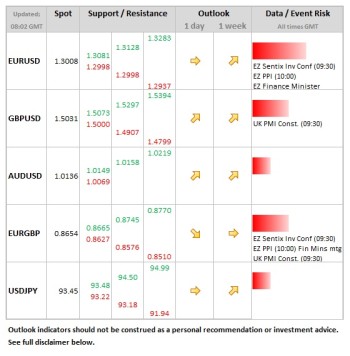

- EUR: Data releases are not major today, but the investor confidence data could provide a marginal lift for the euro if the recent uptrend is continued. The meeting of Eurozone finance ministers today brings risk of some comments which could impact on the euro.

- USD: No releases scheduled for today, although focus remains on the budget sequester which kicked in on Friday. The dollar is up nearly 4% over the past month, having risen each of the past four weeks on the dollar index.

- GBP: Just construction PMI data. Usually not a big deal, but market could be more sensitive after the very weak manufacturing numbers seen on Friday.

Idea of the Day

The dollar is in the ascendency. This is notable because it contrasts to what we’ve seen over the past six months. The currency wars have been played out elsewhere, so on the yen, sterling, euro and Swiss franc. This kept the dollar relatively steady against a basket of currencies. We’re now seeing a shift.

The dollar has been rising each of the past four weeks and was the strongest currency on the majors through last month. Furthermore, the dollar index (DXY) is at a 6 month high. We also look to be entering into one of those periods (again!) during which the ‘risk-off’ crowd want to buy because of the dollar ‘safe haven status, whilst others suggest that the budget gridlock is a reason to sell. For now, it looks like the ‘risk-off’ crowd are likely to have the upper hand. This is once again changing the dynamics of FX, with the yen not sure whether to move to its old ‘safe haven’ status or stick with the status of currency under fire.

Latest FX News

- EUR: Starting the European session with another attack of the 1.30 level on EUR/USD. The uncertainty in Italy remains in place, with Bersani still confident he can govern without a formal alliance with others, but just how is not clear. The euro has shown some resilience to the rise in peripheral yields and risk is of catch-up if Italian yields move higher (which has normally been associated with a falling single currency). Grillo suggests that Italy could leave the euro-zone.

- JPY: The nominated Bank of Japan head Kuroda made clear he will do “whatever we can do” to end deflation. There was also the suggestion of bringing forward open-ended asset purchases from the start of next year in comments overnight. Yen just modestly firmer as more radical solutions not on table (such as buying of overseas bonds) and stocks in Asia are on the defensive.

- GBP: Just hold above 1.50 on GBPUSD in the early part of the week. The focus is on the Bank of England meeting on Thursday where GBP 25bln of further asset purchases is expected by the market. The fundamental backdrop remains negative, but there remains the risk of a squeeze higher, especially of the dollar wobbles.

- AUD: After weaker than expected building approvals data overnight, AUDUSD stands just above the 1.01 level, an 8 month low. A close below here would break the Aussie from the established range and a move to parity would be the risk in the coming weeks.

- CNY: Stronger on the back of new measure designed to curb rising property prices, with services sector PMI also falling short of expectations. CNH seen near to 6.2245, from near 6.22 last week.