Dollar/yen made a sharp move higher but couldn’t break resistance eventually ended the week lower. Household Spending and Industrial Production are the major events this week. Here’s an outlook for the Japanese events and an updated technical analysis for USD/JPY.

Last week The Bank of Japan maintained its interest rate at 0-0.10% and did not alter its 55 trillion yen quantitative easing program announcing that Japan’s economic growth is flat amid a slowdown in foreign markets. However Retail sales climbed 2.5% better than predicted following 2.2% fall in the previous month indicating some improvement in the market. Will this week bring more encouraging news?

Updates: Dollar/yen is leaning on low support at 76.60 as weak US growth still weighs on the greenback. Dollar/yen made a move under 76.60 and is struggling around 76.20. The BOJ might intervene at these levels. The yen continues to strengthen, challenging the BOJ and MOF. The weaker than expected ADP NFP in the US doesn’t help the greenback.

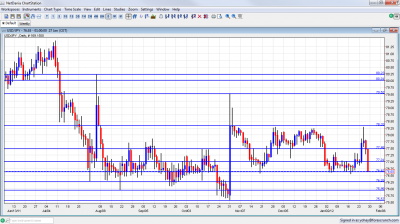

USD/JPY daily chart with support and resistance lines on it. Click to enlarge:

- Manufacturing PMI: Monday, 23:15. Japanese manufacturing activity grew in December after two months of declines reaching 50.2 driven by larger export orders and improved manufacturing capacity. This reading crossed the 50 point line suggesting expansion after November’s score of 49.1.

- Household Spending: Monday, 23:30. Japanese household spending dropped 3.2% in November from a year following 0.4 percent decline in October. Analysts expected a smaller decline of 1.1%. Spending declined 1.3% from the preceding month in as households spent an average 273,428 yen. A smaller decline of 0.1% is expected now.

- Prelim Industrial Production: Monday, 23:50. Industrial production in Japan dropped 2.6% in November much more than the 0.7% decline previously anticipated suggesting a slowdown inJapan’s recovery from the devastating earthquake and tsunami on March 11. The major drops occurred in transport equipment, communications equipment and steel. A jump of 2.6% is expected.

- Housing Starts: Tuesday, 5:00. Housing starts inJapan dropped 0.3% in November from a year earlier following 5.8% plunge in the previous month. The rising construction activity in the earthquake-battered northeast was better than anticipated leading to better reading than the 4.7% drop predicted by analysts. A drop of 1.4% is predicted.

- Average Cash Earnings: Wednesday, 1:30. Japanese total cash earnings dropped 1.0% in November from a year earlier suggesting employers are more concerned about the global future outlook and the strong yen. Special payments and bonuses dropped 22.4% on a yearly base although overtime hours increased by 1.3%. Another decline of 0.3% is expected now.

- Monetary Base: Wednesday, 23:50.Japan’s monetary base increased 13.5% in December from a year earlier lower than the 20.3% increase predicted by analysts and following 19.5% rise in the prior month. These increases were driven by the BOJ funds supply aiming to help Japan’s recovery. A further increase of 14.6% is expected now.

* All times are GMT

USD/JPY Technical Analysis

Dollar/yen began the week in the usual 76.60 to 77 range (mentioned last week). And then it leaped and touched 78.30 before falling sharply and closing at 76.65.

Technical lines from top to bottom

80.25 was a swing trough in June and a peak in July. The round figure of 80, which provided strong support, is the next line, and it is of high importance.

79.50, is the next line of resistance. This is the line that was reached after the recent intervention. 78.30 capped a second recovery attempt in November, after the intervention and had an important role earlier as well, working as support. This is the key line on the upside for now.

77.50 is now stronger once again, and now works as resistance. It worked well also in October and a recent surge fell short of reaching it. The round number of 77, is a significant cap once again and was only temporarily breached. It’s followed closely by 76.60 which was a significant line of support at the beginning of 2012.

Further below we have the swing record low of 76.25 which is still of importance after working well as resistance. A previous low of 75.95 is minor support. The last record low of 75.57 where the BOJ intervened is the final frontier in charted territory for now.

Below, the round number of 75 is the next potential cushion and an area where the Japanese authorities will be keen to intervene.

I remain bullish on USD/JPY.

Ben Bernanke’s move has a smaller effect on the pair than other currencies. With Japan printing a historic trade deficit and with weaker forecasts from the BOJ, the yen has more room for drops, even against the dollar.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the New Zealanddollar (kiwi), read the NZD forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast

- For the Swiss Franc, see the USD/CHF forecast.