Dollar/yen managed to recover only marginally in the first week of 2012. Leading indicators and Prelim Machine Tool Orders are the main events this week. Here’s an outlook for the Japanese events and an updated technical analysis for USD/JPY.

On one hand, the positive US data pushed the pair higher, but these rises were limited by the ongoing flow of bad news from Europe, which triggered safe haven flows. Dollar/yen remains in range and ignores the European drama for now. It trades under 77.

Updates: Dollar/yen kicked off the week in a narrow range.

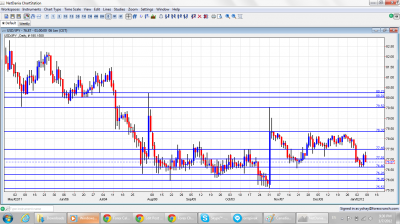

USD/JPY daily chart with support and resistance lines on it. Click to enlarge:

- Leading Indicators: Wednesday, 5:00. Leading indicators of 12 economic markers reveal an unexpected increase in October with a revised reading of 92 from 91.5 following 91.6 in the previous month and a forecast of 91.8. A further increase to 92.9 is expected now.

- Bank Lending: Wednesday, 23:50. Japanese bank lending increased 0.2% in November due to higher demand for reconstruction capital in areas hit by the March 11 earthquake and tsunami. However capital investment did not change. October reading was flat.

- Economy Watchers Sentiment: Thursday, 5:00. The Economy Watchers’ Survey dropped due to the strong yen and the global slowdown, reaching 45.0 after45.9 in the previous month as well as below the 47.1reading estimated by analysts. An increase to 46.3 is forecasted.

- Prelim Machine Tool Orders: Thursday, 6:00. Machine tool orders edged up 15.8%, on a yearly base, reaching 111.99 billion in November. October reading showed a 26% rise. This increase comes amid growing demand for tools to replace the ones damaged by the flooding in Thailand. Additional flood related orders are expected to pore in keeping Machine Tool Orders in a growing trend.

- M2 Money Stock: Thursday, 23:50. Japan’s domestic funds in circulation increased by 3.3% in November as firms and individuals continued to play safe investing in time deposits. The increase was more than the 2.7% rise anticipated and higher than October’s 2.8% gain. Another rise of 3.1% is expected now.

* All times are GMT

USD/JPY Technical Analysis

Dollar/yen kicked off the year by sliding a bit lower, and bottomed out at 76.60, a new line that didn’t appear last week. It then made a sharp move higher, and crossed the 77 line, only to lose it in the last hours of trade.

Technical lines from top to bottom

80.25 was a swing trough in June and a peak in July. The round figure of 80, which provided strong support, is the next line, and it is of high importance.

79.50, is the next line of resistance. This is the line that was reached after the recent intervention. 78.30 capped a second recovery attempt in November, after the intervention and had an important role earlier as well, working as support. This is the key line on the upside for now.

77.50 is now stronger once again, and now works as resistance. It worked well also in October. The round number of 77, is a significant cap once again, after the recent fall. It’s followed closely by 76.60 which was a significant line of support at the beginning of 2012.

Further below we have the swing record low of 76.25 which is still of importance after working well as resistance. A previous low of 75.95 is minor support. The last record low of 75.57 where the BOJ intervened is the final frontier in charted territory for now.

Below, the round number of 75 is the next potential cushion and an area where the Japanese authorities will be keen to intervene.

I remain bullish on USD/JPY.

Positive economic indicators starts pushing the dollar higher. We might be getting back to “normal behavior”. USD/JPY is close to a floor in which the authorities might intervene. EUR/JPY is already below this floor, and Japan exporters certainly suffer.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the New Zealand dollar (kiwi), read the NZD forecast.

- For USD/CAD (loonie), check out the Canadian dollar

- For the Swiss Franc, see the USD/CHF forecast.