AUD/USD was hit by the excellent US NFP but is maintaining the 0.70 level. Can this hold?

Here is the view from Credit Agricole:

Here is their view, courtesy of eFXnews:

Domestic and international releases will likely shape AUD’s price action this week. The calendar is littered with key domestic and Chinese releases.

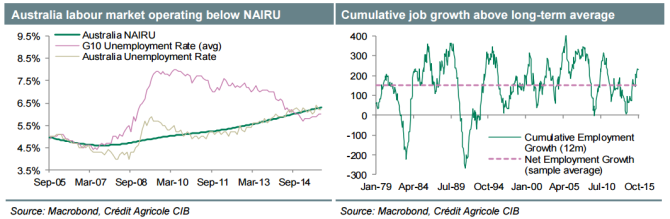

When it comes to labour data, the market expects a 16.5k pickup in the next employment release, which comes on the heels of a 5.1k drop previously. A drop in full employment drove the move in net employment last month, yet we argue that seasonal factors played a key role. We also note that in the year to September Australia created a net amount of 230k jobs with a respectable rotation out of the mining sector. These cumulative gains are well ahead of the average of the past 35 years, indicating that Australia’s labour market is healing. However, any better-than-expected data is unlikely to have any meaningful impact on rate expectations unless external demand expectations start to rise more considerably.

From that angle, next week’s Chinese data should prove key. Elsewhere, global risk sentiment should drive the currency, which we expect to become more unstable on the back of further rising Fed rate expectations.

We expect the AUD to remain a sell on rallies.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.