- XLM price could be on the verge of a major correction, according to various indicators.

- The funding rates for Stellar are significantly overextended across all big exchanges.

- The digital asset faces a lot of selling pressure after a notable rejection.

XLM price has experienced a massive 60% rally in the past two weeks, cracking the previous all-time high of $0.60 established on February 13. However, Stellar did not get any continuation moves above this point, and it is trading at $0.581 at the time of writing.

Stellar funding rates are a concerning indicator

Funding rates are periodic payments that long or short traders have to pay based on the difference between the perpetual contract market and spot market. Basically, if the funding rate is positive, long traders have to literally pay short traders and vice versa.

The current XLM funding rates are extremely overextended at 0.25% on Binance and as high as 0.29% on Huobi. Several analysts think that funding rates of 0.1% or above are significant. Stellar’s rates are higher than 0.1% across Binance, FTX, Huobi and Okex, according to Viewbase metrics.

These rates indicate that long traders have to pay a lot to maintain their positions open. Considering that XLM price increased by 60% in recent weeks, long traders are now more likely to take profits. Similarly, any trader looking to buy would most likely think twice because of the high funding rates.

Although a trader should not use funding rates alone to open a position, this metric can be extremely useful in combination with technical analysis and other on-chain metrics.

XLM price got rejected at a key resistance level

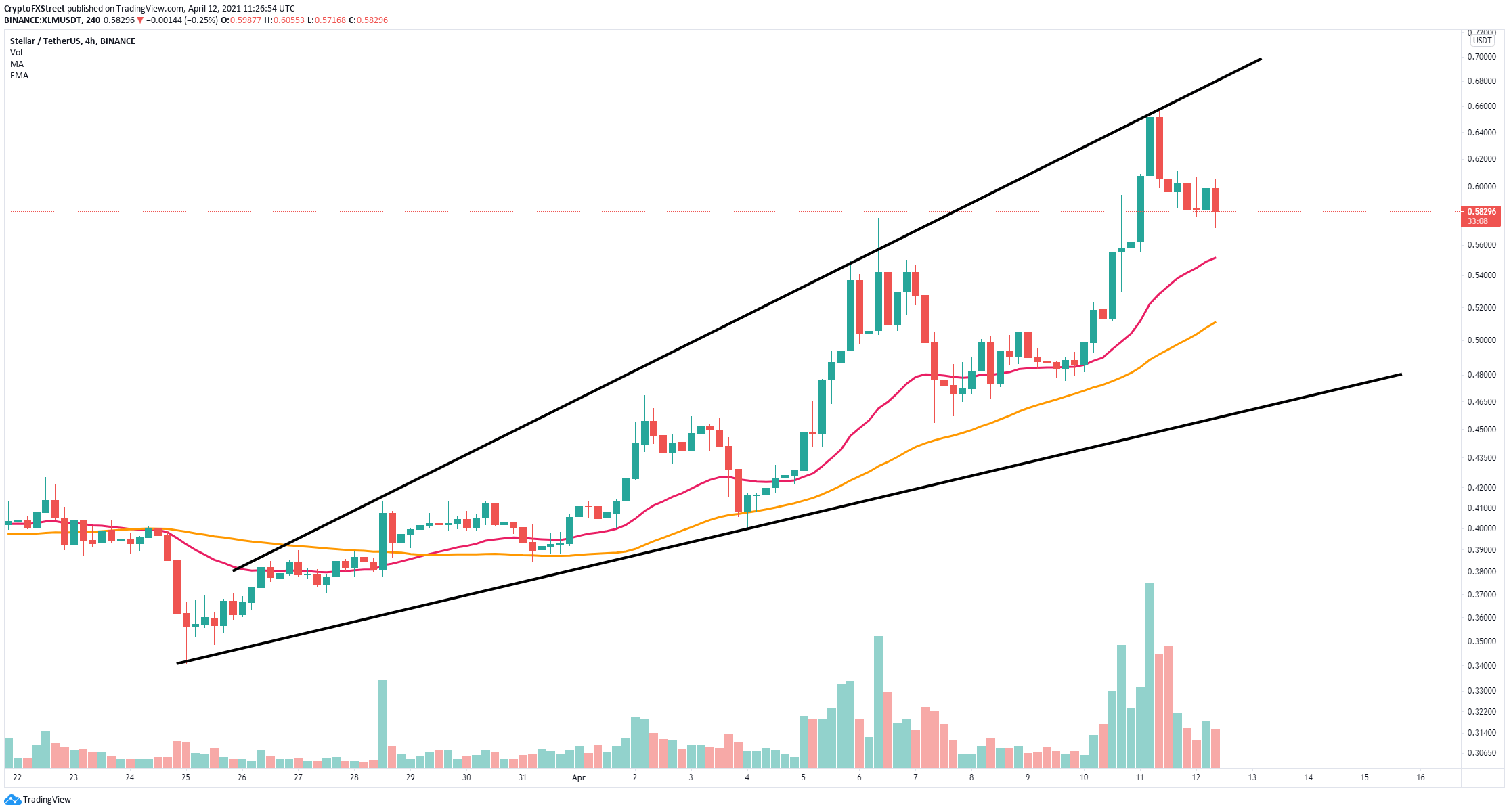

On the 4-hour chart, XLM price has formed an ascending broadening wedge pattern, drawn by connecting the higher highs and higher lows with two trend lines that spread out. Stellar got rejected at $0.654 from the upper boundary of the pattern.

XLM/USD 4-hour chart

Considering the high funding rates, the digital asset could be poised for further downside action. The 26 four-hour EMA support level at $0.55 is the most significant in the short term. A breakdown below this moving average will push XLM price down to $0.51 at the 50 four-hour SMA support and as low as $0.47 at the lower trend line of the pattern.

However, successfully defending the 26 four-hour EMA could reignite the bullish momentum of XLM and drive the asset toward the upper boundary of the pattern again at $0.685.