Dollar yen challenged high resistance once again and couldn’t break through. If the mood has improved, there is room for rises. But is the stock market rally here to stay? Tankan Manufacturing and Non-Manufacturing Indexes together with Average Cash Earnings are the main events this week. Here’s an outlook for the Japanese events and an updated technical analysis for USD/JPY.

Last week positive figures were released with an ongoing increase in household spending climbing 4.0% well above the 2.5% increase predicted by analysts and Retail sales also gained 3.6% beyond the 3.1% rise estimated following another impressive gain of 5.7% in April. All these encouraging figures suggest that Japan’s domestic economy is on a recovery path. Will this trend continue?

Updates: The quarterly Manufacturing Index improved to -1 point, well above the market estimate of -4 points. It was the best performance since Q3 in 2011. There was even better news from the Non-Manufacturing Index, which continued its steady upswing. The index posted a reading of 8 points, which was its best release in over four years. The yen remains close to the important 80 line, as USD/JPY was trading at 79.71. Monetary Base hit a three-month high, posting a 5.9% increase. Average Cash Earnings declined by 0.8%, its worst reading in 2012. USD/JPY is unchanged, trading at 79.81. The yen is steady, as the markets are in a holding pattern prior to Thursday’s rate announcement by the ECB. As well, the US will be release key employment data on Friday. USD/JPY was trading at 79.83. The markets are waiting for the release of Leading Indicators on Friday. The forecast calls for a reading of 95.3%, virtually the same as the previous reading. USD/JPY continues to trade in a narrow range, as the the pair was trading at 0.7965.

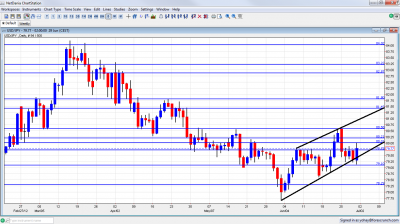

USD/JPY daily chart with support and resistance lines on it. Click to enlarge:

- Tankan Manufacturing/ non Manufacturing Index: Sunday, 23:50.Japan’s large manufacturers’ survey remained unchanged from December with a reading of -4, worse than the flat reading predicted by analysts. Pessimism dominated in most categories. Sentiment at medium-sized manufacturers plunged, to -7 reading, down from-3 in the previous survey and small manufacturers also grew gloomier, with sentiment at -10, down from-8 in the last survey. However the non-manufacturing sector showed signs of improvement rising to 5 as predicted by analysts from4 in the previous quarter indicatingJapan’s economic growth is driven by domestic demand. Tankan Manufacturing index is expected to remain -4 while the non-manufacturing index is predicted to rise to 6.

- Monetary Base: Monday, 23:50. The total cash in circulation increased by 2.4% on year in May following a 0.3% annual contraction in April. The adjusted monetary base declined 37.9% on year to 115.587 trillion yen after edging up an annual 90.5% in the previous month. A further rise of 3.6% is expected this time.

- Average Cash Earnings: Tuesday, 1:30. Total cash earnings per employee in Japan increased less than predicted by 0.2% in April, revised down sharply from the preliminary reading of +0.8%, however this was the third straight year-on-year rise indicating improvement in the job market conditions following the slump resulted in the March 2011 earthquake. An increase of 0.6% is anticipated now.

- Leading Indicators: Friday, 5:00. The Japanese leading index dropped less than estimated in April reaching 95.6 from96.6 in March but the reading was higher than the preliminary estimate of 95.1. Another decline to 95.3% is likely.

* All times are GMT

USD/JPY Technical Analysis

$/yen made another attempt on 80.60 (mentioned last week), before eventually falling down. It finally climbed back up couldn’t breach the round 80 line.

Technical lines from top to bottom

84 was the peak reached in March and remains a tough spot. 83.20 provided support when the pair traded on high ground and it then switched to resistance.

82.87 is a veteran line – that’s where the BOJ intervened for the first time back in 2010. 81.80 capped the pair in April.

81.43 is stronger after serving as resistance for a recovery attempt. 80.60 provided support for the pair around the same time, and served as a bouncing spot for the next moves. It proved its strength as resistance in June 2012, more than once.

80.20 separated ranges in May 2012 and remains another barrier after 80 on the upside. The round number of 80 is psychologically important, even though it was crossed several times in recent months. It is stronger now.

79.70 was a cap was seen in June 2012. 79.10 was a cushion for the pair several times in June and also back in May 2012.

78.30 capped a second recovery attempt in November, after the intervention and had an important role earlier as well, working as support. This is a key line after the fall.

77.50 was the bottom border of a range the pair had at the end of 2011. It is followed by 77, which is only minor support.

76.60 was a cushion for the pair at the beginning of the year and is rather strong. 76.26 is the next line on the downside after working as a support quite some time ago.

Uptrend channel

Since the beginning of June, the pair has been trading in an uptrend channel. Note that uptrend support is more significant than uptrend resistance, and that the pair is close to resistance now.

I am bullish on USD/JPY.

If the relative calm in Europe continues (and that’s a big IF given the holes in the EU Statement), the pair could rise gradually on the absence of QE3 in the US.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the New Zealand Dollar (kiwi), read the NZD forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast

- For the Swiss Franc, see the USD/CHF forecast.