USD/JPY briefly dipped under 100 on the night of the Brexit, but did managed to recover. We are back to the 100 handle and the pair could fall to lower ground:

Here is their view, courtesy of eFXnews:

The bearish global economic growth scenario suggests remaining long the JPY. A break of the USDJPY post Brexit 99.05 level looks increasingly likely.

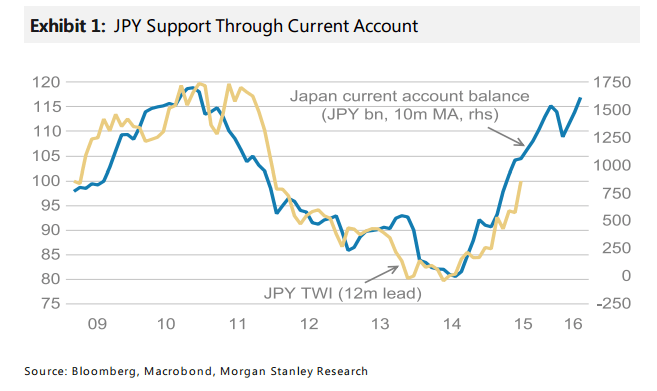

Today when a risk on mood pushed markets higher during the Asian session, USDJPY stayed offered. This observation is in line with our flow analysis linking JPY buying to Japanese entities reducing foreign FX denominated carry exposure or increasing FX hedges on its large foreign asset position (75% of GDP). While the FX management of Japan’s substantial foreign holdings creates JPY buying needs associated to Japan’s financial account, the sharp increase of Japan’s current account surplus indicates that commercial JPY buying needs are on the rise too.

Foreign speculative involvement in the JPY move has been small, increasing our confidence that FX intervention is not a policy option as it could create significant complications in Japan’s relationship with the US Treasury. Indeed, markets may lose their fears that Japan may try to defend the 100 level for USDJPY.

The next round of JPY buying may well see foreign accounts getting more involved, increasing USDJPY’s downside momentum.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.