Dollar/yen reversed its course and retreated after 6 weeks of rallying. Risk averse flows are mostly responsible for that. Will this continue in the last week of the Japanese fiscal year? Retail sales and household spending are the major events this week. Here’s an outlook for the Japanese events and an updated technical analysis for USD/JPY.

The adjusted trade balance posted a smaller than expected deficit of 313.2 billion yen in February, beating forecasts for a larger deficit of 342.5 billion yen following the 612.8 billion yen deficit in January. However Japan’s unadjusted trade balance beat expectations by returning to surplus for the first time in five months due to US demand.

Updates: CSPI fell by 0.3%, an eight-month low. USD/JPYhas climbed above the 83 level, trading at 83.02. The markets are waiting for the release of retail sales later in the week. Retail Sales jumped an impressive 3.5%, the best figures since August 2010.

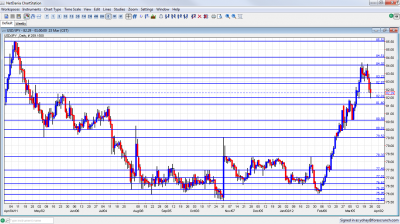

USD/JPY daily chart with support and resistance lines on it. Click to enlarge:

- CSPI: Monday, 23:50.Japan’s corporate service price index declined in January by 0.2% after a minor increase of 0.1% in December. This decline was contrary to analysts expectations of a 0.1% increase. On a monthly basis, prices dropped 0.6% following a flat reading in the preceding month. A drop of 0.3% is expected now.

- Retail Sales: Wednesday, 23:50. Retail sales in Japan climbed unexpectedly 1.9% in January due to a boost in automobile sales following a 2.5% increase in the previous month. Analysts expected a 0.2% drop. Sales of automobiles jumped 24.3% while wholesale sales dropped 3.6%. A further climb of 1.4% is expected this time.

- Manufacturing PMI: Thursday, 23:15. Japan Manufacturing Purchasing Managers` Index (PMI) slightly dropped in February to 50.5 following50.7 in the previous month suggesting a moderate improvement trend in the manufacturing sector and business conditions. Manufacturing output and production increased.

- Household Spending: Thursday, 23:30. Japanese household consumption dropped 2.3% in January from a year earlier while economists anticipated a smaller decline of 0.7%. This plunge comes after a 0.5% rise in the previous month suggesting consumer consumption is still weak. A 0.3% decline is anticipated.

- Tokyo Core CPI: Thursday, 23:30. Core consumer prices in Tokyo dropped 0.3% in February from a year earlier, following a 0.4% decline in January, and smaller than a market forecast for a 0.4 percent decline. Economists predicted a 0.4% decrease. Mean while, Japan’s core consumer prices dropped 0.1% in January from a year earlier, signaling weak demand and sluggish economic growth. Core consumer prices in Tokyo are predicted to decline further by 0.3%.

- Prelim Industrial Production: Thursday, 23:50. Japanese industrial production increased a revised 1.9% on the month in January, broadly in line with the preliminary reading of +2.0% and following a 3.8% increase in the previous month. A 1.4% gain is forecasted.

- Housing Starts: Friday, 5:00.Japan’s housing starts declined for the fifth consecutive month in January dropping 1.1% following 7.3% plunge in the previous month. This reading is better than the 3.4% drop anticipated by analysts indicating a more moderate rate of decline and a possible improvement in the housing market. A further decline of 1.2% is expected now.

* All times are GMT

USD/JPY Technical Analysis

$/yen began the week by moving up gradually. Another attempt to break above the 84 line (discussed last week) didn’t succeed. It then changed course and dropped, finally closing at 82.29.

Technical lines from top to bottom

We remain oh high ground. 88.12 capped the pair back in July 2010, and also worked beforehand as support. It is followed by the round number of 87, which worked as support back then, and is minor resistance now.

86.27 was a distinct line of support and resistance in the summer of 2010 and is the next line if 85.50 is crossed. 85.50 is a key line. This was a peak after a strong move in March 2011. It held for more than one day.

84.50 capped the pair at the end of 2010 and at the beginning of 2011 and is a bit weaker now. An important line of resistance is found at 84, which capped the pair back in February 2011 and provided some resistance in March 2012. It proved its strength for a second week in a row.

It is closely followed by the minor line of 83.20, which was the bottom border of a range in March, and also provided resistance in February 2011. 82.87 was the line where the BOJ intervened in September 2010, and also worked in both directions afterwards. It worked as support when the pair traded higher.

The round number of 82 is the next line. It provided support on the way up and also on the way down for the yen. Close by, 81.60 served as a temporary cap in March 2012 and is now a minor support line .

80.60 provided support for the pair around the same time, and served as a bouncing spot for the next moves. The round number of 80, which provided strong support in June, is the next line, and it is of high importance.

79.50, was a battleground on the way up. This is the line that was reached after the last non-stealth intervention. 78.30 capped a second recovery attempt in November, after the intervention and had an important role earlier as well, working as support. After it was broken, the rally intensified. It now switches to support.

I am neutral on USD/JPY.

The end of the Japanese fiscal year can wreck havoc on the pair’s trading in the upcoming week. The new worries from China and Europe send money to the “safety” of the yen for now. In the longer run, the pair has more room to rise, especially with the fundamental change in Japan’s trade balance, and the improving US economy, seen again with a record low in jobless claims.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the New Zealand Dollar (kiwi), read the NZD forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast

- For the Swiss Franc, see the USD/CHF forecast.