: Friday, 5:00. This indicator excludes the most volatile items that comprise CPI. Little change is expected in the upcoming release, with an estimate of 0.6%.

* All times are GMT

USD/JPY Technical Analysis

USD/JPY opened the week at 102.32. The pair climbed to a high of 102.79 as resistance held at 102.83 (discussed last week). USD/JPY then sharply reversed directions, dropping all the way to 100.09. The pair rebounded and closed the week at 100.72.

Live chart of USD/JPY:

Technical lines from top to bottom:

105.55 was a cushion in May and June.

104.25 is next.

102.83 has strengthened in resistance following sharp losses by USD/JPY last week.

101.52 has switched to resistance.

99.98 is an immediate support level.

98.95 has provided support since late June.

97.61 has provided support since November 2013.

96.56 is the final support line for now.

I am neutral on USD/JPY

The Fed didn’t raise rates at last week’s meeting, but its stance is hawkish regarding a rate hike in December. The BoJ continues to resist pressure to adopt further easing, which has buoyed the yen. Will the pair test the key 100 level this week?

Our latest podcast is titled Bold BOJ vs. Fearful Fed

Follow us on Sticher or iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Canadian dollar (loonie), check out the Canadian dollar forecast.

- For the kiwi, see the NZD/USD forecast