Fundamental Bias: Neutral

Key Takeaways

“¢ Market awaits the RBA rate decision this week.

“¢ No change in monetary policy expected.

“¢ AUDUSD fails once again at 0.9300 resistance area.

The Australian dollar traded lower against the US dollar on last Friday before buyers emerged at 0.9200 to push the pair back towards a critical resistance zone. The Reserve Bank of Australia is scheduled to announce interest rates during Tuesday’s Asian session, which is likely to act as a catalyst for the AUDUSD pair in the coming days.

Technical Analysis

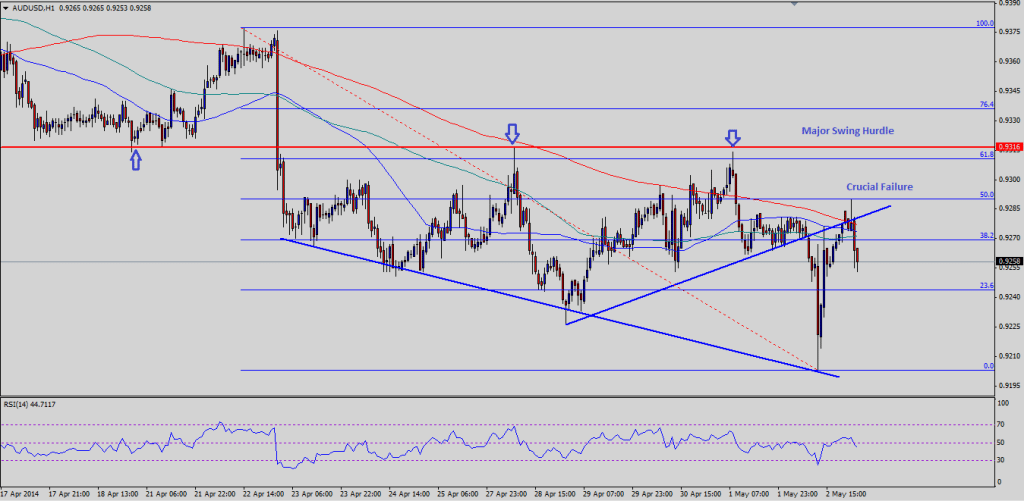

AUDUSD pair breached an important bullish trend line after the US nonfarm payroll data release. The pair fell towards the 0.9200 level where buyers emerged to push the pair higher. However, the pair failed again around 50% Fibonacci retracement level of the last leg lower from the 0.9276 high to 0.9204 low. This can be seen as a crucial failure, as the mentioned level represents a major technical barrier for the pair. The broken trend line and all important simple moving averages (200, 100 and 50) are around the same level.

On the downside, 0.9250 is seen as an immediate support for the pair, followed by the recent low at 0.9204. A break and close below the mentioned level might take the pair lower towards a major support area at 0.9150-30. Alternatively, the AUDUSD buyers need to overtake 0.9300 in order to establish bullish bias in the short term. The RSI is back below the 50 level, which signals a lack of bullish momentum moving ahead.

Looking Ahead

The Reserve Bank of Australia will be announcing the interest rates during the upcoming Asian session. The central bank is expected to keep the interest rates at 2.5%. The official rate statement might be scanned closely by the traders, as any dovish comments could spark a downward drift for AUDUSD. On the other hand, an unchanged statement might encourage the Aussie buyers in the medium term.

For more, see the AUDUSD prediction.