Another round of discussions has ended without an agreement and June 30th is getting very close.

However, reactions in EUR/USD have not always been straightforward. What is the reaction function? The team at BNP Paribas analyzes:

Here is their view, courtesy of eFXnews:

In a special note to clients today, BNP Paribas discuses the EUR’s reaction function as investors are getting relatively optimistic view surrounding the likelihood of a Greek ‘resolution’ before the end of this month.

BNPP’s long-held view is that good news on Greece is not good news for the EUR expecting the EUR to remain under pressure going forward. Here is how BNPP explains in details the dynamics constituting this related EUR reaction function.

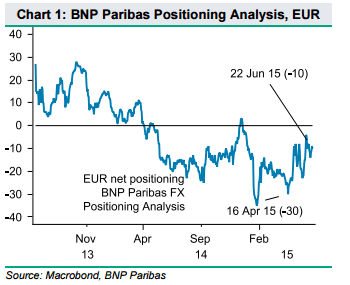

1- “Nervousness about Greece had contributed to a short squeeze in the EUR. BNP Paribas Positioning Analysis highlights that the EUR’s rally corresponded to a substantial lightening of short EUR positioning,” BNPP notes.

2- “A resolution to Greek uncertainty boosts risk appetite and, given the EUR’s status as a funding currency, encourages risk taking funded in the EUR. This is the key reason why good news on the Greek situation is bad news for the EUR and, with short EUR positioning at light levels, there is scope for additional downside,” BNPP argues.

3- “If Greek discussions were to deteriorate again we expect the EUR to initially squeeze higher as the recently established short positions are unwound amid a risk-off backdrop. Beyond a squeeze, however, the EUR is likely to decline,” BNPP adds.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.