USD/JPY posted considerable gains, as the pair closed at 104.63. This week’s key event is the BoJ Policy Rate. Here is an outlook for the highlights of this week and an updated technical analysis for USD/JPY.

In the US, Advance GDP beat expectations at 2.9%, but the internals were mixed. Durable goods orders were mixed. Consumer confidence disappointed, as UoM Consumer Sentiment dropped to its lowest level since September 2015. In Japan Household Spending declined 2.1%, above expectations. Tokyo Core CPI continues to show deflation, with a decline of 0.4%.

do action=”autoupdate” tag=”USDJPYUpdate”/]

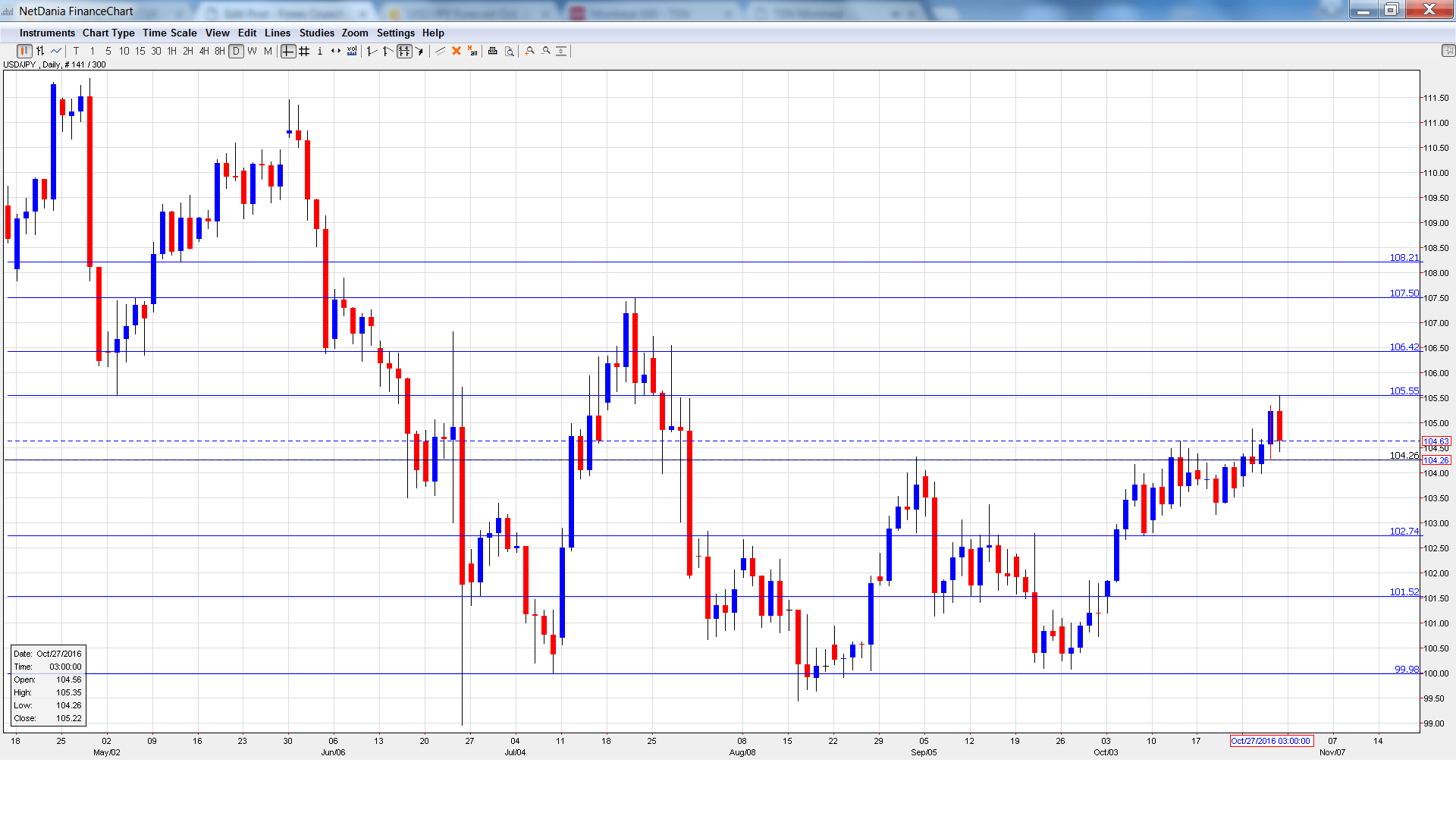

USD/JPY graph with support and resistance lines on it. Click to enlarge:

- Preliminary Industrial Production: Sunday, 23:50. The indicator jumped 1.5% in August, well above the forecast of 0.5%. The September estimate stands at 0.9%.

- Retail Sales: Sunday, 23:50. Retail Sales continues to post declines, as consumer remains in a sour mood. The indicator declined 2.1% in August, weaker than the forecast of -1.7%. The forecast for September is -1.7%.

- Housing Starts: Monday, 5:00. The indicator posted a gain of 2.5% in August, well off the forecast of 7.3%. The markets are expecting better news in September, with a forecast of 5.3%.

- Final Manufacturing PMI: Tuesday, 00:30. The indicator improved to 50.4 points in September, very close to the forecast. The index is expected to improve to 51.7 points in October.

- BoJ Outlook Report: Tuesday, Tentative. This report is released every quarter. The report details the bank’s view of economic conditions and inflation, so analysts will be looking for clues as to future monetary policy.

- BoJ Policy Rate: Tuesday, Tentative. The BoJ is expected to maintain the current rate of -0.10%. In September, the markets predicted a 0.10% cut to -0.20%, but the bank didn’t budge. The BoJ will announce the new rate with a rate statement.

- Monetary Base: Tuesday, 23:50. The indicator has dropped for seven straight months. The trend is expected to continue, with an estimate of 21.8% for October.

- Consumer Confidence: Wednesday, 5:00. The Japanese consumer remains pessimistic, as the indicator continues to post readings well below the 50-level. Little change is expected in the October release, with an estimate of 42.8 points.

* All times are GMT

USD/JPY Technical Analysis

USD/JPY opened the week at 103.92 and quickly touched a low of 103.72. USD/JPY then moved upwards and climbed to a high of 105.53 late in the week, as resistance held firm at 105.55 (discussed last week). The pair was unable to consolidate at these levels and closed the week at 104.63.

Live chart of USD/JPY:

Technical lines from top to bottom:

We begin with resistance at 108.21.

107.49 was the high point in July.

106.55 is next.

105.55 was a cushion in May and June.

104.25 has switched to support following gains by USD/JPY last week.

102.74 has strengthened in support.

101.52 is next.

99.98 has held in support since late August. It is the final support line for now.

I am bullish on USD/JPY

The BoJ has been reluctant to take further monetary easing measures and is not expected to make any moves at this week’s policy meeting. The Japanese economy continues to struggle, in sharp contrast to the US economy, which has been generally solid in the third quarter.

Our latest podcast is titled Bold in oil and talking up the currency

Follow us on Sticher or iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Canadian dollar (loonie), check out the Canadian dollar forecast.

- For the kiwi, see the NZD/USD forecast.