The decline in global economic demand seems to be catching up to the UK economy. On 9 September the Office for National Statistics reported ‘total production output’ increased 0.8%; the best performance was from ‘mining and quarrying’ at 6.7% whereas manufacturing declined 0.8%; a 0.5% year over year; machinery and equipment declined 15.9% Overall, industrial output declined 0.4% in July. The report specified a decrease in basic metals, metal products and ‘transport equipment’. Q2 compared to Q1 numbers were surprising, with production and manufacturing declining 9.3% and 5.2% respectively.

ONS chief economist Joe Grice stated, “…The biggest single factor in the fall in manufacturing output was motor vehicle production, with the summer shutdowns appearing to start earlier than usual, along with anecdotal evidence showing a slowdown in exports. There has also been a fallback in the manufacture of weapons, following a big rise in June …” Mr. Grice was spot on as exports did indeed decline.

Guest post by Mike Scrive of Accendo Markets

The export shortfall was more pronounced in the export of goods more than in the exports in services about 9.16%. The £2.3 billion decline is the largest since 2010. Semi-manufactured goods exports declined, but interestingly imports increased approximately 0.877%. Q2 imports declined, particularly ‘non-EU’ semi-finished as well as finished goods.

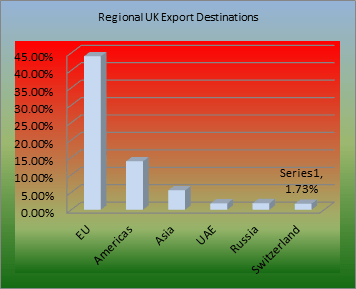

Who are the major non-EU trade partners? Switzerland is not an EU member but certainly does occupy a key position in Europe. Switzerland places 15th of the top 15 UK export partners; about 1.73% of all exports. Else, the United States is the UK’s number 1 export destination at just over 12%, Germany at nearly 11% and China at 3.71%.

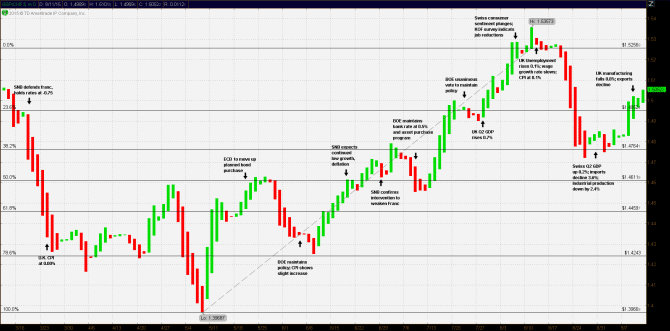

GBP/CHF

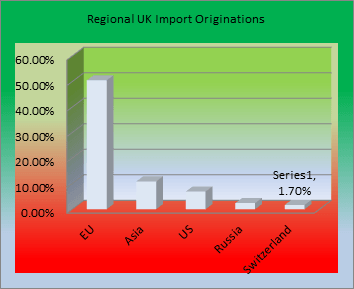

Data from Observatory of Economic Complexity

Of the top 15 UK import originations the largest non-EU import partner is China at 8.70% of total imports, followed by the US at 6.95%, Russia at 2.40%, Japan at 2.19% and lastly Switzerland at 1.70%. Conversely, the UK accounts for 3.97% of all Swiss exports and 3.02% of all Swiss imports.

Hence, it’s safe to say that shortfalls in trade is little affected by the Swiss-UK dynamic, and this is the point of the matter. The cause of shortfall is either heavily skewed by the economic contraction in Asia and other emerging markets. However considering the large percentage of UK trade with EU as well as US, decreasing demand in either or both regions should not be discounted.

The Swiss economy has defied expectations, growing at 0.2% over the previous quarter. However, as reported in Bloomberg, this calculation may have been skewed by a 3.6% decline in imports, in particular, a decline in those semi-finished goods. The main drag to the Swiss economy has been its stubbornly strong Franc, in spite of negative deposit rates and repeated warnings by the Swiss National Bank, (most recently by Vice Chair Mr. Fritz Zurbruegg), FX intervention will be utilized when deemed necessary. The scale of intervention was made evident 31 July, when the SNB reported a £33.34 billion loss, nearly all due to the seemingly futile attempt to weaken the Franc .

A six month chart of GBP/CHF demonstrates that the SNB has had some success vs the Pound Sterling. From the 7 May 2015 GBP/CHF low of 1.39687 Franc to Pound to the 11 August GBP/CHF high of 1.53573, the Franc weakened nearly a full 10%. Further, the weakening trend neatly followed the Fibonacci trend testing and breaking resistance along the way.

The question then becomes where to from here? The next SNB policy assessment decision will be mid-September; about the same time as the US Fed policy decision meeting. Two of the past four BOE policy assessments the voting was unanimous; twice with 1 dissenting vote twice. What’s more important though, and probably more of an indication of the monetary policy committee’s thinking is demonstrated in the continuance of the £375 billion asset purchase program, noted in the 10 September monetary policy summary. A reduction in the programme would have served as a clear signal that the BOE was satisfied with the progress of the economy. Further, the slowdown in the Asia-Pacific region will weigh on the UK trade economy. However, even a moderate slowing with of demand from the US and EU in addition to the more severe contraction in the Asia-Pacific region might, in total, tip the scales negatively for the UK economy.

Swiss economy is doubly affected by a slowing in global growth plus an ‘unyielding’ Swiss Franc making it very unlikely that the SNB can afford to risk any tightening in monetary policy. In fact, it’s reasonable to assume that the SNB may have to become more aggressive in its attempts to weaken the Franc in order to keep the domestic economy from slowing further, and consequently vs the Pound Sterling.