USD/JPY climbed nicely and managed to close the week higher reaching the highest levels in a month. Will this trend continue? Retail sales and Tokyo Core CPI are the major events on out menu this week. Here’s an outlook for the Japanese events and an updated technical analysis for USD/JPY.

The absence of QE3 from the FOMC decision certainly pushed the pair higher. Last week Bank of Japan Governor Masaaki Shirakawa spoke in Tokyo about the global market turmoil following the pro-bailout Greek election outcome saying Japan has to monitor developments in the EU and watch from a worsening of EU stability in the near future. He also referred to the moderate growth rate of Japan’s domestic market claiming it is on the right path to recovery and that he BOJ will increase its asset purchases by Y19 trillion to Y70 trillion by the end of June 2013 to boost growth. Will Japan succeed to maintain a recovery trend?

Updates: CSPI will be released on Monday. The markets are expecting a 0.3% increase for the June reading. The yen continues to strengthen, as USD/JPY has dropped below the 80 line. The pair was trading at 0.7985. The yen has edged upwards, as USD/JPY was trading at 0.7935. Retail Sales will be released later on Wednesday, with the markets expecting a 3.1% increase for the June reading. The yen weakened slightly, as markets remained cautious before Thursday’s EU Summit. USD/JPY was trading at 79.57. Retail Sales fell in May, but were stronger than predicted. The indicator came in at 3.6%, well above the 3.1% market forecast. There are a host of releases later on Thursday, including Tokyo Core CPI and Preliminary Industrial Production. The yen has edged upwards, as USD/JPY was trading at 79.38.

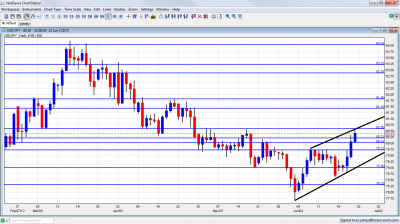

SD/JPY daily chart with support and resistance lines on it. Click to enlarge:

Let’s Start:

- CSPI: Monday, 23:50. Japan’s corporate service price index increased 0.2% in April after dropping 0.2% in March. This is the first yearly base rise since September 2008 came as a surprised to analysts predicting a 0.1% drop. The main contributors for this rise were higher costs for newspaper advertisements and TV commercials as well as software development prices, hotel charges and Tokyo office rents. Another increase of 0.3% is expected now.

- Retail Sales: Wednesday, 23:50. Japan’s marked the fifth straight month of annual increase with a 5.8% gain in April due to growing demand for automobiles, evoked by government subsidies for buying low-emission vehicles. The increase was broadly in line with expectations and followed 10.3% leap in March. A further increase of 3.1% is predicted this time.

- Manufacturing PMI: Thursday, 23:15. Japanese manufacturing activity continued to grow in May at the same rate as the previous month reaching 50.7. The index stayed above the 50 point line indicating expansion. The index increased for the sixth consecutive month, but output, domestic new orders and export orders all slowed.

- Household Spending: Thursday, 23:30. Japanese household spending increased by 2.6% in April from a year earlier rising hand in hand with consumer sentiment following March 2011 earthquake. The rise was above the 2.5% predicted by analysts. An increase of 2.5% is anticipated this time.

- Tokyo Core CPI: Thursday, 23:30. The Tokyo Core Consumer Price Index (CPI) measuring the change in the price of goods and services purchased by consumers in Tokyo, excluding fresh food dropped unexpectedly 0.8% in May after a 0.5% decline in the month before suggesting deflation is hard to overcome. Another decline of 0.7% is forecasted now.

- Prelim Industrial Production: Thursday, 23:50. Industrial production in Japan expanded less-than-expected in April rising to a seasonally adjusted 0.2% upwardly revised from a preliminary -0.2%. Analysts had expected industrial production to rise 0.5% last month. A drop of 2.6% is expected now.

- Housing Starts: Friday, 5:00. Housing starts in Japan jumped 10.3% in April from a year earlier following 5.0% increase in March. The boost in construction had resulted from reconstruction work in quake-hit areas. It was the biggest rise since August last year, when orders rose 14 percent. Another nice rise of 6.6% is anticipated now.

* All times are GMT

USD/JPY Technical Analysis

Dollar/yen kicked off the week with a small rise that became stronger. After conquering the round number of 80 (mentioned last week), it never looked back and stopped only at the 80.60 line before closing a bit lower.

Technical lines from top to bottom

We start from a higher point this week. 84 was the peak reached in March and remains a tough spot. 83.20 provided support when the pair traded on high ground and it then switched to resistance.

82.87 is a veteran line – that’s where the BOJ intervened for the first time back in 2010. 81.80 capped the pair in April.

81.43 is stronger after serving as resistance for a recovery attempt. 80.60 provided support for the pair around the same time, and served as a bouncing spot for the next moves. It proved its strength as resistance in June 2012.

80.20 separated ranges in May 2012 and remains another barrier after 80 on the upside. The round number of 80 is psychologically important, even though it was crossed several times in recent months. It is stronger now.

79.70 was a cap was seen in June 2012. The round number of 79 served as a bottom in May 2012 but is now weaker after the fall.

78.30 capped a second recovery attempt in November, after the intervention and had an important role earlier as well, working as support. This is a key line after the fall.

77.50 was the bottom border of a range the pair had at the end of 2011. It is followed by 77, which is only minor support.

76.60 was a cushion for the pair at the beginning of the year and is rather strong. 76.26 is the next line on the downside after working as a support quite some time ago.

Uptrend channel

Since the beginning of June, the pair has been trading in an uptrend channel. Note that uptrend support is more significant than uptrend resistance, and that the pair is close to resistance now.

I am bullish on USD/JPY.

Without QE3 in the US and with the impact of European troubles having a lower impact for the yen, there’s room for more rises after the pair crossed the 80 line.

Another note: USD/JPY is the most predictable currency pair for Q2.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the New Zealand Dollar (kiwi), read the NZD forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast

- For the Swiss Franc, see the USD/CHF forecast.