The Australian dollar enjoyed the “no-change” decision from the RBA and made a move above 0.72.

The team at BNP Paribas suggests selling rallies from here:

Here is their view, courtesy of eFXnews:

The RBA left the policy rate unchanged at 2.0%, versus market pricing for 30% probability of a 25bp rate cut and im sympathy AUD is a touch firmer.

In this regard, BNP Paribas favors fading any rallies above 0.7200 in AUDUSD for the following 3 reasons:

“1) BNPP Positioning Analysis signals FX investors no longer hold a sizeable short AUD position following last month’s rally;

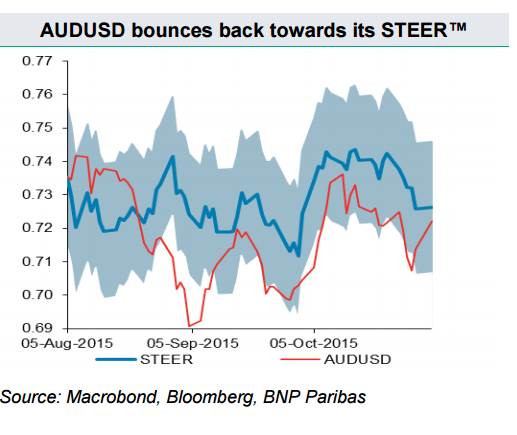

2) the bounce in AUDUSD in recent days has brought the pair back towards its STEER fair-value, indicating room for a further squeeze higher is more limited;

and 3) the RBA remains highly sensitive to AUD strength,” BNPP clarifies.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.