- Crypto staking allows holders to earn passive income through rewards on the tokens locked within a network.

- Staking goes beyond just getting rewards; it lets investors participate in securing the protocols.

The cryptocurrency industry has, without a doubt, evolved and transformed in the last decade from mainly a speculative market to a space where investors can earn passive income from multiple platforms. As the industry matures, there has been a need to grow and diversify various market aspects.

What Is Crypto Staking

Staking, in particular, is an emerging trend referring to the act of holders of specific crypto assets pledging to a blockchain platform, in turn earning rewards. It is worth mentioning that staking goes beyond these rewards because users secure the networks by having their tokens locked. As a consequence, users are rewarded with native tokens for securing the network.

The amount of reward earned depends on the tokens a holder decides to lock. Therefore, to gain more, one has to stake more tokens. Subsequently, the process of distributing rewards is handled autonomously and on-chain. In other words, the user does not need to do more than just staking the tokens but only hold on tightly for the passive income.

Blockchains running on the proof-of-stake (PoS) consensus algorithm are eligible for staking. Some of these tokens include Solana, Tezos, Cardano, and Binance Coin. With every block that is validated, new tokens of the native cryptocurrency are minted. These new tokens are then distributed on-chain as rewards.

Over the last few years, staking platforms have come to allow investors to lock up their tokens easily. This article dives into the nitty-gritty of the three best crypto staking platforms investors can use to earn passive income after buying crypto assets.

-

Crypto Staking On eToro

eToro, the world’s leading social trading platform, has diversified its services to offering staking for its users. The platform is inherently known for trading cryptocurrency and CFDs and allows users to earn while HODLing their tokens.

Staking on eToro has been made much easier because the platform carries out the entire process on behalf of the customers. Rewards from staking come in the same cryptocurrency; thus, it is easier to grow holdings. The process is similar to earning interest of money locked in a fixed deposit bank account.

According to eToro’s website, the staking process is “simple, secure and hassle-free.” Users receive their rewards every month in the supported cryptocurrency and do not need to take any action from their end to this matter.

Note that users do no relinquish their ownership of the crypto assets bought on the best exchange and staked on eToro. Throughout the process, users own the tokens but give eToro the power to carry out the staking procedure on their behalf.

Looking to buy, trade or stake crypto now? Invest at eToro!

Your capital is at risk.

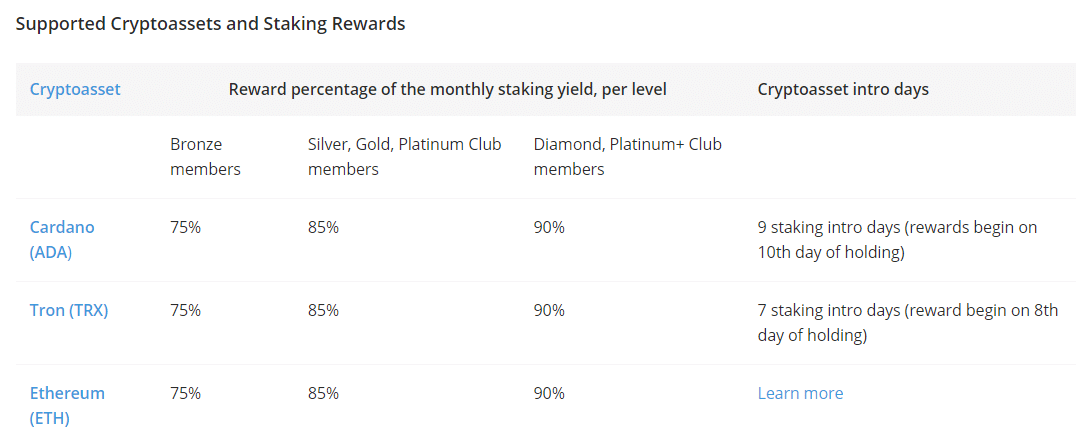

Staking on eToro ensures the safety of the tokens, and users avoid the complex staking procedure altogether. However, eToro will retain a small percentage of the yield as a fee in addition to covering operational costs, technical and related legal costs. Some of the cryptocurrencies supported for staking on eToro include Cardano (ADA), TRON (TRX), and ETH. It is essential to check on the percentage rewards on eToro’s website when considering staking with them.

-

Aave:-

Aave is a decentralized finance (DeFi) platform offering several services to cryptocurrency users, including yield farming, lending, and staking. Currently, Aave leads the DeFi sector with a total value locked (USD) of $14.47 billion (August 26, 2021).

The platform executes on the Ethereum blockchain and has become popular among investors wishing to take advantage of the relatively new DeFi solutions.

Staking on Aave requires a deposit of AAVE tokens in the protocol Safety Module. Realize that platform will reward AAVE tokens as Safety Incentives (SI). The Aave Staking Calculator is a mechanism for holders to know expected reward according to the supply being staked.

