EUR/USD made an impressive break above the key 1.1050 level and remained on high ground even when other currencies retreated against the greenback.

What’s next for the pair? Here is the view from Morgan Stanley:

Here is their view, courtesy of eFXnews:

In its weekly note to clients, Morgan Stanley looks to the reasons behind the recent USD correction, the possible magnitude of the move, and concludes by outlining its medium-term trade strategy for EUR/USD.

USD Correction: What’s Next?

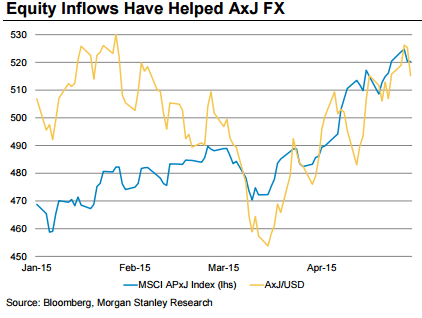

“The performance of the US economy in the first quarter was significantly worse than expected. With the growth gap between the US and the rest of the world temporarily narrowing, we think that the USD correction has a bit more room to run. The change in Asian equity sentiment is also a temporary game-changer for USD; should that persist, we believe that DXY is likely to correct to the 93.00 area before finding support,” MS projects.

USD Correction: Buying The Dip.

“That said, we continue to view this USD decline as a correction within a secular USD bull market. The US economy is set to rebound – and as US yields rise, this should put pressure on the overly-indebted emerging markets…We view a lower USD as providing a buying opportunity,” MS advises.

EUR: When Bund Yields Rise”¦

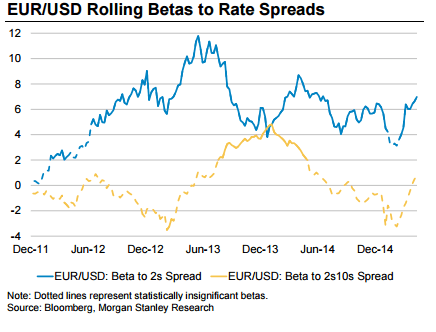

“Bund yields are rising, but this is not EUR-bullish by itself. For EUR/USD to rise materially from here, it is not enough for 10y yield spreads to move in Europe’s favor. A durable EUR/USD rally requires front-end rate spreads to narrow,” MS argues.

EUR/USD: The M/T Trading Strategy.

“Thus, even though we expect that 10y EU-US spread will narrow by 20bp, we forecast 2y spreads to move in USD’s favor by 60bp. This front-end move should be overpowering for EUR/USD, and a major reason why this EUR/USD upward correction is unlikely to evolve into a durable rally. We will therefore look for opportunities to reestablish EUR/USD shorts in the 1.13 to 1.15 range,” MS advises.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.