- Zcash could resume the uptrend to $75 as long as the price makes a daily close above the 50 SMA.

- Despite the technical picture being optimistic, on-chain metrics paint a bearish picture for ZEC/USD.

Zcash, the privacy-oriented altcoin, is nursing wounds after a paralyzing 29% drop from the November peak at $89.5. Support was embraced at $63.5, refocused ZEC upwards. Resistance at $70 is currently an uphill battle, but ZEC seems poised for recovery to higher levels.

ZEC eyes gains to $75 before resuming the uptrend to $90

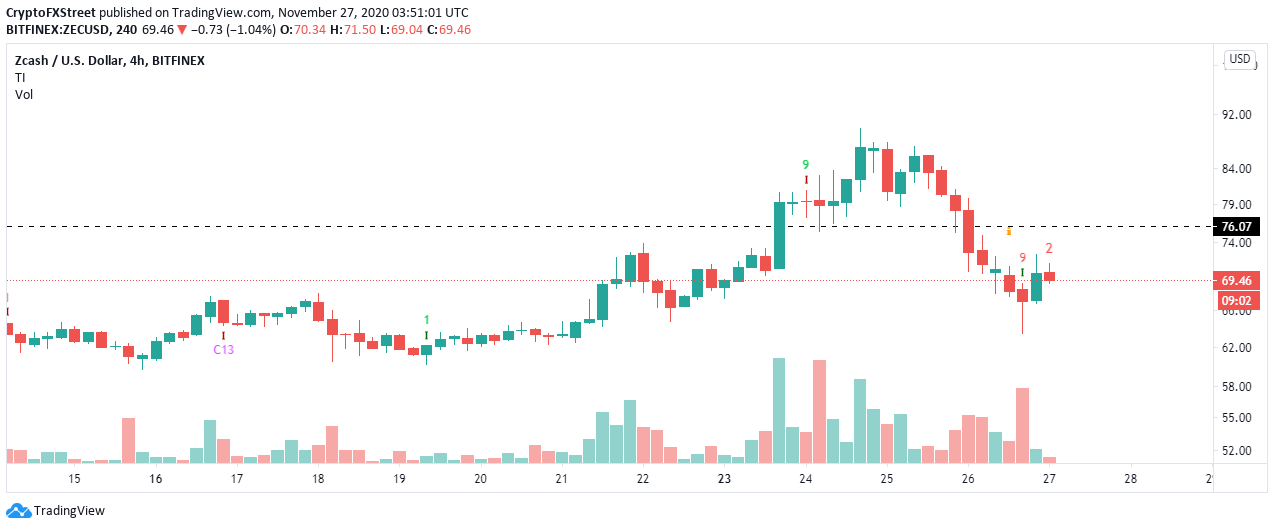

Zcash is trading at $69.9 after making a shallow recovery from the primary support, slightly above the 200 Simple Moving Average on the 4-hour chart. Marginally above the prevailing market value, ZEC/USD is battling a seller congestion zone at the 50 SMA.

A daily close above the 50 SMA would encourage more buy orders as investors look forward to trading above $75. The journey to $90 might run into delays at $80. On the other hand, support at the 100 SMA has to remain intact for the bullish outlook to materialize.

ZEC/USD 4-hour chart

Recently, the TD Sequential indicator presented a buy signal on the ZEC/USD 4-hour chart, adding credibility to the optimistic outlook. The signal manifested in a red nine candlestick and estimated a spike in demand for Zcash likely to see it spike in one to four daily candlesticks. However, if buying pressure becomes strong enough, the privacy-focused token could take up a new upward countdown.

ZEC/USD 4-hour chart

It is worth mentioning the slump in the number of new addresses joining the Zcash network, according to IntoTheBlock’s “Daily New Addresses” on-chain metric. The model highlights a significant drop in the number of newly-created addresses, precisely from roughly 5,500 on November 20 to zero (as from November 24).

Zcash new addresses chart

In other words, the bullish technical outlook may be invalidated if the newly-created addresses fail to recover in the near term. A downtrend in network growth such as this is usually a red flag for the token’s price. If the decrease sustains, the price may continue to dwindle, delay recovery, or give way for more losses.

%20(5)-637420472431374932.png)

-637420472632992923.png)