After Draghi dragged the euro down with dovishness and China cut rates as well, will the BOJ add monetary stimulus of its own?

The team at Braclays suggests buying dollar/yen towards the October 30th meeting:

Here is their view, courtesy of eFXnews:

Currency investors should consider buying USD/JPY via options going into this week’s BoJ meeting, advises Barclays Capital in its weekly FX pick to clients.

“Our expectations for a further BoJ easing is a close call and we believe scope for further yen weakness is limited due to undervaluation, a decisive easing by the BoJ could put a sharp upward pressure on USDJPY, at least in the short term. When the BoJ surprised the markets with QQE2 last October, USDJPY rallied by more than 3 yen on the day,” Barclays projects.

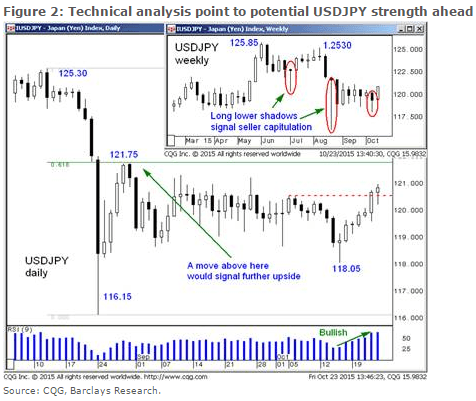

From a technical perspective, Barclays becomes more bullish USD/JPY in the short term.

“Recent seller capitulation on the weekly plot was endorsed by last week’s positive close. Rising daily momentum further helps to confirm recent resistance erosion. We are looking for an initial move towards the 121.75 area. A break above 121.75 would signal higher. Our greater targets are towards the 125.30/125.85 range highs,” Barclays adds.

Hence, Barclays recommends buying a 1-week 1×1 USD/JPY call spread (with expiry on 2 Nov), with strikes at 121.75 and 125.30.

“This option structure costs 0.31% with maximum payout of 4.02% and payout/loss ratio of 12.0, offering an upside hedge in case of a decisive BoJ action.

For those looking for cheaper structures, a 1-week RKO costs 0.24% for the same strike and barrier. The maximum payout ratio is 15.75 although the risk is much more aggressive easing by the BoJ,” Barclays advises

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.