The New Zealand dollar moved lower intraday against the US dollar post the Fed interest rate decision. The NZDUSD pair below the 0.8100, and traded as low as 0.8077. Earlier during the Asian session, the New Zealand’s Gross Domestic Product (GDP) was released by the Statistics New Zealand. The outcome was somehow good, as the report mentioned that the New Zealand’s GDP grew by 0.7% whereas the market was expecting an increase of 0.6%. However, the current rate is down from the previous reading of 1.0%. The NZDUSD has managed to recover some ground after the release, but it looks like that there are several hurdles on the way up for the pair.

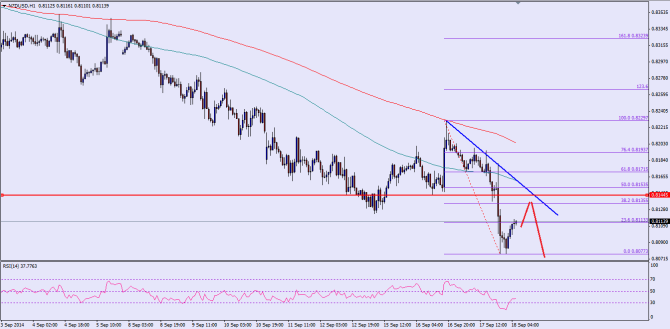

There is a bearish trend line formed on the hourly chart of the NZDUSD pair, which can be considered as a monster hurdle in the near term. Currently, the pair is trading around the 23.6% fib retracement level of the last drop from the 0.8229 high to 0.8077 low. There is a chance that the pair might trade close to the highlighted trend line, which also coincides with the 38.2% fib level and a previous swing level. In that situation, the New Zealand dollar is likely to struggle around the 0.8140-50 levels, and sellers are likely to appear around the mentioned levels. The hourly RSI is bouncing from the extreme levels, which might support the pair in the short term for a correction towards the resistance zone.

There is even a possibility that the pair might fail around the current levels and move lower. In that situation, today’s low around the 0.8077 level might be tested again.

Overall, selling rallies look like a great option considering the pair has breached an important support area.

————————————-

Posted By Simon Ji of IKOFX