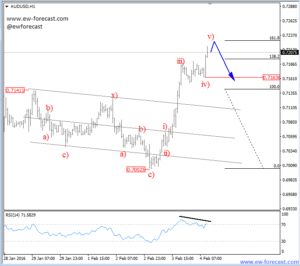

AUDUSD

On the intraday chart of AUDUSD, we are looking for a completed wave v) in the corrective pullback to the upside, that can reach our fibo. ratio levels around 161.8 before turning to the downside. Lately this pair is tracing out some complicated structures. On the larger time frame we are still looking for lower levels after this corrective pullback is over.

That said all pairs are showing one more possible run in 2016 for USD. If we don’t see an impulsive fall on AUDUSD soon, then that would mean that a corrective upward action is not completed and that we have a bit more upward price action to follow.

AUDUSD, 1H

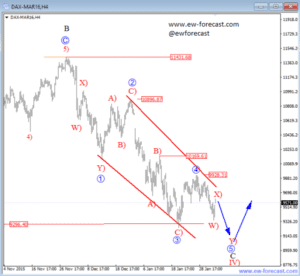

German DAX

As well as AUDUSD, DAX is also trading in a correction on a higher time frame. We are tracking a complex fall from highs in the ending diagonal form in the black wave C. Currently we should be in the fifth wave of C, the last leg of this corrective pullback and according to our count this should be over in the following days or weeks. This means we can expect a recovery of this index soon but we have to monitor the structure of the potential rise and see if the structure will confirm a reversal.

Keep in mind that ending diagonals can indicate sharp reversals after its completion and in our case a new bullish cycle could start in red wave V), if our view is correct.

German DAX, 4H