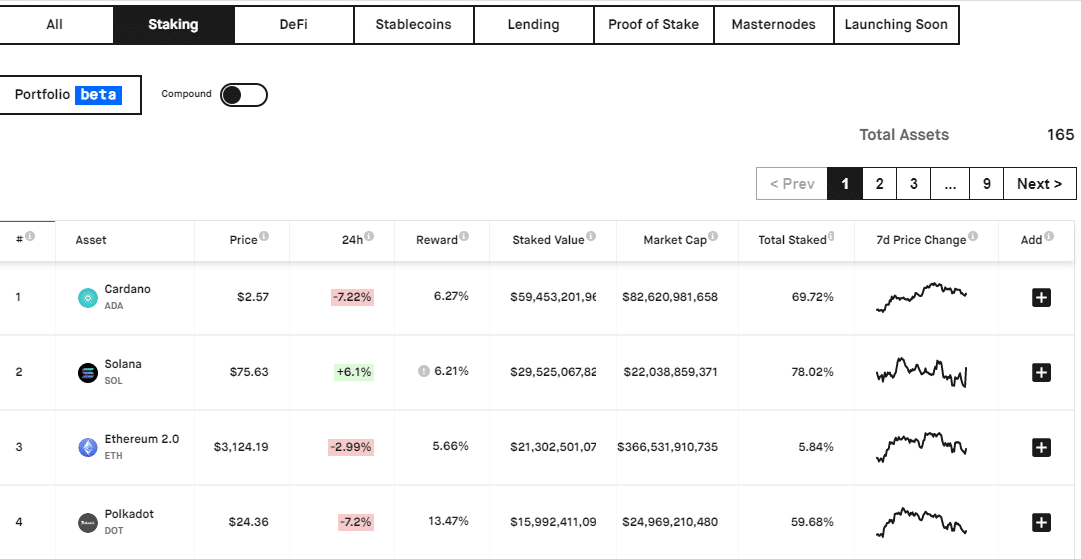

Besides AAVE, the native token of the Aave protocol, 23 other cryptocurrencies are supported for staking. These crypto-assets include Cardano, Solana, Polkadot, Avalanche, Algorand, PancakeSwap, and Terra. Aave plans to grow the list in the future to have Theta, Nash, Cyber, and many others.

-

PancakeSwap:-

PancakeSwap is one of the leading decentralized exchanges (DEXs) in the cryptocurrency industry. Trading in the cryptocurrency is moving from mainstream centralized platforms to DEXs, offering users complete control over their crypto assets.

The platform boasts 2.6 million active users worldwide and has recorded more than 45 million in trades over the last 30 days. Interestingly, PancakeSwap has more than $12 billion in total value staked.

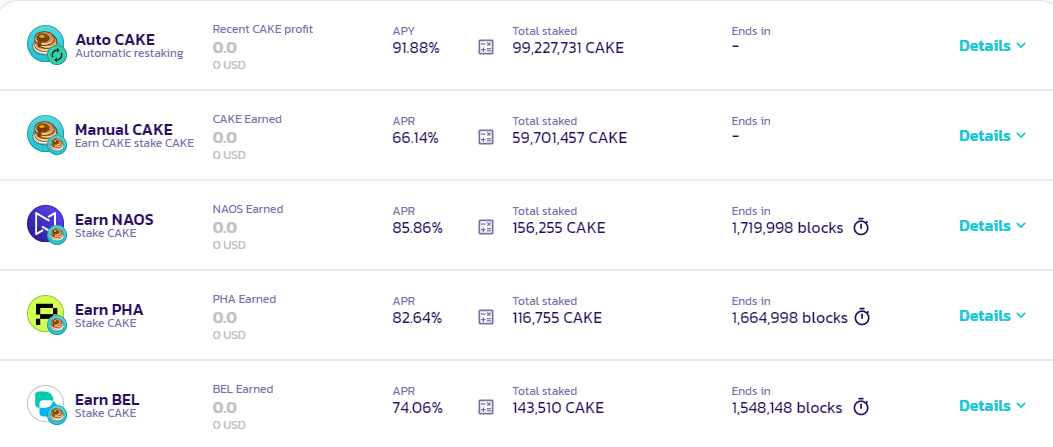

PancakeSwap allows users to stake multiple crypto assets, including CAKE, in pools. There are two staking pools, the auto and the manual. Most users choose the auto pool because it compounds the staked token, allowing one to earn more. However, there is a 2% performance fee.

Users staking on PancakeSwap can stake CAKE and earn other tokens, making the platform stand out among its peers. The percentage of the reward expected depends on one pool to the other. However, the rewards range from 60 to 100% of the staked amount. The pools do not run eternally but end following set blocks apart from Auto CAKE and Manual CAKE which can run indefinitely.

Looking to buy, trade or stake crypto now? Invest at eToro!

Your capital is at risk.