- Yearn Finance price dropped 15% as its platform suffered an exploit from an attacker.

- The exploit of the ‘v1 yDAI’ vault has led to $11 million in losses.

- YFI faces a threat of further collapse if selling pressure persists.

Yearn Finance is one of the most popular DeFi platforms born during the so-called “DeFi summer.” Its native token, YFI, has not enjoyed as much attention lately as prices remain stagnant compared to other DeFi protocols such as Aave and Uniswap.

The recent vault exploit this project suffered could bring even more pessimism around the governance token.

Yearn Finance falls victim to flash loans exploit

On February 4, one of Yearn Finance’s many pools was drained dry due to an exploit. The attacker used flash loans to siphon 513,000 DAI, 1,700,000 in USDT, and 506,000 3CRV tokens. In total, the attacker made away with $2.8 million, but the exploit caused losses north of $10 million.

The news of an exploit caused many users to swap YFI into other tokens. UniTrades, a Twitter account tracking DEX transactions, posted a $1 million swap order converting YFI to ETH. Other DEXs saw similar swap orders leading to a spike in YFI sell volume as the news of the exploit spread.

Yearn Finance is not the first project to fall victim to the flash loans in the burgeoning landscape of DeFi. Almost every other platform which has been exploited included the use of flash loans.

Flash Loans and Yearn Finance’s exploit

Flash Loan is a smart contract construct that allows the issuance of uncollateralized loans valid within a single transaction. A failure to repay the loan within the same transaction results in a rollback.

In Yearn Finance’s exploit, the attacker used flash loans from dYdX, Aave v2, and other DeFi platforms to exploit the v1 yDai pool via the 3crv Curve vault. The attacker had more 3crv tokens every time the 3crv Curve vault was used. The extra 3crv tokens were then swapped to other cryptocurrencies to repay the loan.

While Yearn Finance isn’t the first DeFi platform to be exploited, it certainly will not be the last.

Perhaps, the first victim to fall prey to flash loans was the bZx platform on February 14, 2020. The platform suffered $350,000 in losses from this exploit. Four days after the first exploit, bZx would face another exploit that resulted in losses worth $650,000.

Other flash loan victims include Lendf.me ($25 million in losses), Balancer ($490,000 ), Eminence ($15 million), Harvest Finance ($24 million), Value Defi ($7.4million), etc.

Even before the exploit, YFI has had difficulty keeping up with the market’s bullishness. In fact, Yearn Finance price has seen a mere 50% surge in 2021, while other Defi coins have more than tripled within the same period.

The token has had difficulty keeping up with the market’s bullishness. In fact, Yearn Finance price has seen a mere 50% surge in 2021, while other Defi coins have more than tripled within the same period.

YFI price walks on eggshells

Yearn Finance price shows signs of weakness as it continues making a series of lower since it peaked in mid-January at $40,400.

