The US dollar has been on the back foot during many sessions in 2017, hurt by some Donald Disillusion as well as other factors. Needless to say, foreign exchange is never a one-way street but corrections have been quite shallow.

This one looks a bit different. Fed Chair Janet Yellen took the stage for the second time this week, and this time she made some meaningful comments about monetary policy. All in all, her message was quite upbeat about the US economy.

In San Francisco, Yellen stated that the economy is near maximum employment and that also inflation is moving towards the goal. Her more hawkish statement was that

Waiting too long to begin moving toward the neutral rate could risk a nasty surprise down the road

She expressed worries about too much inflation, financial instability or worse.

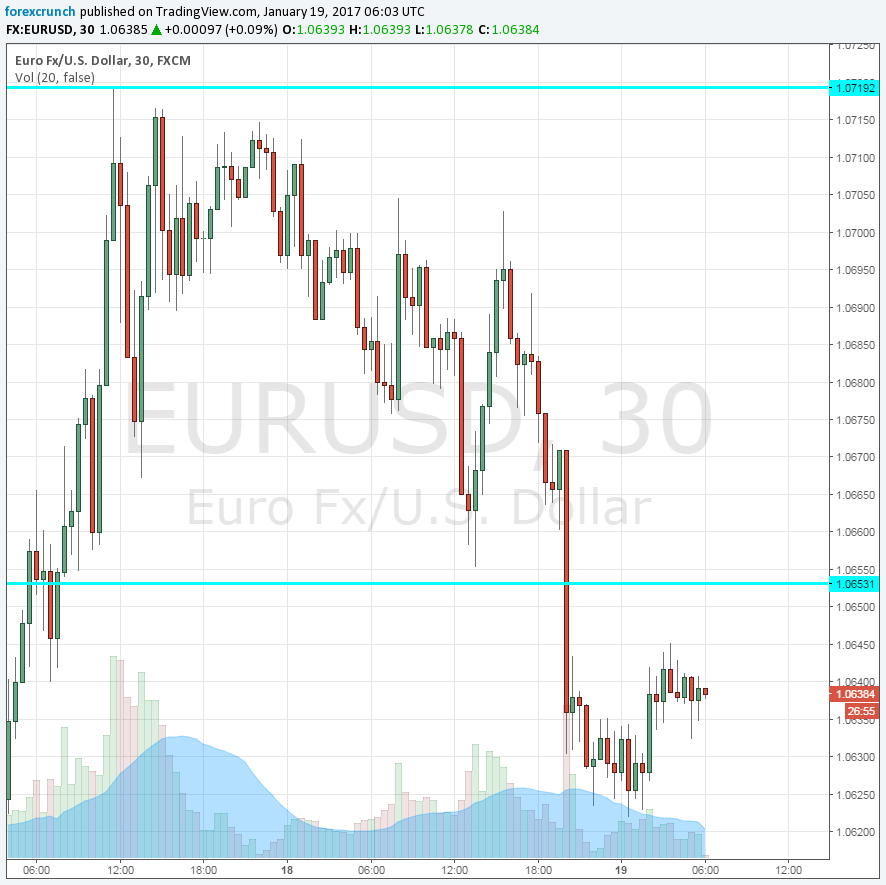

USD rises to Yellen’s comments

The US dollar drove higher across the board. EUR/USD trades at 1.0640, below support at 1.0650 and further away from the highs of 1.0720. GBP/USD has cooled off from the highs over 1.24 that followed May’s Brexit speech. USD/JPY is trading around 114.50, also here, much higher than levels seen earlier.

Among commodity currencies, USD/CAD is back up at the 1.32 handle, trading around 1.3260. AUD/USD is trading at 0.7520, relatively resilient, but off the highs. NZD/USD is around 0.7150, down from 0.72.

Here is the euro/dollar chart. The European Central Bank decision is the next big thing on the agenda.

More: Technical levels for majors and crosses ahead of Trump’s inauguration [Video]