Dollar/yen dipped to low ground and teased the Japanese authorities. Will it repeat these moves or jump higher surge from these lows? Core Machinery Orders is the main event this week. Here’s an outlook for the Japanese events and an updated technical analysis for USD/JPY.

Last week Japan showed signs of recovery with better than expected readings in household spending, rising by 0.5% contrary to the 0.1% decline predicted and Prelim Industrial Production jumped 4.0% in November after a 2.7% slide in the previous month, again better than the 2.7% gain anticipated, indicating positive activity in the market. Will this trend continue?

Updates: Dollar/yen is struggling around 76.60 in the wake of the new week. The Non-Farm Payrolls numbers are still doubted. Japan admitted that it made “stealth intervention” during the last quarter of 2011. This helped the pair stabilize above the 76.60 line. With Japanese authorities probably ready to do more and in a quiet manner, the pair reached above 77 for a few hours, despite Bernanke’s softness. Dollar/yen keeps moving up and it settled above 77.50, after making the break. Another drop in US jobless claims to 358K certainly boosts the pair.

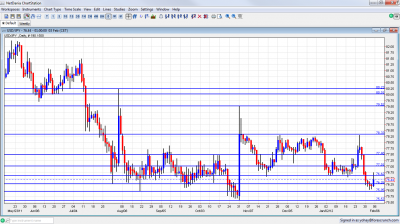

USD/JPY daily chart with support and resistance lines on it. Click to enlarge:

- Leading Indicators: Tuesday, 5:00. Japan’s leading indicators index formed to predict the direction of the market increased slightly in November to 92.9 from92 in October suggesting careful optimism in the market. Another increase to 93.9 is expected now.

- Bank Lending: Tuesday, 23:50. Japanese bank lending increased 0.4% in December from a year earlier after 0.2% gain in the previous month indicating an improvement in the Japanese market.

- Core Machinery Orders: Wednesday, 23:50.Japan’s core machinery orders surged 14.8% in November following 6.9% drop in October. The reading was considerably higher than the 5.8% increase predicted by analysts. The big jump could be explained by the increasing demand for reconstruction tools following last year’s earthquake. A drop of -4.6% is forecasted.

- Household Confidence: Thursday, 5:00. Japanese consumer sentiment improved to38.9 in December from38.1 in November. The reading is still below the 50 point line indicating contraction. A small decline to 38.6 is forecasted.

- Prelim Machine Tool Orders: Thursday, 6:00. Machine tool orders increased 17.4% on a yearly base to 115.99 billion yen in December from 15.8% increase in the previous month. Domestic demand grew by 12.2% while foreign demand increased by 19.9%.

- CGPI : Thursday, 23:50. Corporate Goods Price Index edged up 1.3% in December from a year earlier after 1.6% increase in the prior month suggesting increasing inflation and higher prices for consumers. Another increase of 0.9% is expected.

* All times are GMT

USD/JPY Technical Analysis

Dollar/yen started the week with a loss of the critical 76.60 line (discussed last week). It then dipped to lower ground and eventually bounced off 76. Nevertheless, it couldn’t recapture 76.60.

Technical lines from top to bottom

We start from the round figure of 80, which provided strong support, is the next line, and it is of high importance. 79.50, is the next line of resistance. This is the line that was reached after the recent intervention.

78.30 capped a second recovery attempt in November, after the intervention and had an important role earlier as well, working as support. This is the key line on the upside for now. The last test was in January 2012. 77.50 is now stronger once again, and now works as resistance. It worked well also in October and a recent surge fell short of reaching it.

The round number of 77, is a significant cap once again and was only temporarily breached. It’s followed closely by 76.60 which was a significant line of support at the beginning of 2012. Once it was broken to the downside, any attempts to move higher will be capped by this level.

Further below we have the swing record low of 76.25 which is more of a pivotal line at the moment. A previous low of 75.95 is now stronger support. It kept the pair from falling to lower ground.

The last record low of 75.57 where the BOJ intervened is the final frontier in charted territory for now. Below, the round number of 75 is the next potential cushion and an area where the Japanese authorities will be keen to intervene.

I remain bullish on USD/JPY.

With a strong jobs report in the US and louder rhetoric in Japan regarding intervention, the pair seems to have very limited room to the downside, and it could bounce higher from here.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the New Zealanddollar (kiwi), read the NZD forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast

- For the Swiss Franc, see the USD/CHF forecast.