BOJ interest rate decision and statement on Monetary Policy were released today during the Asian session.

There was no major change in approach of the central bank, and as a result Japanese Yen traded touch lower post release.

BOJ Monetary Policy Statement

Central bank in the policy statement mentioned that they will conduct money market operations so that the monetary base will increase at an annual pace of about 60-70 trillion yen.

Economy Outlook: BOJ expects moderate recovery

Inflation: BOJ expects year-on-year rate of increase in the CPI to be around 1 ¼ percent for some time. The central bank also mentioned that they will continue with quantitative and qualitative monetary easing, aiming to achieve the price stability target of 2 percent.

The main thing is that the market is expecting BOJ to do more in terms of stimulus. Investors keep on pricing more increase in monetary base, which obviously affects the Japanese Yen. However, there are some other aspects as well. The recent growth in US labor market and Fed taper program has also affected USDJPY pair, which eases some pressure from BOJ to do more, and they can afford to buy some more time.

Japan’s Eco Watchers Survey

Japan’s Eco Watchers Survey – Current and Outlook were also released GMT 05:00 AM. The outcome was positive, as current economic conditions in March went up by 4.9 points from the previous month to 57.9.

Technical Analysis

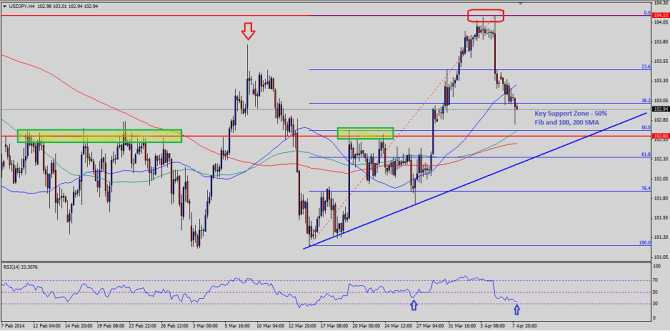

USDJPY climbed above March 7th, 2014 high to trade close to 104.20 level. However, USDJPY buyers failed to settle the pair above 104 handle, which ignited a bear rally. US NFP figures added pressure during last week to take the pair back below 103.00 level. The pair is now heading towards a major support area at 102.60, where lies 50.0% retracement level of last leg higher from 101.18 low to 104.13. Moreover, it also represents the previous major swing level with 100 and 200 simple moving average on 4 hour timeframe around same area.

There is also a bullish trend line connecting all previous lows, which might act as a hurdle for sellers in short term. On the upside, 103.80 level can be seen as first major barrier, followed by the previous high.