The parliamentary elections are underway in Italy and there is an unconfirmed notion that many voters could break for the alternative candidate Beppe Grillo. Grillo, a former comedian, challenged the establishment politicians, vowed to fight corruption and offered some interesting, yet populist suggestions towards the elections. If his 5 Star Movement reaches significant achievements, the euro could plunge.

Exit polls are due at 14:00 GMT, but the real and full results might take another day. Here is some background on the leading candidates and two basic scenarios for the euro’s reaction – one positive and one negative.

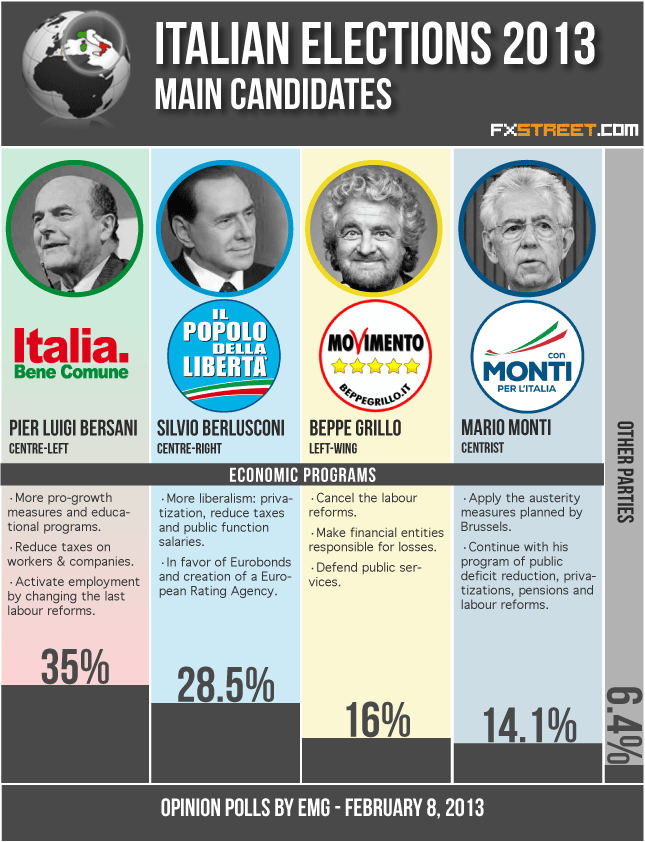

Here are the main contestants:

- In recent months, Grillo and his party toured Italy, the euro-zone’s third largest economy, in what they called a “Tsunami tour”. Many Italian are fed up with the old establishment politicians. His rally on Friday in Rome drew huge masses. Grillo has been working hard and gaining traction with his grassroots organization, ignoring mainstream media.

- Monti’s center: Austerity measures by current PM Monti are very unpopular, and many see him as a puppet of bankers.

- Bersani’s center left: The main opposition party PD party led by Pier Luigi Bersani, has a chance of winning thanks to being in opposition. However, Bersani is expected to go with Monti’s EU policies and to form a government with Monti. For may, Bersani offers nothing new.

- Berlusconi’s center right: Former PM Silvio Berlusconi is also enjoying a last minute rise, thanks to populist offers and thanks to acquiring football star Mario Balotelli for his team, AC Milan. Berlusconi also controls a significant portion of the media. His PDL party could win Lombardy.

There are also a few more parties on the right and on the left. Here is more background information by and a nice infographic from FXstreet.com. The scenarios for the euro are below

Basically, there are two scenarios that markets:

- Euro-positive: The best outcome for the markets and for the euro is that Bersani’s PD and Monti’s center party win a majority of seats in both houses of parliament. In this scenario, they will form a government together and will continue the path of reform that Monti began.

- Euro-negative: Basically, any other result. A big “tsunami” for Beppe Grillo, a victory for Berlusconi or any form of a hung parliament would change Italy’s path, could send bond yields soaring and could also send the euro to 1.30 quite fast.

It’s important to remember that exit polls in Italy are not always accurate. The real and full results for both chambers of parliament in Italy’s complex political system will probably be evident only within on more day.

This could provide lots of volatility in the markets. EUR/USD is currently trading above 1.32, within the range of 1.3170 to 1.3255. A negative outcome could send it the next support lines at 1.3130, 1.31 and even all the way to 1.30.

A positive outcome would challenge the 1.3255 line and even send it eventually towards critical resistance at 1.34. For more lines and events, see the EURUSD forecast.