The USD is higher across the board, while stocks are moving sideways ahead of the FOMC today. Such events can be very important for trend changes, so it could definitely to be prepared rather than surprised.

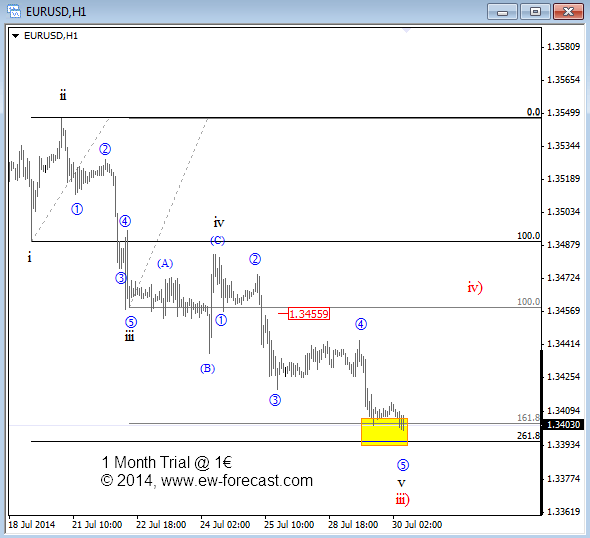

On EURUSD we are tracking an impulsive decline in progress, but the impulses are also structured by corrections. On the chart below we have been looking for a five wave drop within wave v of red wave iii) and it looks like we have it just now. The pair fell into our Fib. support levels around 1.3400 where round numbers could act as a support. We still suspect that sooner or later EURUSD will rally into a correction that could give us an opportunity to join the downtrend.

EURUSD 1h Elliott Wave Analysis

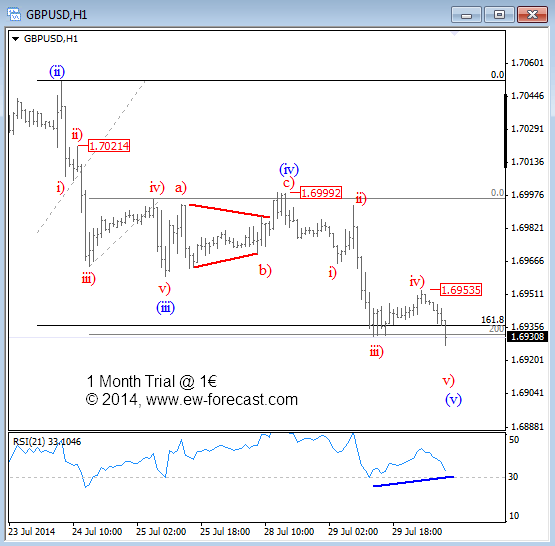

GBPUSD is showing a very similar price action. The pair fell to a new low, towards our 1.6940 projected level and even lower, as highlighted yesterday. It made five waves down from around 1.7000 so a correction is expected. There is also a minor divergence on the RSI suggesting a short-term bounce. I would say don’t sell here, wait on higher “better” levels for shorts.

GBPUSD 1h Elliott Wave Analysis