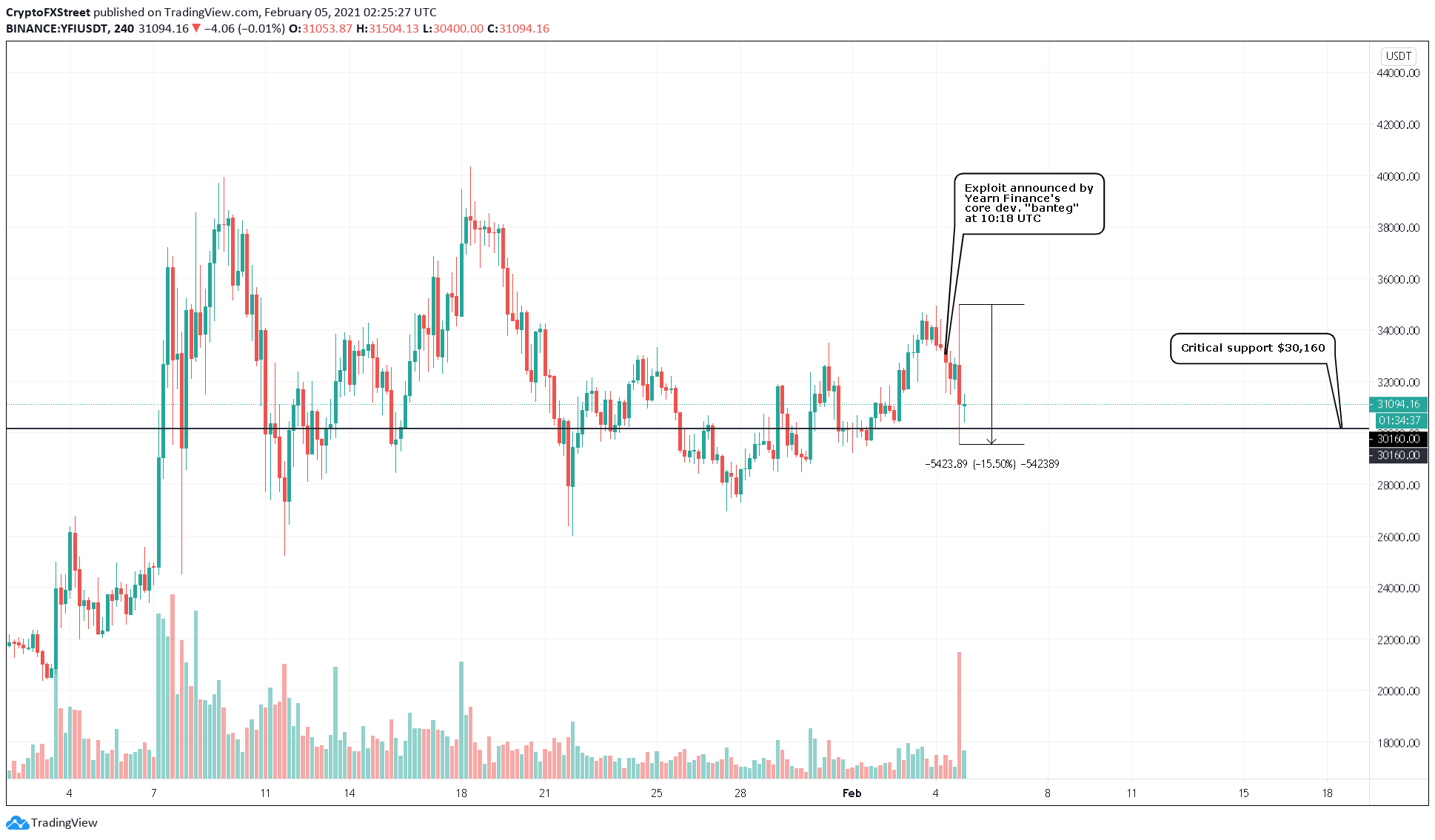

The recent exploit generated panic among market participants who rushed to exchanges to sell YFI. The spike in downward pressure pushed Yearn Finance price down to retest a critical support level at $30,160.

Further selling could lead to a breakdown of this price hurdle that sees the token fall towards $24,000 or lower.

