The recent big moves in forex markets created opportunities and interesting patterns on the charts. Here are the views from SocGen:

Here is their view, courtesy of eFXnews:

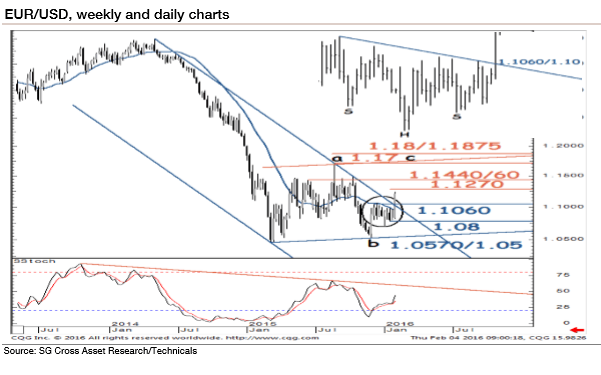

EUR/USD retested last March levels (1.0570/1.05) and also the multi decadal channel back in November after which it has embarked on a recovery. This week it has confirmed an inverted H&S and in the process it has also crossed above multi month weekly channel resistance (1.1060/1.10).

With the weekly indicator breaking a descending trend, the pair appears to extend the phase of rebound. Currently it is approaching 1.1270, with potential for the inverted H&S. A test of graphical levels at 1.1440/60 cannot be ruled out. However, only a durable move above that will open the next leg of the rally towards last August’s high of 1.17 and even 1.18/1.1875.

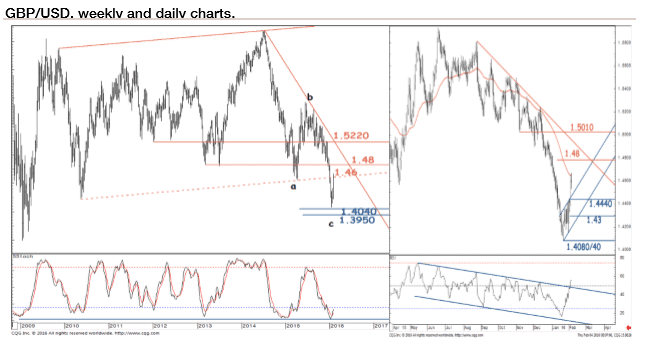

GBP/USD nearly achieved projection for the c wave of an abc down move at 1.3950 last month, and since then it is undergoing a sharp pullback. It is now probing the 50-week MA and also the lower limit of a multi-year upward channel (1.46).

With daily RSI breaching above a descending channel, extension in rebound cannot be not ruled out.

A sustained move above 1.46 will mean re-integration within the weekly channel and indicate a move initially towards the 2013 lows of 1.48.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.