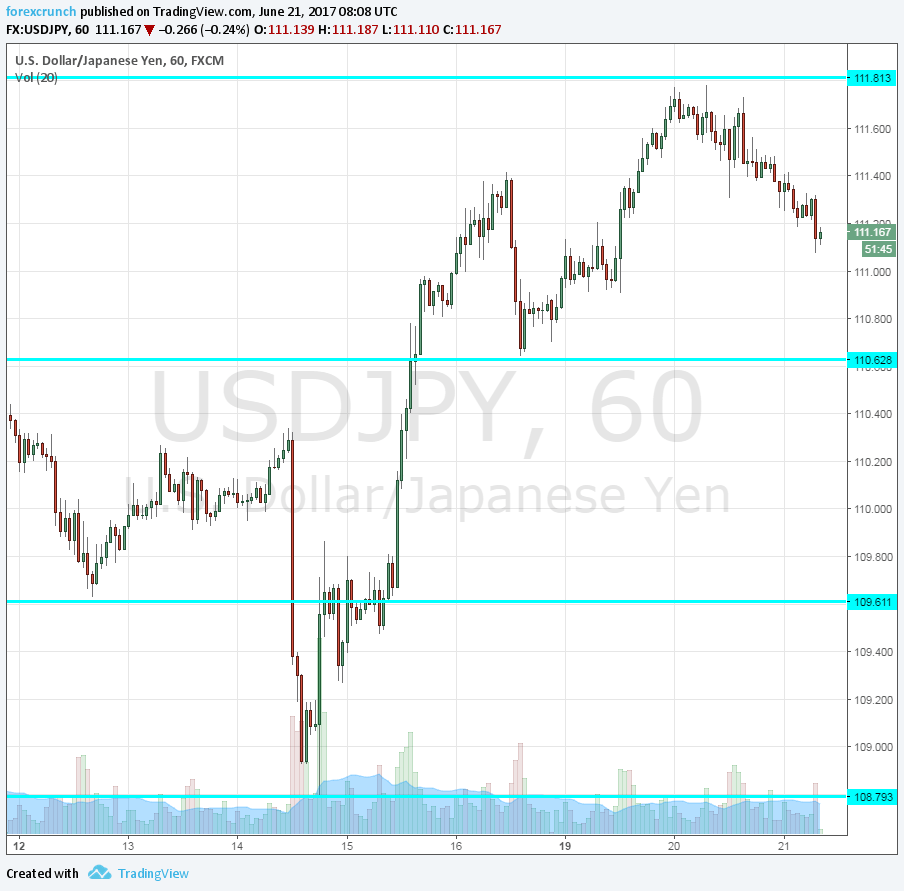

USD/JPY is trading at 111.11, down from the highs of 111.80. It still trades much higher than before the hawkish Fed hike, but the gains are eroding.

The major pair is sensitive to geopolitical developments. After a few weeks of calm, we have two issues to worry about.

Here are the worries:

- Saudi Arabia reshuffle: Mohammed Bin Salman, the energetic 31-year old has ousted Moahmmed Bin Nayef as crown prince. Why is this important? Bin Salman, also known as MBS, has been the driving force behind the war in Yemen and the tougher tone on Qatar and Iran. Tensions are already high around the Qatar crisis and the elevation of MBS to an even higher position could stoke further tensions in the oil-rich region. The world is moving away from reliance on Middle-Eastern oil, but tensions have ramifications everywhere.

- North Korea: President Donald Trump thanked China for its efforts on North Korea but also expressed disappointment from the results. This could be a sign that the US is about to take matters into its own hands. The autocratic regime in the North has been conducting missile tests in an accelerated pace.

The Japanese yen attracts safe haven flows. And yes, this is true even if the trouble is close to home. North Korean missiles haven fallen in the seas around Japan.

More: On fundamentals, technicals and more – Interview with Dale Pinkert

USD/JPY levels

Immediate support awaits for the pair at 110.60. This is followed by 109.60. Note that the round 110 level is not real support. The next lines are 108.80 and 108.10.

Resistance is at 111.80 and 112.20.