The European Central Bank convenes to make its mid-summer decision and they probably planned not to rock the boat too much. However, given the recent rise in the euro and also in bond yields, they might want to cool tapering expectations back down.

In the past, Draghi managed to drag the euro down. Will he succeed this time as well? Here is a preview of the ECB meeting on July 20th.

Update: EUR/USD falls – Is a dovish Draghi already priced in?

EUR/USD on the rise

ECB President Mario Draghi tried to remain cautious and balanced: acknowledging and taking credit for growth while remaining worried about inflation and stressing a very gradual exit. However, markets reacted very positively to his speech in Sintra, Portugal. The talk about reflation replacing deflation and a gradual exit sparked a euro rally.

In addition, the planned speech at Jackson Hole in late August is seen as a “warm up” to a big announcement about QE tapering in the all-important September meeting.

The strength of EUR/USD was extended with the recent weakness of the US dollar and is probably frowned upon. On this background, Draghi might try and dampen expectations for a quick exit from the QE program.

Gradual tapering and exit

The ECB is set to buy 60€ worth of bonds until the end of the year. The big question is: what’s next? Some kind of reduction in bond-buying is expected in 2018. Once this reaches an end, the ECB may raise rates, maybe only in 2019.

The meeting in July does not consist of new forecasts, such as the one in June and in September. Nevertheless, the ECB may take further baby steps towards the exits. They could remove the clause stating that the QE program may be increased in size and duration. This is a first step towards reducing it.

Draghi may also say that a discussion about QE tapering happened in this meeting. He will not disclose any details. Tapering can mean a reduction to 40 billion euros for a few months or remove 5 billion euros on a monthly basis. The end date of bond buying is also unclear.

On the other hand, Draghi may want to balance this by highlighting the risks, such as low inflation, uneven growth and more. The real issue is the euro, which is making exports less attractive and inflation weaker, but Draghi cannot say that out loud.

ECB and EUR/USD conclusion

Many expect the ECB to say as little as possible and leave the decisions for later. However, the recent rise in the currency means that markets already got ahead of themselves with expectations, too far for the ECB.

On this background, Draghi and his colleagues may balance any small steps towards the exits with a large dose of caution.

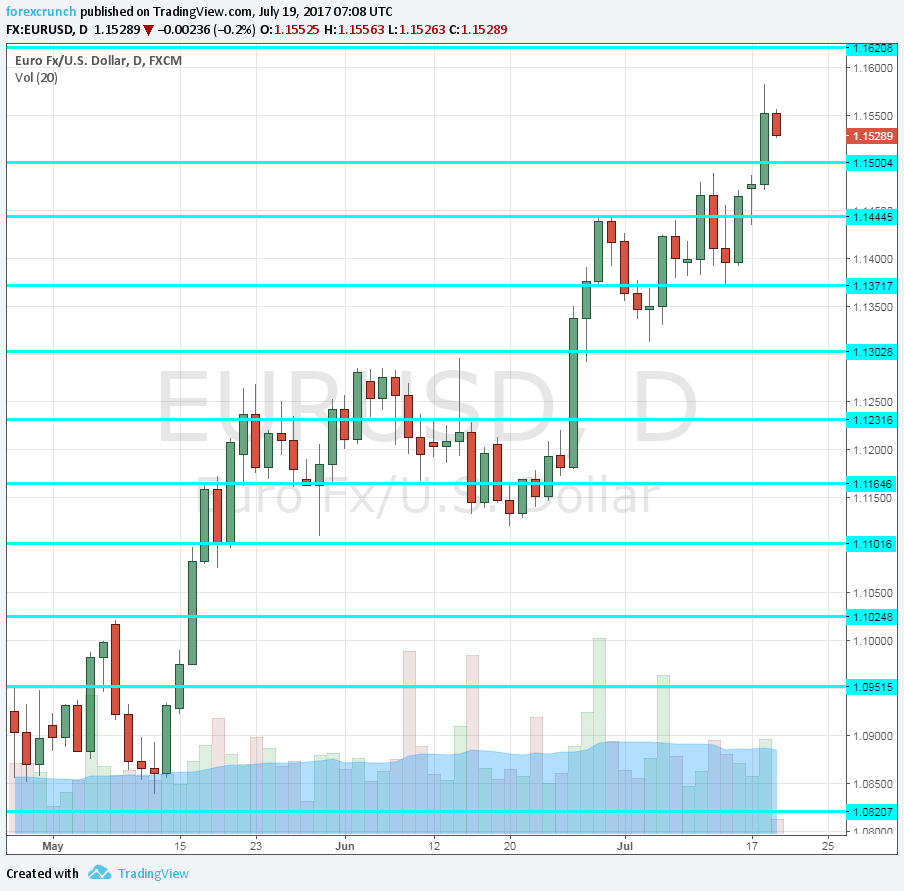

EUR/USD got very close to the 2016 high of 1.1620. If they express optimism and the pair breaks higher, the next level to watch is the 2015 high of 1.1712.

On the downside, 1.1445 remains strong support, followed by 1.13, which is a clear separator of ranges.

More: EUR/USD: Overbought After 1.15 Break; What’s The Trade? – Danske