YFI/USDT 4-hour chart

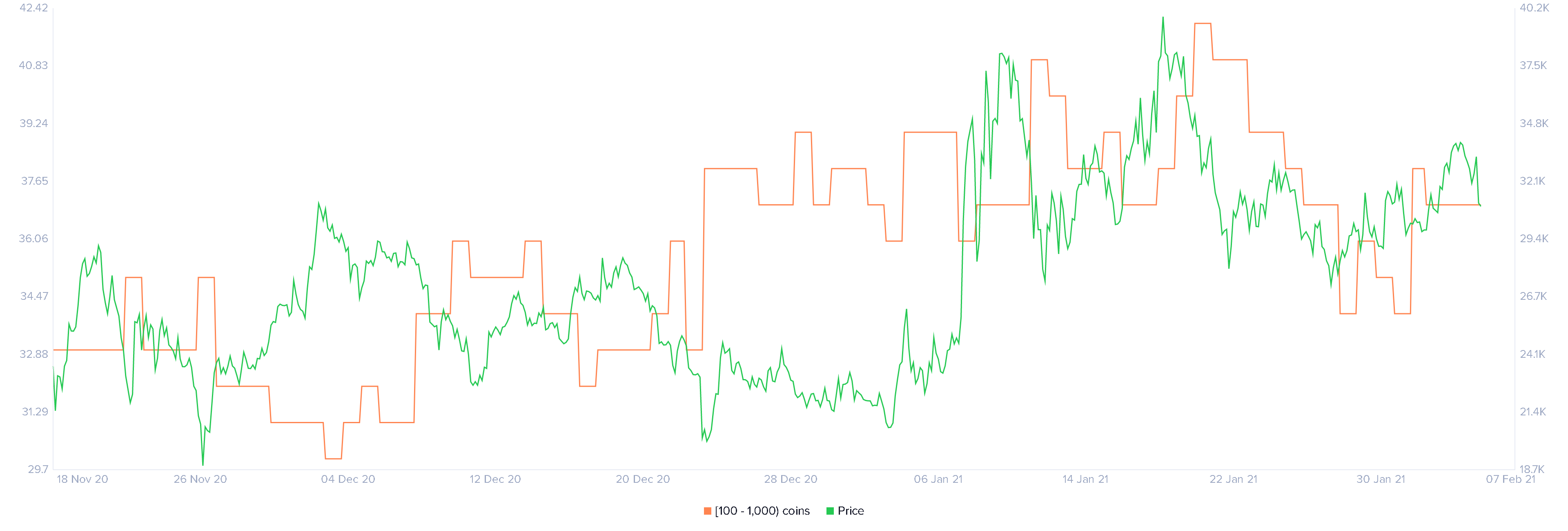

When looking at the whales’ activity on the Yearn Finance network, the bearish thesis holds. The number of addresses holding 100 to 1,000 YFI has decreased by almost 12% since late January, consequently pushing prices down by more than 9%.

Now that the DeFi protocol stability is at risk following the recent exploit, whales could increase the selling pressure seen over the past few weeks.

YFI Holders Distribution chart

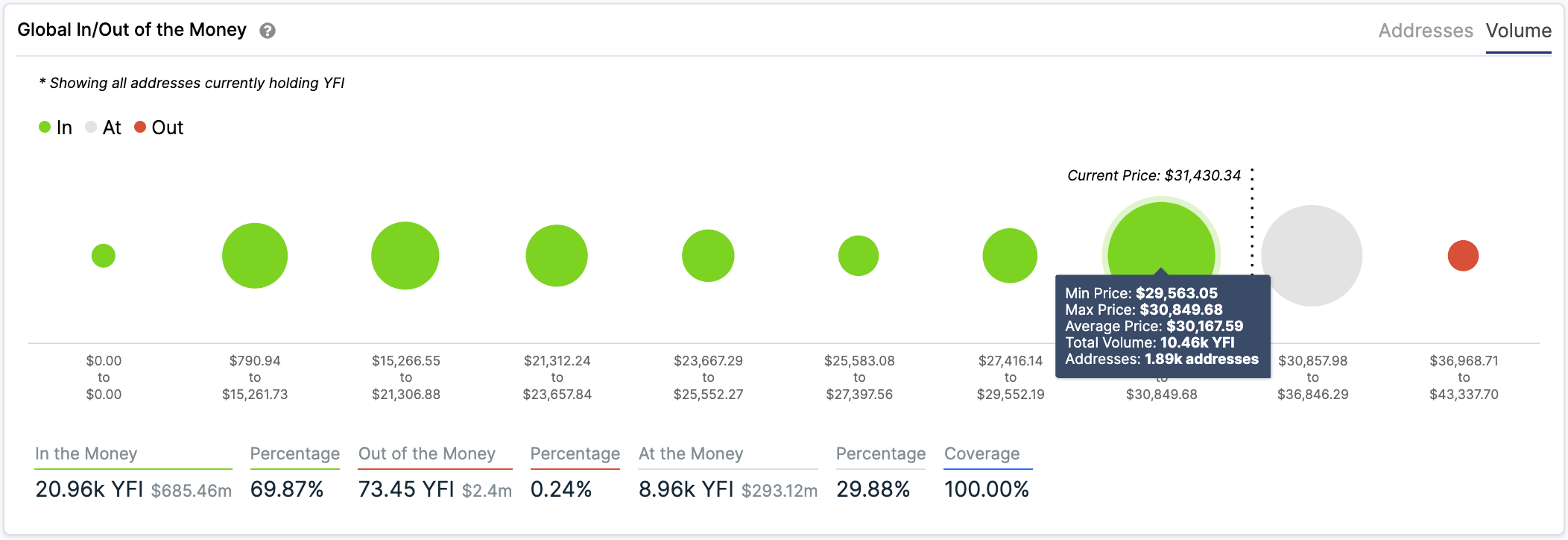

If this were to happen, IntoTheBlock’s In/Out of the Money Around Price (IOMAP) model shows that Yearn Finance must hold above $30,160 to avoid a catastrophic outlook. Even though this is a crucial demand barrier as around 1,900 addresses purchased 10,500 YFI tokens around this price zone, there is no other significant support wall underneath it.

The lack of a strong interest area below the $30,160 level suggests that Yearn Finance price could be bound for a sell-off.

YFI IOMAP chart

Given the significance of the $30,160 support level, investors must pay close attention to it.

If this demand wall is able to absorb the selling pressure seen recently, a rebound could occur. Bouncing from this hurdle would be bullish for Yearn Finance price as there is little to no resistance up to $39,000.