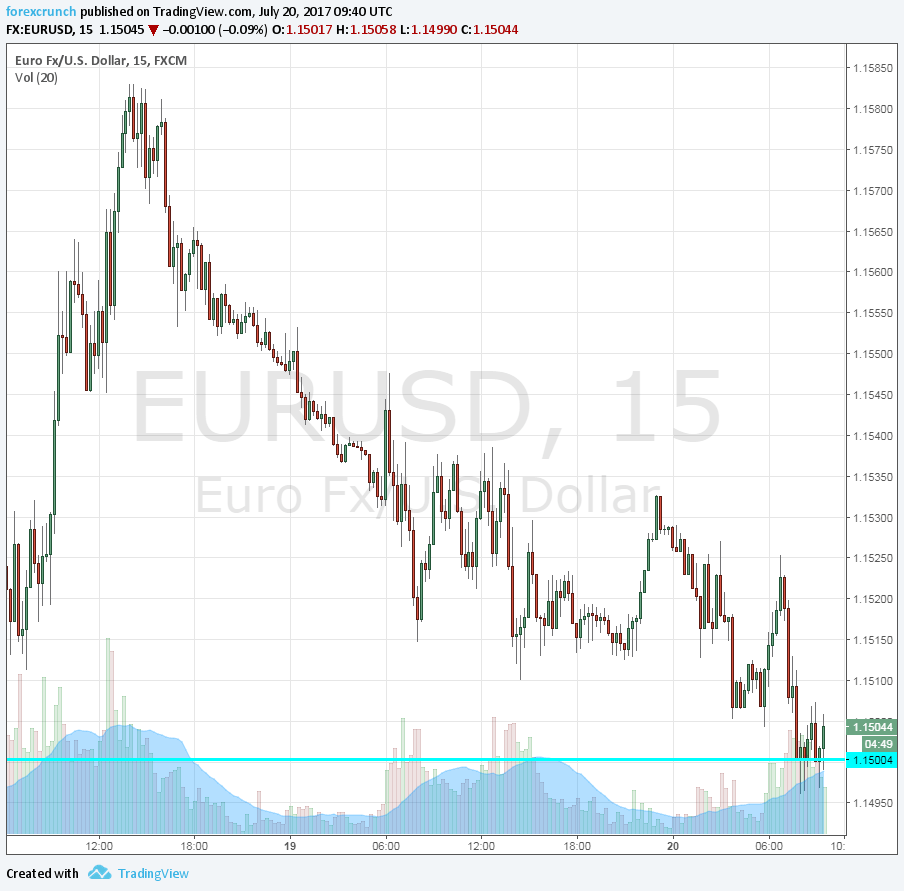

EUR/USD is some 80 pips off the highs, which were 14-month highs seen earlier this week. The fall from 1.1580 to 1.15 comes on the background of greenback come back, but perhaps it isn’t exclusive to the US dollar.

We discussed how the ECB does not like the stronger euro and how Draghi could down the euro in his press conference. Other analysts are saying that the President of the ECB could keep the cards close to the chest and wait until Jackson Hole in late August for a hint.

Update: Dovish Draghi? Doesn’t convince EUR/USD – jumps 80 pips

This is how it looks:

The ECB is set to continue its bond buying scheme worth 60 billion euros per month until the end of the year. The big question is: what happens in 2018? A quick tapering or just a very gradual reduction? Or perhaps more of the same. While growth is strong, inflation, the ECB’s single mandate, is lagging behind.

The euro advanced on Draghi’s optimistic Sintra Speech and is now reversing some of the moves.

Is a dovish Draghi already priced in? If so, it will be hard for him to push the euro lower.

In this case, the current correction or consolidation could be followed by a fresh rise.

What do you think?