- Yearn.finance ‘Coinbase effect’ was short-lived, leaving the token helpless and in the hands of the bears.

- YFI is sitting above an area with immense support, while the upside remains clear with little resistance to $30,000.

Yearn.finance has quickly become the topic of discussion in the DeFi sector and the entire crypto space. Barely a month after its launch, YFI rocketed to new all-time highs. It majestically surpassed Bitcoin (BTC) to become the most costly cryptocurrency in the market. From a little known DeFi token, Yearn finance hit news headlines with gains hitting $44,000.

Despite the meteoric rise, the retreat that followed the yearly highs has seen YFI lose over 50% of its value as reported. Nonetheless, Yearn.finance is not bleeding alone because most of the tokens in DeFi have failed to sustain upward momentum, leading to massive breakdowns.

The rush to get a slice of the YFI cake

The initial massive gains brought too much attention to Yearn.finance, perhaps a lot more than it could handle or deserve. Cryptocurrency exchange companies like Binance and Coinbase listed it for trading almost immediately. The DeFi mania Binance was accused of could have been working in the background, or maybe it was the fear of missing out (FOMO).

The hype surrounding YFI listing on Coinbase took DeFi by storm as the token started to surge to new highs. Before the trading on Coinbase, Yearn.finance exchanged hands around $30,000. The listing sent it to highs above $35,000 in minutes. The meteoric growth saw it step above $40,000 and later pushed to new highs at $44,000.

The listing on Coinbase somehow affirmed FYI’s legitimacy following questions over its value and utility. The final leg up to $44,000 was dubbed the “Coinbase effect.” It is vital to note that traders held the coin for its “worthlessness” initially; besides, it was cheaper to have it. However, a lot seems to have changed with the protocol currently running several services as discussed, including the Yearn Vaults, access to other DeFi tokens like Aave, and an insurance cover.

Unfortunately, the craze surrounding Coinbase listing exited just as quickly as it came. A glance at the YFI/USD daily chart (Coinbase), the token has been falling since the listing. From trading a high of $47,775, YFI has recorded a series of bearish candles to the prevailing market value of $23,351. These losses continue to raise questions about whether YFI has real value or the high price is due to speculation.

YFI/USD daily chart

Yearn.finance bulls continue to nurse losses following the declines in the last 24 hours. Support levels at $28,000 and $24,000 failed to keep the bears in check. The downward trending Relative Strength Index (RSI) hints that YFI is not done with the downtrend. Note that the price is trading under the 50 SMA, highlighting the selling pressure over the DeFi token. Primary support is envisaged at $20,000, especially if the short-term anchor fails to hold at $22,000.

YFI/USD 12-hour chart

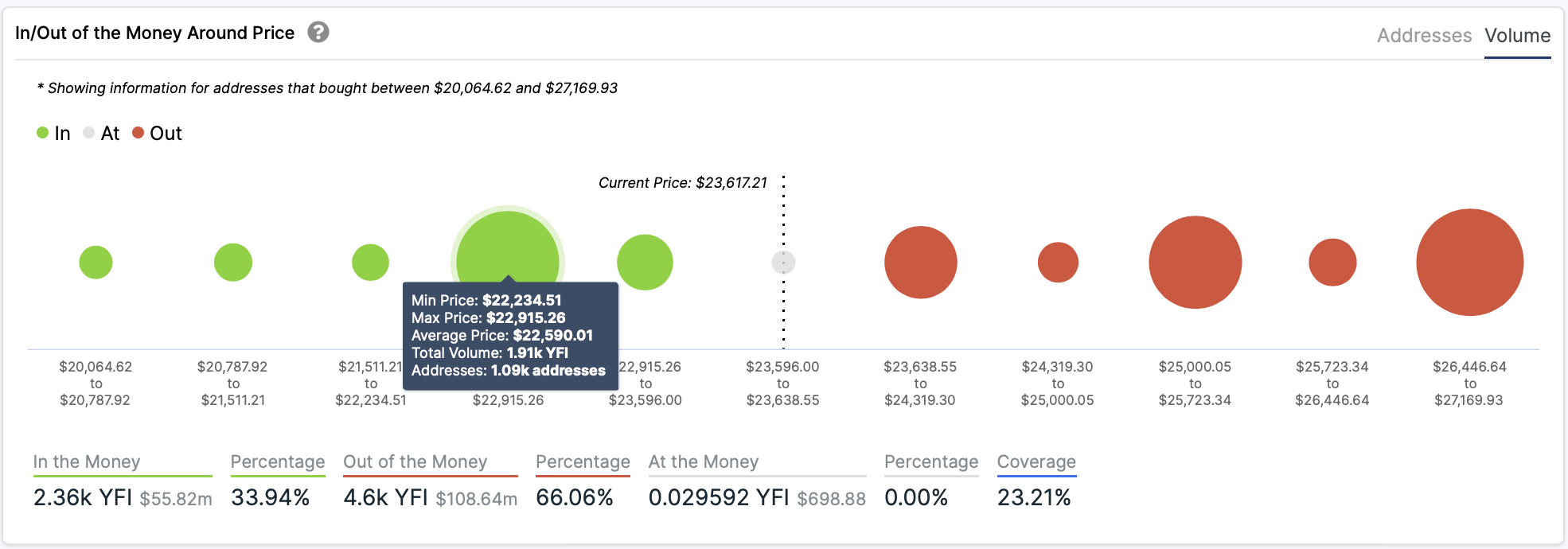

IntoTheBlock’s IOMAP model reveals a relatively strong supply barrier between $23,5553 and $23,812. Here, 240 addresses bought 731,520 YFI. Note that if bulls managed to flip this zone into support, YFI would rally to the next hurdle highlighted between $24,914 and $25,261. In this zone, 68 addresses previously purchased 1,450 YFI.

Yearn.finance IOMAP chart

As far as support is concerned, YFI sits on a strong demand range between $22,149 and $22,586. Here, about 1,000 addresses previous bought 1,910 YFI. It is essential that this support zone is defend at all costs, otherwise, losses could extend below $20,000.

Looking at the other side of the picture

It is also essential to note that a reversal could soon come into the picture following a descending wedge formation. A break above the pattern could invalidate the bearish trend and place YFI on a recovery path eyeing $25,000. If bulls hold the support highlighted by the IOMAP model, YFI could relaunch the upward journey to highs aiming for $25,000.